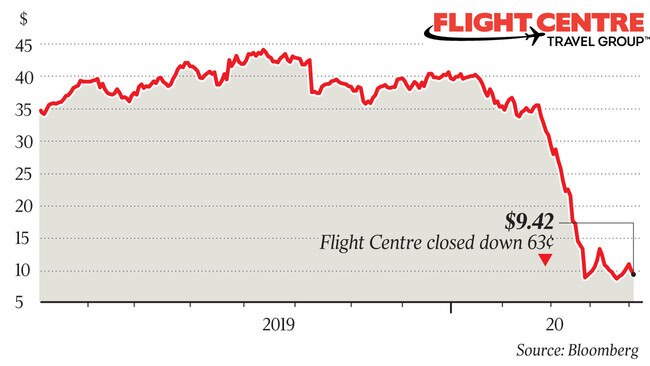

Flight Centre looks past the gloom

Embattled Flight Centre is taking heart from nascent increases in new corporate accounts, as well as its Chinese business.

Embattled Flight Centre is taking heart from nascent increases in new corporate accounts, as well as Chinese travel business, but like its competitors total transaction values were just 5-10 per cent of normal April levels.

The travel agency said net positive cash impacts from the recent $62m sale of its Melbourne headquarters, which it bought for just over $31m in 2008, as well as lower than expected one-off implementation costs and additional government support initiatives, were helping.

“We are tracking towards a target of $65m per month cost base, with lower one-off implementation costs than originally expected,” Flight Centre said in a statement to the ASX.

The $65m-per-month target expected by the end of July is down from $227m a month.

Meanwhile, Flight Centre has reacted to ACCC and customer pressure and dropped its coronavirus refund and cancellation fee policies in Australia and New Zealand. It was previously charging $300 on international bookings and $50 on domestic bookings. Analyst Morgans said this move would be applied retrospectively to bookings cancelled due to COVID-19 on or after March 13, 2020.

In a note, RBC Capital Markets said irrespective of the ACCC and potential class actions, Flight Centre had done the right thing by amending cancellation policies and removing and refunding cancellation fees.

“The widespread negative media coverage and customer reviews associated with their (previous) refund policy in our view would have materially damaged the Flight Centre brand. This move may help this sentiment turn around, noting it has only occurred after significant customer and regulatory pressure,” RBC said.

Flight Centre also announced an additional credit of up to $200 per person for customers who elect to leave funds on file for future bookings.

Flight Centre managing director Graham Turner said although travel restrictions remained in place globally, the company continued to generate sales with some ongoing activity in most countries.

“And we are seeing a slight uptick in bookings in countries like China as travel and trading restrictions ease,” he said.

“Importantly for the future, we continue to win and implement new corporate accounts that will help drive TTV growth when conditions recover and normalise.”

Although the time frame for the recovery remained unclear, Mr Turner anticipated an increase in activity in Australia as soon as interstate borders reopened, which he expected would happen in the coming months, adding that domestic travel accounted for about half of Flight Centre’s leisure business.

Rival Helloworld told the market on Friday that it expected a return of some domestic travel by September but any international activity would be unlikely until next year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout