If the world’s biggest economy, as measured by GDP, shrinks 1.6 per cent over the three months to the end of June, which is the current best forecast from the Federal Reserve Bank of Atlanta, that definition will be met, after a 1.6 per cent fall in the first quarter.

But it would be a phony recession, another sign that GDP, an arcane statistic designed in the 1930s, had decoupled from economic reality.

“You don’t see any of the signs. Now, a recession is a broadbased contraction that affects many sectors of the economy. We just don’t have that,” said Janet Yellen, US Treasury secretary, on Monday (Australian time), speaking on US television.

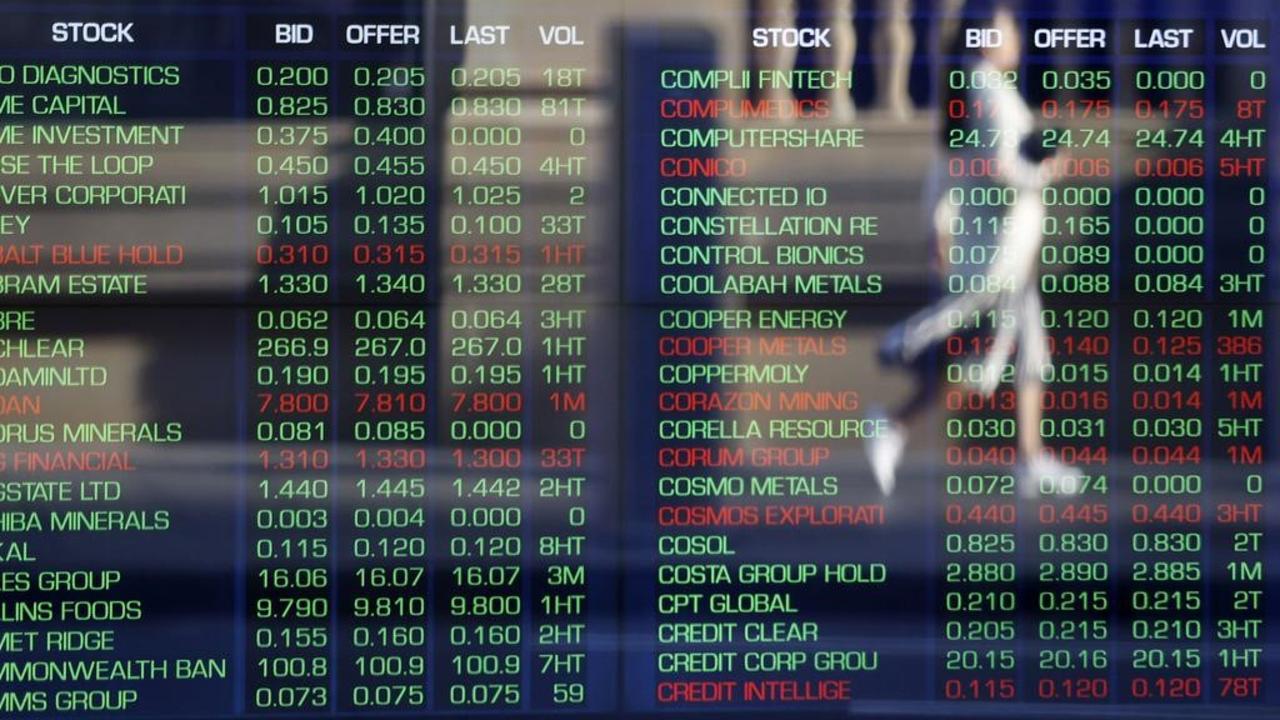

For a start, the US jobless rate as in Australia remains at half century lows, 3.6 per cent in June, and retail spending, the engine of modern economies advanced a healthy 1 per cent in June, up 8.4 per cent from a year earlier. Yes, blue chip US stocks have dropped about 17 per cent this year, but measured against earnings, share prices are still expensive.

None of this, however, is any guarantee against a recession within the next 12 months, which is a very different question. A quick glance at the previous 12 recessions in the US since Second World War shows unemployment, which tends to grind gradually lower during expansions, can suddenly surge within a matter of months.

One of Yellen’s predecessors, Larry Summers, also speaking on Monday, said the likelihood of a recession in coming months was “very high”. And it was “very unlikely”, he added. the US would have a “soft landing” as the Federal Reserve tightens the monetary screws to throttle the economy – and inflation.

Four reasons suggest he’s right. First, and most obviously, Americans are rapidly becoming poorer, meaning they can’t afford to buy the same quantity of goods and service. The real median full-time earnings the US have fallen almost 9 per cent since their peak in the middle of 2020, as record inflation has outpaced wages increases.

And the Fed, which arguably caused the inflationary surge by creating trillions of new dollars to finance Washington’s massive budget deficits, in coming to the rescue with higher interest rates, is almost sure to tip the economy over the edge.

The US central bank is almost certain to lift the benchmark US interest rate by 0.75 percentage points to 2.5 per cent on Thursday, as part of a well telegraphed tightening of the monetary screws crush economic activity enough to quell inflation, or so the theory goes.

New home construction, long the canary in the coal mine for the overall economy, has already started to fall, as higher interest rates drastically curb affordability. At an annual rate, US home starts have plunged from 1.86 million in April to 1.56 million in June, a nine-month low.

Record petrol and electricity prices have hogged the limelight, but the interest rate on a 30-year fixed rate home loan, the most popular kind in the US, have almost doubled from 2.8 per cent a year ago to 5.5 per cent this month.

One of the best predictors of recession is the sum total of wisdom among bond investors, who have a lot to lose from getting inflation and interest rate forecasts wrong.

Typically, longer term bonds earn a high yield than short term bonds because the investor’s money is tied up for longer, but the opposite is the case now, what known as “yield curve inversion”, which doesn’t happen very often.

When that occurs, suggesting investors collectively believe interest rates will increase in the short-term then collapse later as the central banks are compelled to lower them again, a recession ensues within the next six to 18 months, according 2018 research by the Federal Reserve Bank of San Francisco.

An inverted yield curve has preceded every US recession since 1955. Last week, the yield on 10-year US government bonds was around 2.9 pe cent, compared with around 3 per cent for two year bonds.

If the US economy tanks, politicians and central banks will be quick to blame the Covid-19 pandemic, Russia, or nasty big businesses, but they could deserve as much of the blame.

Steve Hanke, a professor of applied economics at Johns Hopkins University, who accurately forecast the surge in inflation this year over a year ago, by highlighting the explosion in the money supply courtesy of the Fed.

“In its panic to raise rates and begin quantitative tightening, the Fed has, in the three months before June, allowed M2 growth to plunge to an anaemic annualised growth rate of 0.1 per cent,” he told The Australian.

“When broad money growth falls to near zero, nominal spending contracts and a recession begins. If this minuscule growth in the money supply persists, a recession will start in late 2022 or early 2023.”

In the US, a group of economists at the National Bureau of Economic Research determine the start and end dates of recessions, considering a wide variety of factors, sensibly eschewing the simplistic rule of thumb based on GDP over six months. Whatever emerges on Thursday about GDP, the US isn’t yet in a recession, but all the signs suggest it will be soon.

The US economy will probably be in “recession” by the end of this week, according to the conventional rule of thumb – two consecutive negative three month periods.