Green transition will deliver repeat inflation shocks, TCorp’s chief economist warns

Supply issues every ‘two, three, four years’ will spike prices over the next two decades, the asset manager’s chief economist warns.

The transition away from fossil fuels to a low-emissions future could result in inflation spikes every few years in the next two decades – a problem central banks won’t be able to control and governments won’t be able to subsidise their way out of.

That’s the view of TCorp chief economist Brian Redican, who says he is uncertain whether the low-inflation environment of the last three decades before the Covid-19 pandemic will return, as many in the market expect.

“The debate at the moment is about how aggressive central banks need to be to get rid of this current inflationary period, and whether they’re actually going to have the internal fortitude to bring inflation down,” Mr Redican, previously the chief economist at Macquarie, said.

“And the debate really is about how long inflation will persist, whether that is six months or 12 months or 18 months, until (central banks) get it under control.

“My question is whether these kinds of episodes will become more frequent in the future. If that’s the case the economic and financial market landscape could look very different.

“What are some of the forces that could actually make these episodes more frequent? The move towards net zero I think may be one of them,” Mr Redican added.

Central to those concerns are energy market shocks which are hard to predict, and even harder to control.

European leaders are already bracing for the prospect of supply cuts and sustained price hikes after Russian oil firm Gazprom again halted the key Nord Stream pipeline indefinitely at the weekend, hours after G7 leaders agreed to implement a price cap on Russian oil.

In Australia, the Reserve Bank warned in August that it expected elevated energy prices to remain as a result of unplanned maintenance problems at several coal-fired power plants over recent months. Market instability abroad has also raised the price of thermal coal, affecting local costs.

Mr Redican said it was these types of issues that would – “every two, or three or even four years” – have a profound effect on energy prices and send inflation surging.

“Then we’ll get another one of these negative supply shocks where you get a heatwave in the Northern Hemisphere … the wind turbines are not able to supply the power that people need, and so countries revert back to fossil fuels, in particular gas, and that drives up gas prices markedly, as we’re seeing at the moment,” he said.

“So inflation is kind of running along that 2 per cent and suddenly you get these adverse weather effect, inflation spikes up to five or six or seven per cent.

“The question is, how should central banks kind of react to that? Do they again, raise interest rates aggressively as they’re doing now or should they take a more medium-term approach and try to smooth the cycle … if the shocks are not just going to be a one off, but recur more frequently.”

TCorp – the NSW Treasury Corporation – is one of the country’s largest asset owners. It has issued some $7.2bn in bonds earmarked against ESG projects including sustainable water and wastewater management and clean transport.

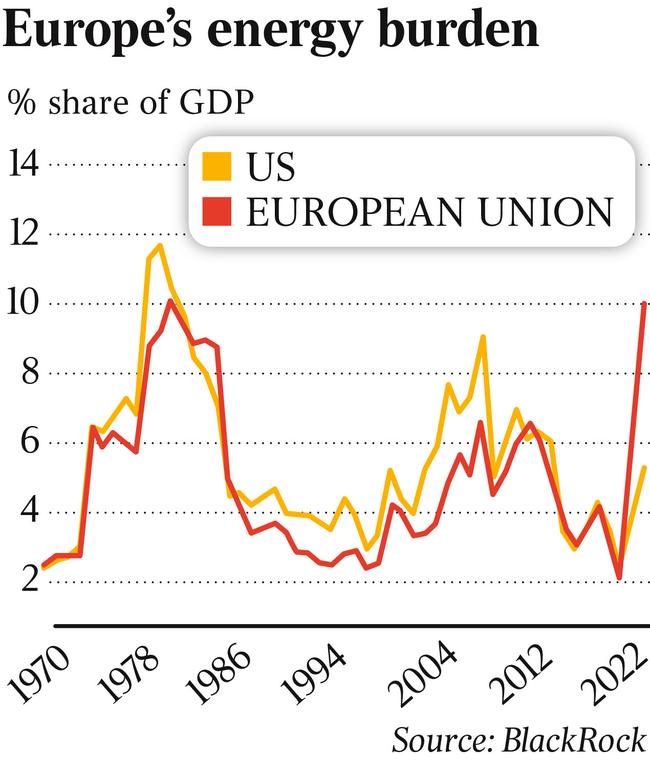

Other major asset managers have also warned about the difficult path to a low-emissions economy, most notably BlackRock, whose chief executive, Larry Fink, wrote: “Divesting from entire sectors – or simply passing carbon-intensive assets from public markets to private markets – will not get the world to net zero.”

In separate analysts, the BlackRock Investment Institute said the additional production costs as the world shifted away from carbon-intensive energy sources could reach some $210 per tonne of emissions by 2030. “Result: Consumer prices could rise by as much as 4 per cent by the early 2030s if all additional cost ends up there, we estimate,” a February report released by the organisation reads.

“The inflationary impact of net-zero will be supplemented by the transition’s resource reallocation as demand and supply shift across companies and sectors.

“We see a risk of resources becoming misaligned, particularly if the transition is rapid and disorderly. 2021 gave a glimpse of what that could look like. In the powerful economic restart from pandemic-driven shutdowns, demand moved toward spending on goods, from services. Supply couldn’t adapt quickly enough. The result: bottlenecks, disruption and high inflation, even though economies had yet to fully recover overall.”

Mr Redican said a spike in inflation caused by energy shocks every few years would have a significant impact on business.

“I’m sure they’d just be pulling their hair out and going ‘we haven’t actually got a viable business’,” he said.

The situation, he warned, would not easily be resolved by either central banks or government spending.

“One thing is a lot of the criticism of central banks is that they’ve allowed inflation to rise to these kind of levels,” Mr Redican said. “That assumes that central banks have this mechanical control of where inflation is going to be. That is actually a false assumption. Central banks are like lion tamers. Most of the times they’ve got control of lions but if the lion goes crazy, there’s nothing they can do. And these kind of supply shocks are the lion going crazy.”

The other risk, Mr Redican said, was “bad, kneejerk policy responses” from governments under pressure.

“The more populist response is just to subsidise the energy prices for households. But that’s a massive cost to the budget and we all know that government budgets are under pressure enormously already,” he said.

“The other problem is that by not having the price signal to households, they don’t actually turn off the air conditioner or turn off the lights.”

“Government debt loads are ratcheting higher, and when things kind of normalise, you’re not getting any improvement.

“When the next shock comes along, we’re starting from a worse point. Some countries, places like Greece, have already reached that tipping point. And more countries seem to be going down that path.”