Investment mandate set for small-business fund

Canberra has proposed a structure and low-hurdle investment mandate for its $2bn small business securitisation fund.

The federal government has proposed a structure and low-hurdle investment mandate for its marquee $2 billion Australian Business Securitisation Fund, including targeting returns at just a little above the official cash rate.

In an exposure draft for the fund — which aims to fill a lending void for the $300bn small business sector — the government says the investment mandate would have a timeline for money to be deployed to the fund and a targeted rate of return.

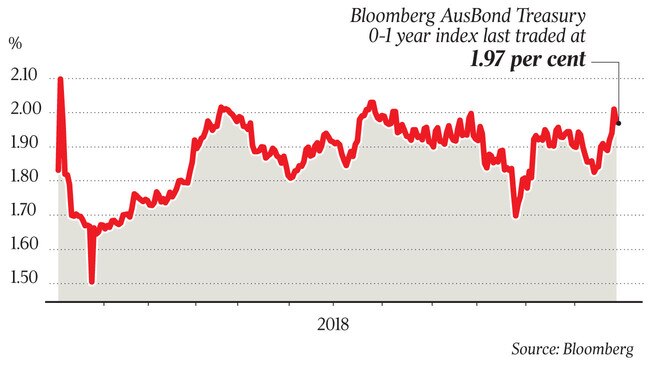

“To account for variability in business and market conditions the financial return of the investment portfolio generated by the fund over the medium term should at a minimum match the return on the Bloomberg AusBond Treasury 0-1 year index,” the document says.

The Bloomberg AusBond Treasury 0-1 index has gained 1.9 per cent over one year and 1.8 per cent annualised over three years. It is a weighted index that includes bonds maturing within one year and measures the market of securities issued by the commonwealth government.

The Reserve Bank’s official interest rate sits at 1.5 per cent.

The securitisation fund was one of two key measures announced by the government last month to boost lending to businesses and inject more competition into the market.

The securitisation fund will see the government buy bonds that are drawn from a pool of loans and also provide cheaper funding to smaller banks and non-bank lenders through warehouse facilities.

The big four banks and Macquarie are not eligible to participate.

The investment mandate outlined five key areas that would support the fund’s decisions, including prioritising investments in “underdeveloped sectors of the SME securitisation market” and investments that are likely to “promote competition”.

The draft legislation for the Australian Business Securitisation Fund Act 2018, released earlier this month, also proposes an indicative schedule to credit the fund’s special account with amounts annually over five years, beginning in July next year. The annual credits begin at $250 million and then increase to $500m.

“The ABSF special account will also be credited with any income derived from the fund’s investments, capital returns or other financial distributions relating to the fund’s investments and the proceeds of the realisation of the fund’s investments. This will allow the ABSF to reinvest its capital and earnings,” the exposure draft says.

“The minister is able to make a written direction to withdraw specified amounts from the ABSF on a specified day.”

After a consultation period ending on January 16, the draft legislation to govern the fund is expected to be introduced when parliament resumes early next year.

The second plank of the government’s small business proposals will see industry set up a private equity-style fund that would take equity stakes in small businesses seeking growth capital, modelled on a similar fund in Britain.

The two new small business measures were announced by Treasurer Josh Frydenberg and Small Business Minister Michaelia Cash last month.

The government’s debt-portfolio manager, the Australian Office of Financial Management, will play a key role in managing any risk associated with the securitisation fund.

During the global financial crisis, the AOFM bought $15.5bn in mortgages packaged up as securities to support banks and lenders when funding markets collapsed.

The draft legislation also says that the securitisation fund will be subject to annual reporting and review. “There will be a yearly update on the operation of the ABSF as part of the Treasury annual report,” it said.

“The bill requires the minister to commence a review into the ABSF as soon as possible two years after the fund commences.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout