Investment climate changing as BlackRock rolls over

The $US7 trillion funds manager has finally come to the party on climate change issues.

When it came to pressing big companies to take action on climate change, the $US7 trillion ($10 trillion) BlackRock has been slow to come to the party.

The New York-based fund manager, which has two-thirds of its portfolio tied up in index-style passive funds, was also known in financial circles for taking a passive approach to engaging with the boards and management of the companies it invested in — particularly on issues like climate change.

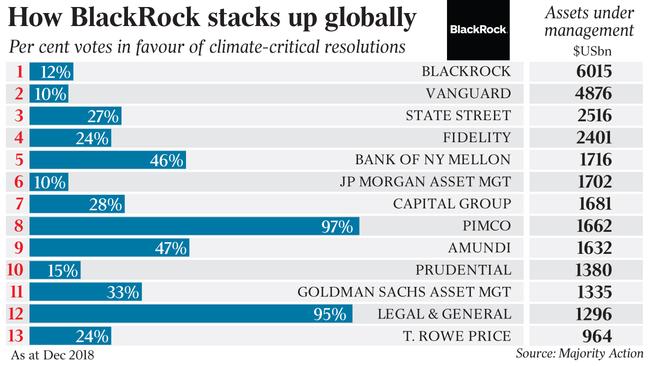

A report released late last year by US advocacy group Majority Action slammed BlackRock and fellow passive investment giant Vanguard for “continuing to undermine global investor efforts to promote responsible climate action” in some of the world’s largest companies.

It pointed out that when it came to voting for climate-related resolutions at annual meetings, BlackRock, the world’s biggest fund manager, only supported 12 per cent of shareholder resolutions, one of the lowest by major global institutional investors. This was in stark contrast with active investors such as BNP Paribas Asset Management, Legg Mason, PIMCO, Standard Life Aberdeen, UBS Asset Management, DWS Group and Legal & General Investment Management.

The net effect of this, Majority Action said, was to “shield management from accountability, serving as a blockade for global investor action on climate”.

As global pressure mounted, this week BlackRock’s chief executive Larry Fink did a public about-face with a more proactive approach to investor action on climate change, including engaging with boards in forums such as annual meetings.

“Climate change has become a defining factor in companies’ long-term prospects ... but awareness is rapidly changing, and I believe we are on the edge of a fundamental reshaping of finance,” Fink said in his annual letter to CEOs. “Investors are increasingly ... recognising that climate risk is investment risk.

“From Europe to Australia, South America to China, Florida to Oregon, investors are asking how they should modify their portfolios. They are seeking to understand both the physical risks associated with climate change as well as the ways that climate policy will impact prices, costs and demand across the entire economy.”

Mr Fink said that BlackRock had just joined the Climate 100+, an investor initiative backed by more than 370 investors, including many major Australian industry super funds, with total assets of more than $US35 trillion, to engage some of the world’s largest corporate greenhouse gas emitters to take action on climate change.

(There are 13 major Australian companies being engaged under this initiative, including AGL, Origin, BHP, Rio Tinto, Qantas and Woolworths.)

The fund also announced plans to double its offering of sustainable exchange-traded funds from 75 to 150, including versions of its flagship index products.

The company said this would involve introducing new “fossil fuel screened funds” and “building new sustainable active strategies focussed on the global energy transition and impact investing”.

It said it would take a more active approach to engaging with companies it invested in on climate change and would be “increasingly disposed to vote against management when companies have not made sufficient progress” in planning for a world that complied with the Paris Agreement goals.

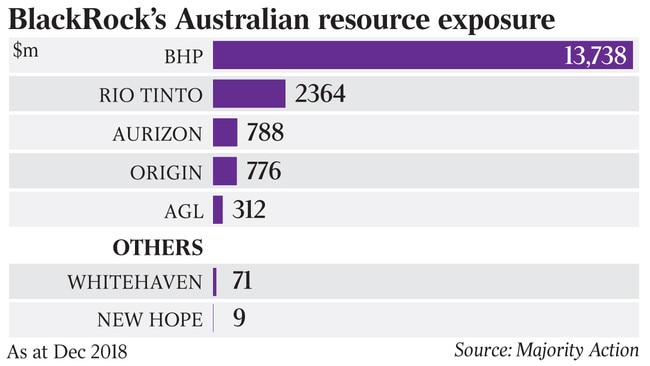

Mr Fink said BlackRock’s $US1.8 trillion actively managed investment portfolios would be selling their shares in thermal coal companies as part of rising investor concern about climate change and the fund would be prepared to take a more active role in voting on climate-change related resolutions at annual meetings.

While the stance has been widely hailed as a step in the right direction, critics have pointed out that this divestment decision only applies to the funds actively managed funds — 25 per cent of its total funds under management.

The plans to divest coal companies also exclude those which have less than 25 per cent of their revenues generated from coal, an exemption which allows it to retain its holding in BHP.

“BlackRock has been a laggard when it comes to climate change,” John Hewson, chairman of the Business Council for Sustainable Development Australia, told The Australian.

