The under-pressure fund manager will now look for a chief executive that can restore asset growth and deliver outsized returns. Acquisitions of boutique funds are also on the horizon, and a short-lived $100bn funds under management target has been quietly shelved to focus instead on performance.

But what Magellan really needs to do is prove to its backers it can be a fund manager more than the Hamish Douglass show.

George has agreed to resign a little more than 14 months into his tenure, and in that time Magellan has seen funds under management drop by nearly $23bn. This follows a loss of mandates and lacklustre performance. Today, Magellan now has $35bn in total funds under management, a fraction of the $116bn it had this time two years ago.

Magellan’s new chairman Andrew Formica, a highly-experienced global funds boss from UK major Henderson, knew straight away something had to change.

New chairman, new plan

Formica was named Magellan’s new chairman in August and gave the Australian manager a much-needed outsider’s perspective. After a stint as co-CEO of Janus Henderson with $450bn under management as well as running Jupiter Asset Management, Formica brought plenty funds heft to the table. He immediately launched his own review of Magellan and met with big clients. And in recent weeks he started a series of talks with George around the path of Magellan’s broader strategy.

“I’m very proud of the time when he (David George) stabilised the ship, and he’s a done number of things around improving the structure and the way we run the business,” Formica tells The Australian. “And we’ve looked at going forward, David and the board came to a very clear view that it’s actually probably better somewhere else to take this forward. That suited David and that suited us”.

George, a former top Future Fund executive, will stay on with Magellan until the end of December, although Formica will step in as an executive chairman while a search is underway. The changes have come two weeks out from Magellan’s annual meeting.

The blame in Magellan’s flagging performance can’t all be sheeted back to George, who was hastily brought in to stop the bleeding.

Magellan is still working through fallout from the personal crisis of Douglass, its founder and star stock picker. It was Douglass’ marriage strains, loss of mandates and ultimate exit that sapped confidence and ultimately led to big doubts around the direction of the fund.

Douglass nailed his stock picks to a small collection of high-flying tech names and rode the China story all the way up. However, he failed to anticipate the world turning against both of the investment themes.

Out of time

Douglass is no longer involved in executive or board decisions of Magellan but remains as a consultant. He is no longer listed as a major shareholder, but retains a stake of just below 5 per cent of Magellan. Formica says the management changes were not as a result of any “individual or collective shareholder”.

“This was a discussion between myself and David and also with the board, we have to look at what’s right for the business”.

George came from the world of big pension funds rather than buy-side funds, built his Magellan rescue plan around improving long-term performance. He pushed for more infrastructure investments and wanted to launch new ESG strategies. After a crisis left by Douglass Magellan didn’t have time on its side for a patient capital approach.

George rebuilt fund processes and governance and put in place a lofty target of getting back to $100bn in funds under management in five years.

While the mandate losses slowed, George wasn’t able to quickly put Magellan back on the course it needed.

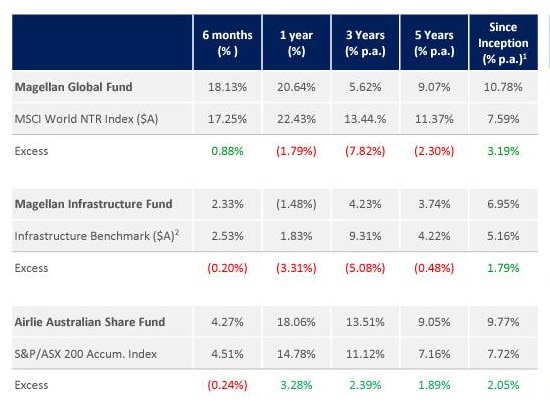

Magellan simply lacked an investment edge in a crowded market. Performance too underwhelmed, with the flagship Magellan Global Fund and infrastructure fund trailing their respective benchmark. Indeed, on a three-year return the global fund was more than 7.8 per cent below its benchmark and the infrastructure fund down 5 per cent. The only strong performer was independently run boutique Airlie Funds. However, Airlie also faces a period of transition following well-regarded funds boss John Sevior retiring this year.

Formica says the $100bn target is no longer a focus, rather it is about delivering exceptional outcomes for clients. He says this approach will instead lead to increased value across the business.

And as a former boss with globally-focussed managers, Formica believes funds – especially Magellan – need to break away from the idea of celebrity fund manager running the show. Since its ASX listing nearly two decades ago, Magellan was built and marketed around the identity of Douglass.

“I don’t think any one person can deliver on their own, they need a team around them. And there may be some people who are really important to that process. But they are part of a team,” Formica says.

“The days of a single fund manager driving the entire investment process and outcome is not where I would see the business going forward”.

johnstone@theaustralian.com.au

David George wasn’t the right person to deliver the fundamental reset that Magellan needed, and it took a new chairman to quickly make this call.