How Sidney Myer’s £50,000 gift, worth $150m today, changed the course of Melbourne business

A lesser known part of Sidney Myer’s legacy will be celebrated in Melbourne this week, when the nation’s top business leaders gather to mark the 100th birthday of Melbourne University’s famed Faculty of Business and Economics.

Rupert Myer never met his famous grandfather, Sidney Myer, the founder of the Myer retailing dynasty.

Sidney passed away in 1934, 24 years before his grandson was born.

But the Myer family scion, now one of the nation’s top patrons of the arts and a leading philanthropist, learned plenty about Sidney’s legacy over countless hours of talking to his legendary grandmother, Dame Merlyn Myer.

“She had to talk him out of moving the entire business to America at one point in the 1920s. I recall her saying to me 60 years later that she would never have agreed to it and that she would ‘always remain loyal to her eucalyptus trees’. She made that point very clear to him,” he reveals.

Australia was fortunate for Dame Merlyn’s intervention, given the enormous contribution the Myer family has made to the nation’s retail heritage, its artistic community and philanthropy.

But there is a far lesser known part of Sidney’s legacy that will be celebrated at Melbourne’s historic Royal Exhibition Building on Thursday evening, when hundreds of the nation’s top business leaders gather to mark the 100th birthday of Melbourne University’s famed Faculty of Business and Economics.

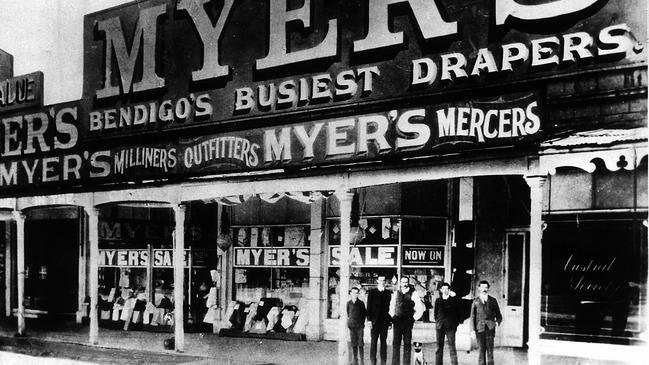

In 1926 Sidney Myer gifted £50,000 worth of newly listed Myer Emporium Limited shares to help create a firm financial foundation for the then fledgling faculty, which had been launched a year earlier with a significant donation of £1,000 by the then National Bank of Australasia.

Given the annual rate of inflation and GDP growth over the past century, that donation would be worth around $150 million today. If it had been invested in the ASX All Ordinaries Index over that time, including dividends it would be worth over $2 billion.

Douglas Copland was appointed as the first Professor of Commerce at the university on 8 September 1924 and the first classes were held on 2 March 1925. A year later Professor Copland’s chair was named the Sidney Myer Chair of Commerce in recognition of Sidney’s gift.

“In his inaugural lecture, Copland commented that ‘...commercial education is likely to be more successful if it springs from the needs of industry and is supported by businessmen’,” says the chair of Melbourne University’s Foundation for Business and Economics (FBE), investment banker Tony Burgess, who co-founded the boutique advisory firm Flagstaff Partners.

He says Copland’s words highlight that the faculty was established “at the behest of and with the support of business to meet the educational needs of business”.

“From these auspicious beginnings, there is no doubt that the faculty has excelled in its mission.

“For many years, it has been the top rated school for business and economics in Australia and in the Top 30 in the world; and it is of course an integral part of Australia’s top ranked university, which itself is ranked in the Top 30 universities globally.”

In an interview with The Australian ahead of Thursday evening’s celebration - which will host the entire NAB board, including chief executive Andrew Irvine - Burgess and Rupert Myer reflect on Sidney’s legacy in tertiary education and the future of the sector.

Both serve on the FBE board and Myer, along with a number of his family members, are past graduates of the faculty.

“Over the years, the faculty has educated tens of thousands of graduates, meeting the needs of business, professional services, government and academia for talent,” Burgess says.

“Many of these graduates have gone on to become distinguished leaders in business, professional services, government, public service, regulatory institutions, and academia.”

Its global business alumni include Morgan Stanley chair emeritus James Gorman, former JPMorgan head of global investment banking Jennifer Nason, managed funds billionaire Sir Michael Hintze and former Rio Tinto CEO Sam Walsh.

Sidney and Dame Merlyn Myer were still newly married when the faculty was established in 1924.

They were deeply engaged in growing the Myer Emporium and establishing a family company that would both own and control the department store for most of the rest of the century, and diversify the family’s asset base.

That company, today known as Myer Family Investments (MFI), also celebrates its centenary this year.

It is chaired by another of Sidney’s grandsons, Sid, and its directors include Rupert, Martyn, and Andrew Myer as well as other Myers family scions, Vallejo Gantner and Lindy Shelmerdine. Former McAleese Group CFO John Russell is CEO.

MFI’s external independent directors are former CBus CEO Justin Arter and Scentre Group and NAB director Carolyn Kay. Current ABC managing director Kim Williams is a former director.

Today MFI, the Myer family’s primary business, is an investment house with a globally diversified portfolio.

Rupert Myer says he will never know the exact motivations of his grandfather 100 years ago to make such a seminal gift to Melbourne University. But his research and family storytelling has given him many clues.

“I surmise that he was motivated to do so from his and Merlyn’s frequent travels to America during the 1920s where they kept a home in San Mateo, near San Francisco. Their four children were born there, including my father. Sidney loved the pace of new ideas that he encountered and the abundant opportunities that he could see everywhere,” he says.

Has father, Baillieu (Bails) Myer - one of Australia’s top philanthropists - was the only surviving son of Sidney when he passed away on January 22, 2022 at the age of 96.

“My grandfather greatly admired the American entrepreneurial spirit and he greatly admired the example of American philanthropy and the connectivity between successful businesses and the ability to serve the community in a multitude of ways,” Rupert Myer adds.

He says his grandfather believed that education in business was an enabler of business success, recognising the indelible link between entrepreneurship, productivity, imagination and insight with rising living standards, financial independence, better health outcomes and the social cohesion that comes from participation in and access to arts and culture.

“Pleasingly a century later, along with support from many others, the fruits of that association that began with the faculty still flourish through the support for the faculty’s leadership and its students, and throughout the entire university,” he says.

In fact in 1931 Sidney gifted a further tranche of Myer Emporium shares to support other parts of the university’s activities, which today sits in the Sidney Myer University Trust that is funding 26 scholarships to undertake a Bachelor of Commerce.

The scholarships, announced last year and worth $5.8m, pay for 100 per cent of the recipient’s tuition fees, as well as a $37,500 living allowance per year for the whole three years of their undergraduate degree.

Going forward Rupert Myer believes expert knowledge must be central to great decision making, and that business and the public good should always be in close alignment.

“Universities are still those institutions that transform nations. They have serious intent and they are incredibly important for future employment, for the positioning of industry and serving the community in multiple ways,” he says.

“These are incredibly important places that need to be thought of as central to the critical infrastructure of a nation.”

Burgess adds that in the age of artificial intelligence, education is even more important to foster critical thinking and analytical skills in young people.

“There are some renowned examples of artificial intelligence producing absolute bunkum as it hallucinates itself, or because you’ve got bad actors who are actually trying to tilt the answer that comes from artificial intelligence,” he says.

“So the critical thinking skills and the analytical skills that we teach at the faculty are now more important than ever.”