“They have been slow to respond to action on climate change and now they are catching up.”

Dr Hewson said US opinion leaders such as former US Treasury secretary Hank Paulson were warning that climate change-induced financial risks could have a worse impact than the global financial crisis.

“Some big global funds have also moved towards more direct investment in renewable energy and low carbon investments.

“The pressure on people like BlackRock has been significant.”

“Now it is catching up.”

While most Australian super funds do not have a policy of divesting coal companies and large emitters, the large industry funds are actively working with companies to help them move to a lower carbon emission future.

Representatives of Australian super funds welcomed the BlackRock announcement.

“It’s encouraging to see Blackrock participate in Climate100+ and join other investors in ensuring the world’s largest corporate greenhouse gas emitters take necessary action on climate change,” Louise Davidson, the chief executive of the Australian Council of Superannuation Investors (ACSI), told the Australian.

“ACSI and our members have been engaging with companies on climate risks and opportunities for many years.

“Blackrock’s decision to step up their voting policy on climate risk is in line with what our members expect of their asset managers.”

The $180bn industry fund Australian Super has long been involved in working with companies on climate change issues.

It prefers active engagement with management on the transition to a low carbon future.

“AustralianSuper takes climate change into consideration with all investment decisions, especially given that climate change threatens the ability of long-term investors to generate value and meet their investment objectives over time,” a spokesman said on Wednesday.

“AustralianSuper is a key institutional supporter of the Climate Action 100+ initiative.

“This has helped shape corporate priorities at some of the world‘s largest emitters.

“We put climate change at the centre of conversations on business strategy through our ongoing engagement with major corporations.”

While it is generally agreed that BlackRock is playing catch up, observers agreed that this week’s announcements were significant, given the size of the fund and its role in global investor markets.

The chief executive of the $57bn construction industry super fund, David Atkin, said BlackRock’s announcement reflected “the shifts occurring in global finance”.

“There is significant private sector momentum towards sustainable finance, especially here in Australia,” he said.

“We are likely to see more activity from large investors as the year progresses.

“We welcome Blackrock to Climate 100+ and look forward to working together with them.”

Debby Blakey, the chief executive of the $55bn health and community services industry super fund HESTA, welcomed BlackRock as a new member of Climate Action 100+.

“This is targeting the 100 biggest corporate emitters of carbon which represent two thirds of global emissions,” she said.

“It is very meaningful work.”

HESTA played an active role in working with oil company BP last year, along with several other major investors, including the Anglican Church, to get it to support a shareholder resolution requesting it set out its expansion plans in a way that complied with the Paris agreement emission targets.

“We engage very actively with the companies we invest in on climate change,” she told the Australian.

“We are very thoughtful about how we do it.

“It’s all very well to have a long-term goal (to reduce carbon emissions) but we want to get a clear view on the pathway the company intends to take to achieve it.

“We also want to see executive remuneration linked to achieving those targets.”

Like many other major industry funds, she said HESTA preferred the strategy of actively engaging with companies rather than selling out of their shares. “If we want to change the behaviour of companies in our portfolio, engagement is the most influential way we can do it.”

Ms Blakey said passive investment fund managers like BlackRock had “historically not tended to be as active in engagement (of the companies they invested in)”.

“Our view is that ownership is always active, even if it is a passive investment,” she said.

“BlackRock’s announcement is an enormous market signal and some of the strongest evidence yet that global finance is shifting in response to the structural economic risk of climate change,” Emma Herd, CEO of the Investor Group on Climate Change, told the Australian.

“Given BlackRock’s sheer size and reach, its announcement ups the ante for Australian fund managers because it shows there is clear demand from asset owners for zero and low-carbon products.

“This will in turn increase competition among managers in our market.”

Ms Herd, who is also a member of the global steering committee of Climate Action 100+, said there were already “many Australian fund managers who have already progressively moved in terms of their market offerings, along with their broader engagement to secure company-level action to cut emissions across the value chain in line with the Paris Agreement, improve governance and raise transparency on climate-risk and opportunities”.

“This is a significant step from the world’s largest asset manager that will have a material impact on carbon-intensive companies that are not actively de-risking from climate change and transitioning their business strategies towards a net zero carbon future.”

She said major companies were “already on notice that institutional investors are demanding stronger action on climate-risk and decarbonisation”.

“This will only accelerate that,” she said.

She said BlackRock’s shift would put pressure on other major passive investors “who have yet to step up”.

Ms Herd said BlackRock’s announcement came at a time when climate change was becoming a key issue in the finance industry debate in Australia.

“Regulators like ASIC, APRA and the Reserve Bank have already recognised that climate change is a systemic threat to our economy.

“They are now demanding finance companies treat their exposure to climate change as a “foreseeable, actionable and material risk” and have a plan to deal with it.

“This regulator interest, coupled with community pressure and the growing physical risk of climate change, has meant there has been substantial momentum among Australian investors on climate risk and decarbonisation.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout