Government warns insurance response to cyclone, reinsurance pool, to face review

The federal government has put the insurance industry on notice, announcing its industry probe will now include hearings in FNQ in the wake of cyclonic storms over summer.

The Federal Government’s ongoing probe into the insurance industry may hold hearings in Far North Queensland to look at the response to tropical storms and cyclones which lashed Australia’s top end over the summer.

Speaking after an insurance industry forum in Cairns on Wednesday, assistant treasurer Stephen Jones said the government would ask the committee to hold additional hearings, which could examine the affordability and access to insurance, broadening the inquiry beyond the 2022 floods.

Mr Jones told The Australian the move would be part of a package of measures taken by the government, which may also see changes made to the Cyclone Reinsurance Pool.

The assistant treasurer said the insurance industry demanded “immediate solutions” around issues with claims management, in the response to cyclonic weather has lashed the top end and threatens to hammer down in coming days.

But he said if there were systemic issues with insurance, the Albanese government would act.

“As a country we’ve got to face up to it. We’ve got a rude shock coming if we don’t,” he said.

Mr Jones said the ongoing flood inquiry had revealed a number of issues and skills shortages.

But he said it had also highlighted a need to “stop doing dumb things”.

“We’ve got to … stop building the wrong houses in the wrong places and pretending it’s not going to have an economic impact,” he said.

“The cost of bad planning decisions is unaffordable insurance.”

Mr Jones said it was clear many were struggling to access insurance in the face of price rises, noting the government was looking to work through a number of issues surrounding the sector.

Several key insurance executives met in Cairns on Wednesday, including Suncorp, Insurance Australia Group, and QBE, amid concerns about the industry’s response to storms which hit the top end over the Christmas period.

QBE Australia chief executive Sue Houghton said the roundtable had allowed the industry to “understand what people are facing and how they are dealing with the enormity of the recovery”.

“Today demonstrated how all levels of government, the community and insurers can work together to respond to such events,” she said.

The latest cyclone and storm season will prove a test of the $10bn Cyclone Reinsurance Pool, which the Federal government has funded in a bid to ensure insurers remain active in providing cover in the top end.

The Cyclone Reinsurance Pool will pick up some of the losses for claims for cyclone and flood damage from the time a cyclone starts until 48 hours after it ends.

But Mr Jones said the pool required a review, noting its 48 hour window was unclear to some insured customers.

He said the government may make adjustments to the scheme in the coming six months, but pushed back on a call from insurers and politicians to extend the time frame and make it retrospective.

Mr Jones said forces at work internationally were pushing up premium prices and said the government would look at “what, if anything the commonwealth can do around mitigation and sustainability and affordability of insurance”.

Insurers have pulled back from writing cover for homes in areas that have been inundated in recent years.

While property in cyclone-prone areas have also faced a jump in premiums, with some insurers walking away from markets in the top end.

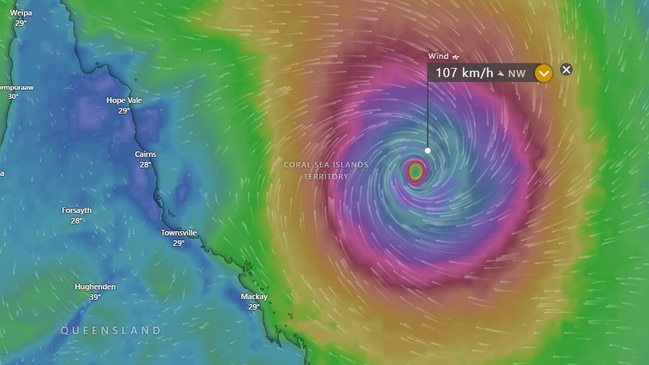

Weather authorities have warned a tropical low sitting in the Coral Sea risked forming a tropical cyclone in coming days.

This comes as insurers are scrambling to respond to Cyclone Jasper, which hit Queensland in December.

The Insurance Council of Australia declared the cyclone and wild weather over New Year’s an insurance catastrophe, with more than 38,000 claims lodged with insurers since December 23.

Australia’s insurers have warned although losses were mounting from the storms, claims were tracking below budgets.

But this comes amid expectations insurers would enjoy a benign summer, after the declaration of an El Nino weather event, after years of floods and storms.

Insurance premiums have soared on the back of years of wild weather, while insurers have faced hefty increases to reinsurance costs.

Insurers purchase reinsurance from global financial players in a bid to offset their own claims costs.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout