Future Fund board of guardians member Deborah Ralston is wiser to the politics of the job

She might be the least-known member of the Future Fund board of guardians but Deborah Ralston is no stranger to the politics of the superannuation industry.

The tranquil country village of Bonalbo in the Northern Tablelands of NSW is more than 800 kilometres and a world away from the bustling streets of inner Sydney.

Living on a 1600 acre cattle property outside the town was the last place Deborah Ralston expected to find herself in 1973 after attending a Sydney’s private girls schools and studying engineering at Sydney University, where she was one of the only four women among 400 first year students.

“I was young and I fell in love with my husband. His family lived in the Bonalbo area and he wanted to open his survey practice there. So we moved up there,” she recalls.

“When we started, interest rates were 7 per cent. Within a relatively short period of time, they were 14 per cent.

It also coincided with the UK joining the European Union and the beef cattle market just went through the floor. So we had significant debt and not much income from the property.”

To help make ends meet her husband returned to the city to work for the Queensland government, leaving her on the farm to raise their children and manage their country bank manager, who was credit rationing at the time.

“I saw what happens when the market goes bad and interest rates go crazy. I thought this is not a business I want to be personally involved in,” she says. “I never wanted to see another farm again.”

It was an experience which inspired her passion for education, the economy and the financial services sector. For the next five years she completed an economics degree on the farm via distance education and eventually embarked on a career in academia.

Fast forward 40 years, and today Ralston is one of the least-known members of the Future Fund board of guardians, yet she is universally recognised as one of the nation’s pre-eminent thought leaders in financial services and retirement funding.

She is also a member of the Reserve Bank’s payments system board and from 2009 to 2015 was the executive director of the Australian Centre for Financial Studies, in her role as a professor of finance with the Monash University Business School.

Once the dean of business at the University of the Sunshine Coast, she enjoyed the coastal lifestyle so much that she and her husband Bruce have settled there. Their children live in Brisbane.

They also have a small apartment in Melbourne, where she stays when attending monthly Future Fund board meetings.

Ralston has long believed that good research – and good policy – comes when academics, industry and regulators co-operate.

“You bring together the context, the frameworks and the investigative skills. Because I’m a big fan of evidence-based policy, she says.

“If you get all those three parties to the table, you ended up with a better outcome.”

“If you get people to sit at the table and say, ‘Well, we’ve all got our own personal interests. Let’s put those aside and say we are here for the people of Australia in the national interest, how do we find a way of producing better outcomes?’ I find that people respond really well to that.”

She says her appointment for a five-year term to the Future Fund last September reflects that passion to pursue the common good.

“I’m an unusual appointment, because I’m not a fund manager,” she says. “But I’ve been a professor of finance for a long time and I do understand that side of things. So I’m hoping that I can contribute specifically to the work of the Future Fund in ensuring that it is serving the national interest.”

The Fund’s small loss in fiscal 2022 came after it recorded a record return of 22.2 per cent last year, but it would have worse if not for the 20 per cent return from a near $35 billion book of hedge funds, part of its alternative assets diversification strategy. But it also wrote down its private equity portfolio by 5-10 percent in the June quarter.

Ralston says she is a great supporter of investing in innovation, but notes allocation to alternatives need to be continually monitored to ensure they deliver the anticipated returns.

Political nous

Ralston is no stranger to the politics of the superannuation industry. When she was appointed by the then treasurer Josh Frydenberg to the Retirement Income Review Panel examining the state of the retirement system in 2019, Labor quietly cried foul.

“I think I have worked with all sectors of the superannuation area with industry funds, retail and self managed super funds. When I was appointed to the Retirement Income Review, I’d been chairing the SMSF Association,” she says.

“That caused consternation in some areas from people particularly who didn’t know me, who assumed that immediately meant I had an economic bias and so on.”

Her connections among some of the most senior members of the ALP called the political dogs off, but the experience has made her wary.

“It does mean now that I very rarely give an interview. It’s too easy for what you say to be politicised. We should be having these great debates in the national interest and I know politicians on both sides who are doing a terrific job, but then there are others who possibly are not. That’s not to do with the party, it’s to do with the personal motivation,” she says.

She says her track record proves her ability to rise above politics and remain independent in her thinking and analysis.

“It’s a much more political world for us to be in compared to when we did our first research back in the 90s,” she says.

“Back then I did quite a lot of media and you would be treated fairly independently by both sides. In fact, we did some work on bank branch closures through that period and it was on the election policies of both sides of government.”

Her appointment as the inaugural chair of Australian Securities and Investments Commission’s Digital Finance Advisory Committee led to her being in the frame to join the Reserve Bank payments system board.

“Because I had done a lot of work with start-ups, fintech and had a PhD in regulation,” she says.

“That’s the spot I tend to fall into: How do we create a regulatory environment that encourages innovation”.

