Health insurers in $3bn pitch to ALP over reforms

Health insurers are preparing for a Labor government with a pitch to Bill Shorten on a list of reforms to save money.

Australia’s health insurers are preparing for a Labor government with a pitch to Bill Shorten on a list of new reforms they say can shave almost $3 billion from the system to drive annual premiums lower.

Top executives from the nation’s biggest insurers said that they were prepared to work with any future government led by Mr Shorten and support his plan for a Productivity Commission review of their sector. But during a roundtable, hosted by The Weekend Australian, the industry executives also warned that the pain of cost-cutting could not be felt by them alone and warned of challenges they would face under Mr Shorten’s plan to cap annual premium increases at 2 per cent for the first two years of a Labor government.

NIB chief executive Mark Fitzgibbon said it was “myopic” to concentrate on health insurance premiums when state and federal governments were increasing their spending by more than 6.5- 7.5 per cent a year on healthcare costs.

“That tells me it’s not just a challenge for health insurers,” Mr Fitzgibbon said.

Health insurers have long argued they are passive payers into the healthcare system, but critics have said insurers could be more efficient and do more to take pressure off premiums.

Australian Unity chief executive Matt Walsh said it was a myth that there was a “huge pot” of inefficiencies the sector could address to lower premium increases.

“We are squeezing the stone as hard as we can,” Mr Walsh said.

“We need the rest of the sector to come to the party ... they have got their hands on most of the cost levers.”

A federal election is due by May next year and, while Scott Morrison remains as preferred prime minister over Mr Shorten, current polling points to a decisive Labor win.

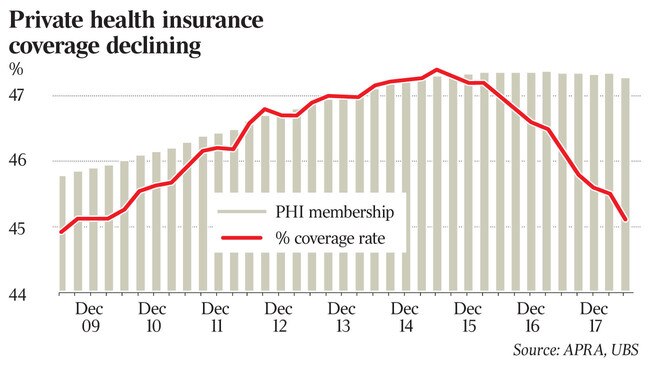

In a document prepared by industry body Private Healthcare Australia to help the sector mount its case to the Labor Party, it was argued that declining private health insurance participation was putting the sustainability of the public and private systems at risk.

“The proportion of Australians with private health cover has fallen to the lowest level in eight years and by 2030-2035 it could drop to 30 per cent,” the report said.

The industry heads said that healthcare inflation was now driving a downward spiral in private health insurance participation that must be arrested before it gathered pace.

In a report prepared for any future Productivity Commission review, should Labor win government, the health insurance industry outlined 10 reforms it believed would help keep insurance affordable.

Ideas proposed by the industry include:

● Eliminating unnecessary and harmful care.

● Substituting hospital care with affordable settings.

● Preventing hospitalisation of complex patients by setting up patient-centric care management.

The pitch for reform also included bringing the cost of medical devices, known as prostheses, to international standards and also eliminating default benefits for large hospital groups. The proposed reforms could reduce healthcare cost inflation to 2-3 per cent a year by 2030, according to Private Healthcare Australia, which it said would significantly reduce pressures on health insurance premiums.

It forecast that the suggested reforms could save the industry $2.8bn in the next five-plus years, with half of that saved in the next few years.

Private Healthcare Australia chief executive Rachel David said that on prostheses reform, the industry wanted a national procurement process with full reference pricing and price disclosure. She said that would go further than the current prostheses reform introduced by Health Minister Greg Hunt and could save $500 million annually in health costs.

“It is not the one-off benefit reductions on prostheses (introduced by Mr Hunt) that is going to make a difference given current utilisation trends and technology trends,” Dr David said.

“A whole of system reform is needed to bring medical device pricing more in line with the way the government deals with pharmaceuticals, which means not thinking of this as an endlessly growing uncapped budget but a fixed budget.”

The insurance chiefs said Labor’s planned Productivity Commission review would provide a “tremendous opportunity” for the sector.

“The fundamental thing the Productivity Commission should look at, and we will put this position, is the co-funding of outpatients in certain key areas,” Dr David said.

Medibank’s group executive of healthcare and strategy, Andrew Wilson, said it was important to look at how the industry could work with the government to change the care model.

He said that could include insurers funding additional services and changing some of the regulatory barriers that restricted what insurers could cover.

Mr Fitzgibbon agreed, adding that the focus needed to shift to how insurers could allocate resources away from fixing people, to preventing and better managing healthcare conditions in the first place.

Despite the willingness to work with a future Labor government, should Labor win the next election, insurers raised concerns about Mr Shorten’s 2 per cent cap on premium increases.

The industry body warned in its proposed submission for a future Productivity Commission review of the sector that a temporary cap of 2 per cent premium growth, without any accompanying reforms to reduce costs, would move a total of 22 health funds into the red.

Australian Unity’s Mr Walsh highlighted that funds could be forced to eat into capital reserves to weather the 2 per cent cap for two years.

He argued that reserves were built up over many years to protect policyholders from external shocks or sudden changes in liabilities.

“Those reserves are there to pay claims and if you deplete that pool, the not-for-profits will take a long time to rebuild it,” he said.

“There will be some really rough outcomes for some of the smaller health funds.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout