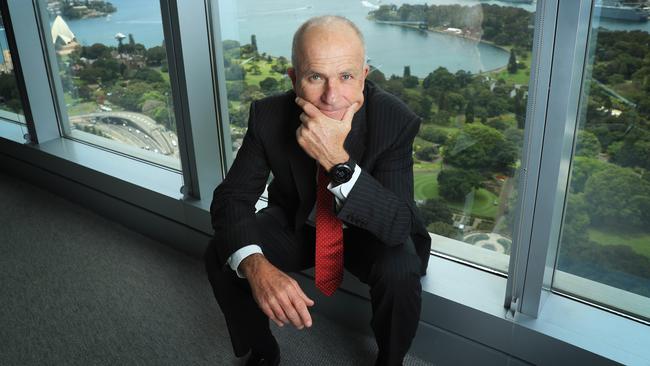

Zenith downgrades Paradice Investment Management mid-cap fund on John Lake stepping back

The departures from the local funds management industry keep on coming, with John Lake’s retirement from Paradice Investment Management being dubbed a ‘material loss’.

Ratings house Zenith has downgraded Charter Hall-backed Paradice Investment Management’s mid-cap shares fund, citing the stepping back of co-head of the strategy John Lake as a “material loss”.

In a ratings update, obtained by The Australian, Zenith said while Mr Lake had not set a date for any departure, he had “formally relinquished” managing the fund and related stock coverage responsibilities.

The stepping back of Mr Lake is the latest in a changing of the guard in Australia’s funds management sector, which has endured the exit of a string of well-known managers in the past five years. Investments veteran and Airlie Funds Management co-founder John Sevior retired last year and Magellan Financial Group saw the departure of chairman and investment chief Hamish Douglass in 2022, and more recently the exit of chief executive David George.

At Perpetual, head of equities Paul Skamvougeras parted ways with the firm in 2022, while last year Investors Mutual founder Anton Tagliaferro retired from the firm.

Paradice Investment Management was set up in 1999 by well-known stockpicker David Paradice and began managing funds in 2000. The Paradice Australian small cap strategy came first in that year, followed by the mid cap strategy in 2006 and the Australian large cap strategy in 2007.

“Following the announcement, (Matthew) Riordan, who co-founded the strategy with Lake became the sole head of Australian Mid-Cap. Riordan will continue to be supported by Jordan Woods and Jovana Gagic, who joined the team in November 2022 and September 2023, respectively,” Zenith’s update said. “Until his official departure, Lake will continue to support the team where appropriate.

“Zenith believes Lake’s imminent departure is a material loss for the fund, given his tenure with the strategy and extensive portfolio management experience.”

But Mr Paradice said Mr Lake was still employed by the firm on an indefinite basis and noted the change was part of longer-term succession planning efforts.

“It’s actually really positive and I’m really excited by it,” he added.

“These people (those taking over the day-to-day management of the mid-cap fund) are really high quality … allowing John to gradually wind back.”

Mr Paradice said Mr Lake was staying on with the firm and remained as a “sounding board” to the team.

Zenith’s rating on the Paradice mid-cap fund was cut to approved from recommended.

“Although we are comforted by Riordan’s continued involvement, believing his oversight is critical, we view the change as a diminution in portfolio management capabilities,” the update said.

“Additionally, we note that (Jordan) Woods and (Jovana) Gagic have limited portfolio management experience and a relatively short working relationship at Paradice. As such, we will seek to build confidence in their investment and portfolio management competencies going forward.”

Mr Riordan is a long-standing member of the Paradice team, having joined in 2004 from BT Financial Group. Mr Woods joined Paradice from Ausbil Investment Management in 2022, while Ms Gagic started at the firm last year, joining from Tribeca Investment Partners.

In 2021, 50 per cent of Paradice’s eponymous firm was snapped up by ASX-listed Charter Hall in a deal valuing Paradice Investment Management at about $414m.

Separately, ratings house Zenith last month downgraded two Cooper Investors’ global share funds, citing the second restructure of the firm’s portfolio management personnel over the past three years.

The changes saw Zenith downgrade the funds to an approved rating, after a period of review. Prior to the review the two funds were rated recommended.

Those downgrades related to the Cooper Investors Global Equities Fund (Hedged) and the Cooper Investors Global Equities Fund (Unhedged), after Marcus Guzzardi and Geoff Di Felice were appointed the co-portfolio managers of those funds, replacing Christopher Dixon.

Interestingly, Mr Paradice and Peter Cooper of Cooper Investors were initially in business together running Paradice Cooper Investors. After four years, the pair went their separate ways.

Mr Cooper was valued at $631m on this year’s The List, published by The Australian.