Fortescue could benefit from Rio Tinto’s Cape Lambert port fire

Fortescue Metals Group could emerge as the main beneficiary of last week’s fire at Rio Tinto’s Cape Lambert port in WA.

Fortescue Metals Group could emerge as the main beneficiary of last week’s fire at Rio Tinto’s Cape Lambert port in Western Australia after Rio confirmed it would not be able to meet some of its contracted export commitments.

Rio Tinto yesterday said it had declared force majeure over lower-grade iron ore exports from Cape Lambert due to damage sustained to equipment that separates its Robe Valley ore into lump and fine products.

Rio ships about 30 million tonnes of lower-grade Robe Valley material out of Cape Lambert each year on behalf of the Robe River joint venture, in which it has a 53 per cent stake.

Fortescue is the biggest player in that lower-grade ore market, with its 170 million tonnes a year of 58 per cent iron ore exports eclipsing the combined lower- grade shipments of Rio and BHP. Lower-grade ores have suffered in recent years by a widening discount compared to higher grade iron ore. The lower- grade material has historically traded at a 15 per cent discount, but that had blown out to as much as 42 per cent last year as Chinese steel producers tried to capitalise on wide margins by maximising production.

Shaw and Partners analyst Peter O’Connor said Rio’s misfortune would potentially provide a handy price tailwind for Fortescue, noting that the price gap between lower and higher-grade ores had already been narrowing in recent months. He said lower-grade supply had been shrinking over the past year in response to the price discounts — a trend that would be exacerbated by last week’s fire — while higher grade supply had been expanding.

“Steelmakers’ margins have been sliced by around 66 per cent over the past quarter and mill capacity utilisation rates are lower,” Mr O’Connor said.

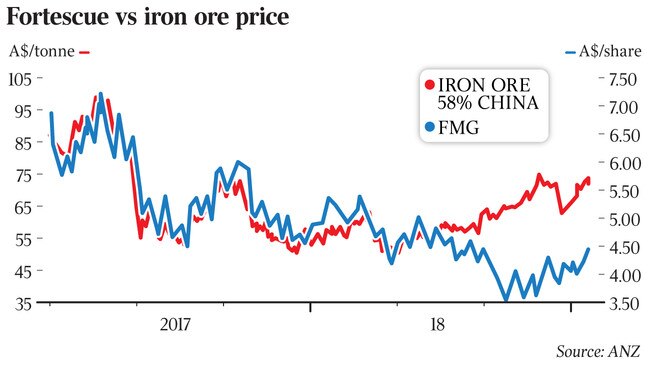

The discount on lower-grade iron ore has been narrowing in recent months, from around 45 per cent at its peak a year ago to around 27 per cent today. Historically, 58 per cent ore has traded at a discount of about 15 per cent.

Mr O’Connor said Fortescue should be trading at around $5.50 a share based on its typical correlations with the iron ore price. The stock was trading at $4.52 yesterday.

While Rio did not say how long the force majeure would be in place, a spokesman said the fire had no impact on the company’s other Pilbara iron ore products. “Rio Tinto is assessing the full impact of the damage and will do all it can to try and minimise disruption to our customers,” the spokesman said.