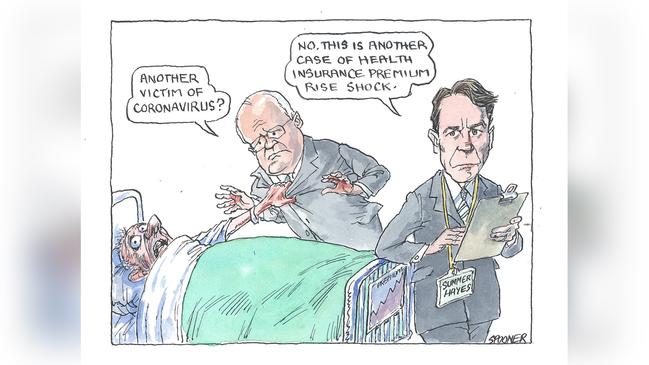

The strongly worded Sydney speech was nominally directed at the industry, but in reality it was a wake-up call to the politicians, starting with Hunt.

Summerhayes is a prudential regulator and his job is to call out when he sees financial trouble, which is written in capital levels all over the health sector.

His suggestion for a major inquiry divided the industry, with some preferring the politicians actually make the call themselves, but others welcoming the chance to have a comprehensive review that may rid the sector of its complicated web of conflicting misdirected regulations.

The political backdrop is a Productivity Commission inquiry into the sector, a longstanding ALP policy but rejected by Hunt.

PC chief Michael Brennan also spoke at the health insurance conference. Yet three years ago when he trumpeted cuts in prosthesis prices to save $800m over three years, industry estimates say the year-one savings were more like $13m. The reason being the industry cut prices but ramped up volumes so supply increases offset the cuts.

Multinational equipment suppliers like Johnson & Johnson treat the Australian market as a honey pot.

Then there are technological advances. A decade ago a heart pacemaker may have cost $10,000 but today it includes self-starting boosters and costs $50,000. If asked you would go for the latter, but then again you would not be asked — you’d just pay the bill.

The tightly regulated industry is facing financial ruin in the wake of costs rising by 5 per cent and more and premiums by an average of 3.25 per cent.

Summerhayes said: “APRA’s analysis indicates that only three private health insurers will still have a sustainable business model by 2022. None of those three are the smaller, not-for-profit funds represented by Members Health.”

Assuming these three are the listed vehicles Medibank, NIB and UK-based giant Bupa, it doesn’t sound great for the not-for-profits.

Some in the industry say the capital levels of the likes of MBF in Western Australia, HCF and the group-managed Australian Unity are OK, but the point remains, as Summerhayes noted, it was time to start enacting Plan B. By that he means consolidation.

The big funds have the money to invest in technology and other innovations to boost their chances of survival.

Summerhayes was right to tell the industry not to wait around for the government to bail it out because a vibrant private sector is actually the best form of defence government can have to help keep system costs down.

For too long politicians have fiddled around the edges, making grandiose claims about reforms that do little when fundamental policy change is needed. The clear message was the industry is not sustainable in its present form and needs to help itself by rapidly consolidating and working out ways to cut costs and grow revenue.

One of the more efficient members, NIB, last week issued a profit warning, in a major sector wake-up call. NIB has a cheaper, younger demographic and has done a lot to grow membership, which means it is “rewarded” under the risk equalisation scheme by being forced to pay an extra $20m into the pool, bringing its payment to $250m.

The pool is part of the community rating scheme, which is designed to ensure everyone is treated equally, so coverage is guaranteed.

In theory, young people subsidise older people who make more claims, but the trouble is younger people are dropping out because health insurance costs too much and wages are going nowhere.

Summerhayes wants the major independent review of the system, looking at the community rating model, out-of-hospital treatment — which isn’t covered even though service from the same doctor in hospital is — and management of chronic care.

The solutions include more home care, which can be claimed, fewer non-urgent operations, more remedial care and less inpatient care.

The hospital system is bizarre given your treatment might start with state-of-the-art tests in multi-million-dollar machines, with the results sent to your doctor by fax or letter.

If you see the same specialist outside who operates on you in hospital, you can’t claim the first but you can the second.

An operation may spark two or three bills including the anaesthetist, surgeon, physio, etc.

The reform list goes on and is not new, but the fact is no one is making decisions on it, and the politicians are not controlling the doctors and hospitals.

Private health has its benefits, because it wants to run the system more efficiently and is motivated to do so. The industry is running at inflation rates of 6 per cent-plus when prices elsewhere are flatlining.

Summerhayes’ warning is timely and the industry does need a plan B that doesn’t simply rely on government, which means consolidation.

Neal to exit fund

For the first time in its existence there will shortly be no David Neal at the Future Fund after he was appointed as the new boss of IFM.

Neal, then at Towers Perrin, advised the government on the Future Fund’s structure and then became its investment chief before taking the top job. Over the period from 2007 the fund has grown from zero to $212bn and Neal he has served under just three chairs — David Murray, David Gonski and Peter Costello.

He assumes the IFM job from Brett Himbury, who took the fund manager global and increased funds under management by a factor of eight times, to $160bn.

Himbury is expected to hit the non-executive director path.

The Future Fund will conduct a formal search for Neal’s replacement but its investment boss, Raff Arndt, would be the obvious internal replacement.

In-house lawyer Cameron Price will mind the cookie jar until a replacement is found.

Battle for Cromwell

When ARA representative Gary Weiss just missed out on being appointed to the Cromwell board, he promised to fight on.

On Tuesday he stepped up to the plate, demanding an extraordinary general meeting to roll long-time friend Geoff Levy as the chair of the property group.

Levy was planning to stand aside this year in any case, but given ARA has 23.7 per cent of Cromwell, he has no choice but to hold the meeting.

Cromwell argues that as the Singapore-based property group is a competitor, it would be wrong to appoint a representative to the board. ARA disagrees and thinks owning nearly a quarter of the company demands at least one board seat.

Weiss may have some alternate views on issues like the 33 staff and board members who attended the company’s pre-AGM board meeting in Japan.

The meeting was timed for the Rugby World Cup and had an attendance of some 135 people.

The call for an EGM came after Levy failed to follow through on the promised delivery of voting records from the annual meeting.

It sparked a rise of activity, with Levy stepping aside immediately in favour of his deputy Leon Blitz and a previously unplanned strategic review advised by UBS and Goldman.

Weiss is making his mark.

APRA member Geoff Summerhayes’ strong warning to the private health insurance industry on Tuesday was the last thing federal Health Minister Greg Hunt wanted to read.