Geminder’s Pact back on track with CEO

Packaging billionaire Raphael Geminder says Pact Group’s underlying earnings are improving.

Packaging billionaire Raphael Geminder says Pact Group’s underlying earnings are improving and the worst appears to be behind the embattled company, after it announced the appointment of a former BlueScope Steel executive as its new chief executive.

After a six-month search, Pact yesterday revealed that Sanjay Dayal would take over as CEO on April 3. Previously at BlueScope, Mr Dayal held the position of chief executive, building products, corporate strategy and innovation.

Before that, over a nine-year career with BlueScope, he held several other senior positions in Asia and Australia. He joined BlueScope after working for explosives maker Orica in Asia and Europe.

Mr Dayal also previously worked with Pact chief financial officer Richard Betts when they were both at Orica.

“Sanjay started from the factory floor in a manufacturing environment and he has seen every role,’’ Mr Geminder told The Australian from Hong Kong yesterday.

“This is also a man who has worked for decades in Asia. That is where we are going to get most of our growth going forward. We need somebody who has that experience. In Australia and New Zealand, we are in an environment where we are not seeing a lot of growth.”

Mr Geminder, who owns 39 per cent of Pact and has been executive chairman at the company since the shock departure of former CEO Malcolm Bundey last September, said he also enjoyed good chemistry with Mr Dayal.

“That is most critical for me personally. Then after chemistry comes his track record and background,’’ he said.

Mr Geminder defended the length of time it had taken to appoint a new CEO. In February Pact reported an embarrassing $320 million loss for the first half of 2018-19 after booking one-off items of $408m.

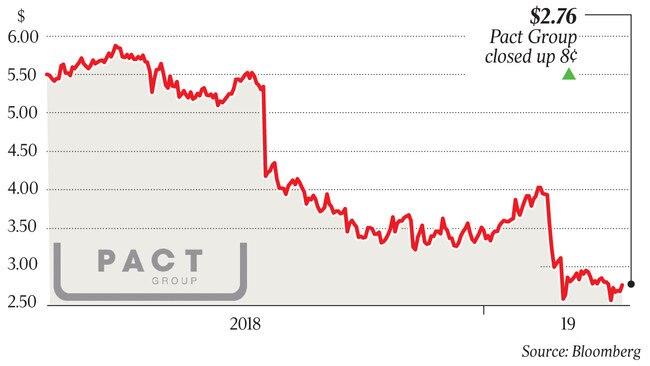

The Pact share price has fallen more than 30 per cent since mid-February.

“This was a process that was well considered and well thought through. This wasn’t knee-jerk. I wanted to take my time and make sure we had the right person,’’ Mr Geminder said.

“To be frank I also wanted a period of time to get into the business and understand where the issues were and then I could help the board look for the right type of person to fix the issues. And I am going to stay close. I won’t be handballing this to Sanjay and saying, ‘seeya’.”

Mr Geminder said he would judge Mr Dayal on his ability to continue to integrate the acquisitions Pact has made in recent years and his ability to “cut costs and implement our strategy”.

Pact has flagged it is seeking $50m in cost savings by 2022.

“The Australian economy is still sluggish but our underlying earnings are improving. As far as commodity price spikes go and electricity price increases go, they are behind us. We have a lot of integration and consolidation to get after. That is ongoing but the early signs are encouraging. We are delivering on what we said we would do,’’ Mr Geminder said.

Some analysts were wary about Pact’s cashflow deterioration in its half-year result.

“The underlying cashflow is not in bad shape. The challenge for us is we have spent capital, earnings before interest, tax, depreciation and amortisation has gone down and that has put pressure on our balance sheet,’’ Mr Geminder said.

Pact shares closed 8c, or 3 per cent, higher yesterday at $2.76.

Last week they slumped to another record low after investment group Ubique Asset Management offloaded its 6 per cent stake in the company. Mr Geminder has had no dialogue with Ubique since it sold its interest.

“They have been a good shareholder. I am disappointed they are no longer on the register,’’ he said. “But the good news is that puts some liquidity back into the stock.”