Xinja seeks wholesale funding

Digital bank start-up Xinja is in talks with providers of wholesale funding, as it accelerates plans to start offering home loans.

Digital bank start-up Xinja has kicked off talks with providers of wholesale funding, as it accelerates plans to start offering home loans later this year and take market share from the big banks.

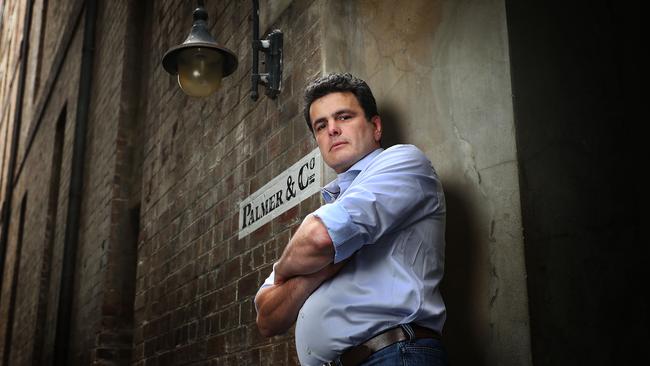

As Xinja pushes ahead with its second equity crowd-funding campaign, chief executive Eric Wilson told The Australian the company would need to capture just 0.7 per cent of the $1.7 trillion mortgage market to break even.

“The push to open up this market can only be a good thing,” he said, noting the Hayne royal commission had shown big banks had “abused their power for too long”.

Xinja is targeting as much as a $5m raise from its latest crowd-funding drive, after last year attracting $2.7m from its first round.

Crowd-funding allows companies to tap large numbers of retail investors online to access capital.

In total, including a series of funding rounds targeting high net worth investors, Xinja has raised more than $24m.

But like other digital banks pushing into the market, Xinja faces a tough road ahead.

The crowd-funding offer document shows while the company was revenue-positive in the four months ended October 31, 2018, its net loss before tax amounted to $5.6m.

It wants to sell 245,099 to 2,382,260 shares at $2.04 apiece, which will deliver the company a post-raising maximum valuation of $94.2m. The initial crowd-funding campaign was pitched at $1.25 per share.

The latest offer document still outlines a string of risks with the investment including funding, regulatory and technology risks.

“There is definitely still risk … but the level of risk has decreased substantially,” said Mr Wilson, a former National Australia Bank employee.

His comments reflect Xinja being granted a restricted banking licence from the Australian Prudential Regulation Authority in December, a first step to obtaining a full licence, which the company is targeting in the second quarter.

If that is achieved, Xinja’s proposed timeline will see the company begin to offer home loans and deposit accounts in the third quarter.

Discussions about wholesale funding lines with banks, pension funds and insurance companies were under way and would “supplement” Xinja’s deposit book as its mortgage lending stepped up, Mr Wilson said.

More than 23,000 people had so far signed up to the Xinja app and the company had issued 8000 prepaid travel and spend cards as at December 2018.

“We have set out quite a modest set of numbers on customer acquisition,” Mr Wilson said. “We set out a plan and we are really comfortable.”

He added that growth in Xinja’s travel and spend cards had occurred “much better and much quicker” than the company’s initial modelling.

The restricted banking licence category was introduced by APRA in 2017 to help digital online-only banks gain easier entry to the local market and start offering limited services to customer.

There will, however, be a race to grab the attention of customers by digital banks this year. Volt is also in the process of securing a full banking licence and Cuscal-backed 86 400 has opted to pursue a full licence from the outset.

Mr Wilson believes the crowd-funding campaign gives Xinja an edge.

“It is something that is really important to us that everybody gets the same opportunity,” to invest in the company, he said.

Xinja has about 1200 investors of which roughly 1100 are retail investors from the first crowd-funding round.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout