GCQ heads into online real estate after strong July gains

An investment in online real estate portal Zillow has brought naught but pain for investors in Will Vicars’ Caledonia, but fellow fundie Doug Tynan, now at his own shop GCQ, clearly sees opportunities in the sector.

GCQ, which came about earlier this year after Tynan’s split with VGI Partners, had a strong July – up 11.5 per cent – according to a memo to investors. Across June and July, the fund is up 4.4 per cent compared to a fall of 1.4 per cent in the MSCI World Index.

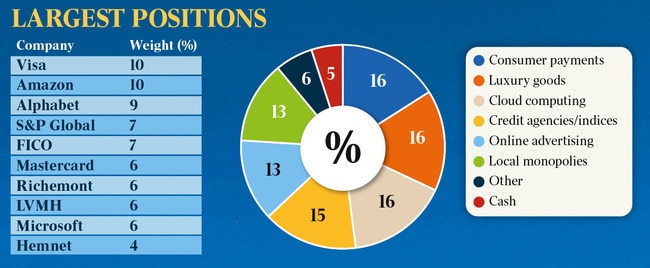

But the note to investors provides an extensive discussion about the rationale of investing in real estate, describing ASX-listed REA Group (majority-owned by News Corp, the publisher of The Australian), as a “trailblazer in the industry globally”. But Tynan is not invested locally. Instead, as his update shows, GCQ has built its position in Swedish player Hemnet, now four per cent of the entire portfolio.

“In the US, Zillow is the market leader, and generates most of its revenue by generating sales leads for brokers who are either trying to find home buyers to represent, or attract buyers to properties they are selling,” the GCQ note reads. “We believe this is a much more challenging business model than selling premium advertising to home sellers.”

“We believe Hemnet Group is best placed to build a business similar to REA, but is around five years less developed in doing so,” it continues. “Hemnet started out as an industry-owned initiative in Sweden in 1998, and has gone on to establish itself as the country’s monopoly digital real estate portal.”

“Hemnet’s business model is similar to REA, in that both companies generate the majority of revenue from advertising fees paid by home sellers. However, REA shares the Australian market with Domain, while Hemnet is a monopoly. Further, real estate agencies receive sales commissions for upselling value-added services to the home seller, and we believe this alignment is also a positive when compared with REA.”

In a separate note earlier this month, GCQ outlined a near 40 per cent return since its inception in January 2021 – and a 9.6 per cent fall since it was opened to outside investment in February.