“It maintains a fairly neutral framework that doesn’t disadvantage either newcomers or established business,” she says.

Then her work on the Retirement Income Review Panel led to her appointment to the Future Fund.

What is less known about Ralston is that two earlier experiences in her career gave her an admiration for building societies and mutuals, as well as mortgage brokers.

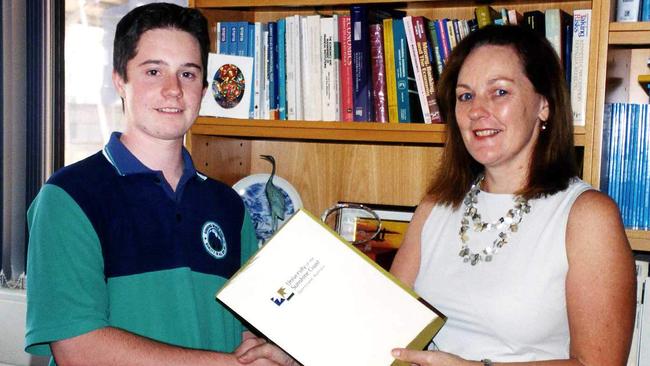

The first was in 1992 when she was asked to join the Heritage Building Society board. She stayed there for 11 years.

“Having been a keen student of economics and financial deregulation, I found that every board meeting I’d go to there seemed to be a new set of regulations to consider. I kept thinking that at the political level, we had statements about how this would be so much better for consumers.

“Then it went through the legislative process and the regulatory bodies and seemed to come out a bit differently. The question that I kept thinking was, ‘Will this be in the public interest?” she says.

It led to her authoring an acclaimed major research study on how national regulation would impact on credit unions and building societies.

From 2004 to 2018 she was also a non-executive director of the ASX-listed Mortgage Choice, now owned by REA Group. It was her first and only public company directorship. “I got to know mortgage brokers through my role with Heritage. I even referred my own kids to Mortgage Choice so they could see the spread of loans available in the market. Mortgage Choice was highly innovative. Before brokers, people only knew the loan product of their own bank. The role of mortgage brokers in educating consumers has been fundamental,” she says.

Complex issues

An issue of the moment in the super system is the Retirement Income Covenant, encapsulated in a bill passed through federal parliament in February this year that requires super trustees to create retirement income strategies that provide more granular detail about how they can assist members in retirement.

The covenant aims to provide funds with flexibility to design and tailor their strategies to meet the needs of members.

Ralston says only one third of the obligations on funds in the post accumulation phase of retirement should be about products.

“It’s about engaging with members and guiding them through and assisting them to get the best outcome they can. I think digital advice is going to be incredibly important for that,” she says.

Nick Sherry, one of the godfathers of the super sector and the new chairman of the $6.4bn TWUSuper – the industry super fund for the transport industry – believes super funds should be doing more to provide holistic retirement advice to clients, including estate requirements and helping them access quality home care services.

Ralston doesn’t disagree.

“I think in time our super funds will have a platform with a range of products to assist people. Home equity is a really important one, as is long-term care,” she says.

The federal government last year revamped the Pension Loans Scheme to help senior Australians fund their retirement by unlocking the value of their home.

The scheme, which was rebranded as the Home Equity Access Scheme, provides non-taxable fortnightly loans using their real estate as security.

Treasury’s Retirement Income Review, released two years ago, found using relatively small portions of home equity through the Pension Loans Scheme or similar equity release products could substantially improve retirement incomes for many people.

“For many people now, their superannuation balance is a lot less than the value of their home. So drawing on your home in a sensible way can often help people have a much better standard of living in retirement,” says Ralston, who is chairman of the advisory board of independent specialist retirement funding provider Household Capital.

Last year the Future Fund published a position paper titled A New Investment Order, outlining the 10 paradigms that it said were “shaping the investment order in ways that should encourage investors to think afresh about their portfolios”.

They were deglobalisation, populism, technological disruption, demography, climate change, challenges to corporate earnings, a changed inflationary regime, fiscal-monetary co-ordination, a change in fair values, and a decline in sovereign bond duration in portfolios.

Two of those were recently highlighted by Jim Chalmers, when he outlined a new agenda for the superannuation sector to build more local investments in housing and clean energy.

Ralston agrees that investments in domestic infrastructure by superannuation funds will increasingly become important, especially given the ongoing volatility in international markets.

“So there are really solid sound financial reasons why we might see a stronger bias more towards Australian investments than there has been in the past. That’s well thought out and, of course, we do have issues such as climate change and housing that need to be dealt with,” she says. But she adds an important caveat.

“That needs to be balanced with the interests of members. They need to be sure that money will grow in a way that will assist them in retirement,” she says.

“We always need to balance what we do as a nation with the interests of the members to make sure that their returns are appropriate and are building towards a better outcome for people in retirement. You just don’t throw out all the individual interests for the national interest, you find the balance between the two.”