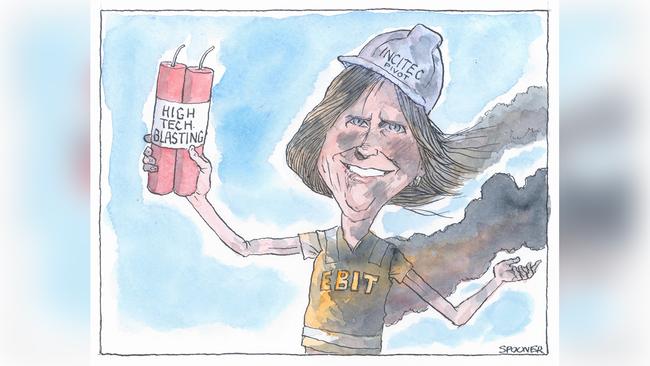

The division accounts for some 20 per cent of earnings and 95 per cent of the headaches due in large part to difficulties in securing long-term affordable gas and coping with the ravages of the Australian rural climate.

The division includes the Gibson Island and Phosphate Hill plants, and has long been either considered for closure or sale.

So full marks to Johns for biting the bullet. To be fair, all she has done so far is appoint UBS to conduct a strategic review, but the next time UBS does a strategic review which doesn’t involve asset sales will be the first.

This one won’t be rushed, and with any luck before the “for sale” sign is formally hung on the assets there may be a solution to the domestic gas crisis.

Johns will mark two years in the job in November, having learned the trade with BP.

One of her jobs there was handling the environmental clean-up from the 2010 Gulf of Mexico spill.

She is used to tough decisions.

Her first 22 months at Incitec have not exactly been a walk in the park, as shown by the 4.4 per cent fall in the stock price to $3.07 a share, the lowest since April, compared to $4.17 the shares fetched four years ago.

By combining the fertiliser asset sale news with the downgrade, she at least mitigated some of the downside and to be fair the issues raised were not exactly new news.

The drought has ravaged demand for fertiliser and the state-of-the-art $1 billion Waggaman plant in Louisiana has had more than its share of snafus, known in the trade as unplanned outages.

This is the second for the year for the plant, which is just two years young and heralded not so long ago as a superstar facility thriving on cheap US gas.

The upside remains — it’s just some teething problems.

Ammonia is presently selling at $US279 a tonne, down from a 52-week high of $US401 and up from a low of $US261.

Weak commodity prices are an issue but compared to the more reliable resources company earnings from fertiliser, the returns just aren’t there for the fertiliser business.

Incitec announced its profit downgrade on the same day as news reports promoting its technology wins in a BHP contract and two days before its strategy day.

Both sides now

Jason Ellis, the former Bluescope executive involved in the ACCC cartel court case, now works for independent distributor Selection Steel, run by Rocket Rod Gregory.

Ellis wasn’t returning phone calls yesterday, but his employment at one of the big importers is a touch ironic given Bluescope is traditionally at war with the sector.

But it’s all the same game after all.

The ACCC civil case is due for a case management hearing in the Federal Court in early November while the Director of Public Prosecutions considers what other action may follow.

Merger debate

ACCC chief Rod Sims’ weekend call for lower thresholds for merger cases has won little support, with many at the recent Law Council conference saying more evidence of the need for change is required.

As the Law Council is comprised of big business lawyers, the lack of support was not surprising. But former ACCC chief Allan Fels supported Sims, noting you can argue the ACCC may have mishandled one or two cases but to lose six in a row suggests there is something wrong with the law.

This was the point pressed by Sims at the weekend conference, where he argued Australia should look to US practice, which puts the onus of proof on the merger parties if they operate in highly concentrated industries.

One problem with that argument is that, of the six example cases presented by the ACCC, only two placed the onus on the ACCC to prove the argument, with the others leaving it up to the merger parties.

In other words, it didn’t matter who had the onus — the ACCC still lost.

The lawyers also say the ACCC doesn’t take note of the mergers it has prevented via, say, a tough statement of issues which causes the parties to back off.

The contested cases date back to 2003, when AGL took the ACCC to court over a Loy Yang deal and won the argument that the merger didn’t substantially lessen competition. The issue was debated at the Law Council’s competition law workshop in Melbourne on the weekend, with new mergers commissioner Stephen Ridgeway, DLA partner Simon Uthmeyer and former Federal Court judge Ray Finkelstein supporting Sims, while Ruth Higgins SC and Herbert Smith Freehills partner Liza Carver presented the opposing arguments.

Higgins and Carver will be leading the case next week against the ACCC’s blocking of the $15bn TPG-Vodafone merger.

In that case, TPG boss David Teoh will presumably tell the court (as he has publicly stated previously) he has no plans to roll out a fourth mobile network because of the government ban on Huawei equipment.

This makes it difficult for the ACCC to prove its case because there will be no fourth network without TPG.

The ACCC will press Teoh about his plans for the mobile spectrum he controls.

Most big business lawyers think the ACCC will lose the TPG case, which will make it seven losses in a row.

The ACCC argues the merger test requires future predictions that can be easily rebutted by company statements when blind Freddy would be able to predict the impact of the merger.

The courts take the company executives at their word.

The six cases presented were the AGL-Loy Yang, AGL-Macquarie Generation, Toll and Sea Swift, Tabcorp and Tatts, Metcash and Franklins, and Pacific National and Aurizon.

Some of these were authorisation cases which are subject to public benefits tests, which complicates the issue.

Forex advice

Josh Frydenberg, as expected, has backed ACCC findings that consumers are being ripped off by the big banks in foreign exchange transactions.

The message from the Treasurer and the regulator is to shop around, because using the likes of Transfer Wise or Travelex could save you 30 per cent or thousands of dollars, depending on the amount transferred.

The ACCC noted consumers are also better off using their own debit cards than the bank travel money cards, which are also more expensive.

A World Bank report last year found Australian’s pay 11 per cent more than the G20 average and 40 per cent higher than the US.

The ACCC has released a guide to help travellers, but the message is shop around and keep clear of the big banks.

Incitec Pivot boss Jeanne Johns will host an investor day on Wednesday when she will explain how she is trying to catch up to Orica’s two-year-plus technology advantage in explosives. Just to clear the air, she unveiled a 25 per cent profit downgrade on Monday and finally pulled the plug on the company’s highly cyclical Asia-Pacific fertilisers division.