Which bank morphed from ‘value creator to value trap’

Detailed analysis by Jefferies analyst Brian Johnson shows that CBA’s total shareholder return (share price growth plus dividends) did better than the banking index and the ASX 200 under CEOs David Murray, Ralph Norris and Ian Narev.

While CBA has outperformed the banking index under newcomer Matt Comyn, who succeeded Narev in April 2018, it still lags the ASX 200, which has climbed 12 per cent in Comyn’s tenure compared to the bank’s 8 per cent TSR.

NAB is at the other end of the spectrum, always underperforming in relation to one or both measures. Only former CEO Don Argus was able to beat the banking index and the ASX 200.

Johnson, who has followed the big four since 1987, says in his report that he’s still amazed by the “hubris cycle” in banking.

This was best demonstrated by NAB, which comprehensively outperformed the broader market and the other banks under Argus.

But under his four internal successors — Frank Cicutto, John Stewart, Cameron Clyne and Andrew Thorburn — it morphed from “value creator to value trap”.

While asset quality cycles hurt banks, Johnson says longer-term cultural denial by management and inaction by the board can lead to persistent underperformance.

Internal succession can embed poor strategies, whereas fresh management can unlock shareholder value.

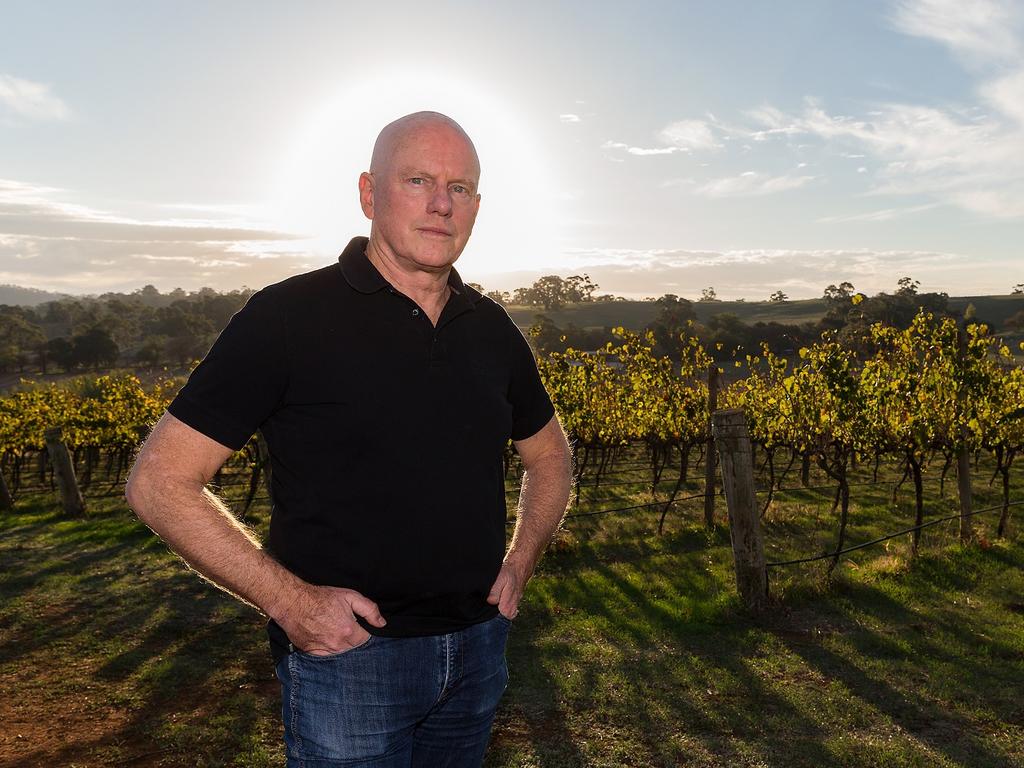

With NAB going external to recruit CEO Ross McEwan and chairman Phil Chronican, the report says there is a chance that the bank will exceed expectations.

“Following the April 2020 capital raisings, MLC sale and rundown of the commercial real estate book (largely achieved under Thorburn), NAB emerges well-capitalised, de-risked and with an observable shareholder value focus,” Johnson says.

ANZ has marginally outperformed the banking index but lags the ASX 200 under CEO Shayne Elliott, who was an internal successor to Mike Smith in 2016.

Elliott has downsized the Asia franchise built by Smith and predecessor John McFarlane but the bank remains overweight in the New Zealand market and institutional, where there’s an imbalance between the risk and the available profit margin.

As for Westpac, Johnson says the No 2 home lender is struggling with an underperforming mortgage franchise, exposure to an Austrac civil penalty exceeding its $900m provision, and a likely inadequate common equity tier one capital position.

“These earnings/CET1 headwinds should have been addressed by past management and pose a major challenge for new CEO Peter King and new chair John McFarlane,” he says.

Of Westpac’s five CEOs since the early 90s — Bob Joss, David Morgan, Gail Kelly, Brian Hartzer and Peter King — only Morgan can boast outperformance of the industry and the ASX 200.

A deal worth Zip

What happens when a large bureaucratic institution invests in an ambitious disrupter, promising that both will capitalise on an “emerging market opportunity”?

Not much, if Westpac’s strategic partnership with buy now, pay later group Zip is any guide.

On Monday, Westpac’s head of global transaction services Di Challenor stepped down from the Zip board, reflecting dilution of the bank’s shareholding to below the agreed 15 per cent threshold for a board seat.

Three years ago, amid considerable fanfare, Westpac paid $40m, or 81c a share, for a 17.1 per cent stake in Zip.

The bank also qualified for 9.8 performance options in return for an extra $8m if Westpac-related Zip revenue exceeded certain annual hurdles, starting at $25m.

The revenue would be earnt from rolling out Zip’s products and services across Westpac’s payments network.

Suffice to say, Westpac hasn’t qualified for performance options.

Not only that, but the bank’s shareholding has diminished to 10.9 per cent as of August 31 due to Zip’s scrip-funded acquisition of US BNPL group QuadPay.

Westpac still holds 55.2 million shares. At its current share price of about $6, the holding is worth a cool $331m.

It’s been an astonishingly good investment, but that’s all down to the work of Zip and its founders Larry Diamond and Peter Gray.

Westpac’s contribution has been minimal, although there are suggestions work has started on the promised integration of Zip’s product with the bank’s network. If true, it wouldn’t be before time.

It’s easy to understand Zip’s motivation for doing a deal with Westpac. Like all fintechs, it faced the challenge three years ago of building scale before cash and/or investor interest evaporated. Like most incumbents, Westpac would have had the best of intentions to help Zip achieve its ambitions.

But when the euphoria of the deal dies down, responsibility for execution transfers to the business unit — in this case the consumer bank — as the sponsors move on to the next transaction.

The consumer bank, for its part, has had other problems, notably the erosion of its home-lending market share due to processing challenges offshore.

Group CEO Peter King, who is trying to awaken the bank from its Austrac anti-money laundering nightmare, has also had to replace about half his leadership team.

These are not excuses; it’s the unfortunate reality of dealing with large institutions.

In the meantime, Zip has replaced Challenor with company director and former investment banker Pippa Downes.

The company is also looking to expand its board with the appointment of a US-based director, in line with its expansion into the key US market.

Twitter: @Gluyasr

Commonwealth Bank chief executives and chairs have consistently outperformed their major-bank peers since the last recession in 1992, with NAB the sector’s perennial laggard.