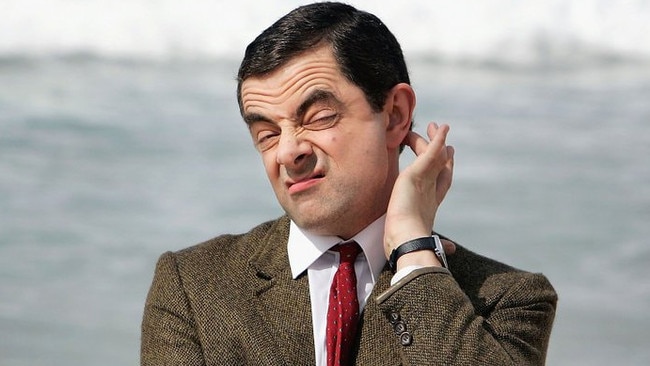

Westpac’s ‘Mr Bean’ email: a symbol of banks’ disconnect with rural communities

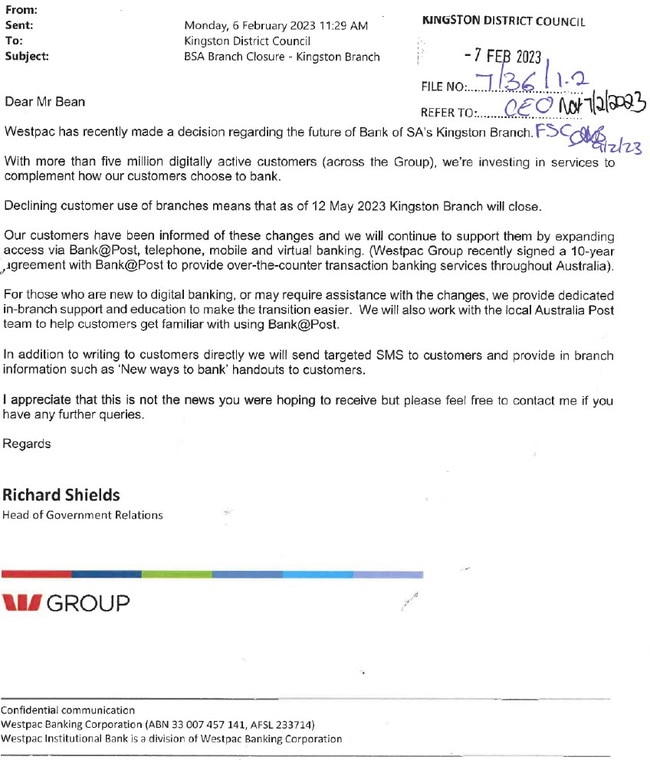

Westpac addressed ‘Mr Bean’ in an email notifying the SA council of Kingston their last bank branch would close. No one resembling Rowan Atkinson lives there.

Westpac addressed “Mr Bean” in an email notifying the South Australian council of Kingston the coastal community’s last bank branch — located next door — would close.

District council CEO Ian Hart said he doesn’t know if the bank’s subsidiary BankSA was trying to contact Rowan Atkinson, the actor who plays the fictional character, or if it simply reflected the bank’s level of care.

“We don’t have anyone who resembles Rowan Atkinson or is even known by that nickname,” he told a senate inquiry into the impact of bank closures on regional communities.

“The fact that they couldn’t even get the salutation to such an important item of correspondence correct speaks volumes about the bank closure process.”

The year-long inquiry comes as banks have closed over 650 branches in rural and regional areas over the past five years, leaving them without essential banking services and in many cases leading to economic decline.

Senators undertaking the year-long inquiry had asked lenders to pause closures until the end of the review, which was originally due last December but has been extended until May.

Westpac, which argues the closures reflect a sharp decline in the use of physical branches in recent years, had obliged with the senators’ request to halt some closures.

In March last year, the bank made a public announcement saying it would keep open a handful of rural branches it had previously earmarked for closure, including in Kingston, South Australia.

Mr Hart said he had started his role less than four weeks ago, but handover briefings and notes showed the bank had not consulted with the district council, which services over 2000 residents in the area.

“We were given no warning at all, and no courtesy phone call either, from any of the BankSA representatives. Given that the council itself uses BankSA as its only operational banking facility and that we are located right next to the branch, this was very difficult to comprehend,” he said.

Mr Hart said the community still harbours fear about a potential closure of the local branch after the senate inquiry ends, which would disproportionately impact the ageing population who rely on face-to-face banking. The town’s economy relies on agriculture, tourism and small businesses which need cash to operate.

He said the bank provided no data to substantiate its claims of unviable branch operations, ignoring broader community and customer impacts. Mr Hart also said the bank’s actions were against its — and its parent company, Westpac’s — stated values, including being helpful and ethical.

Later on, Ross Miller, a Westpac executive with the authority to close branches, explained why the bank had addressed its notice to “Mr Bean” when emailing the council’s generic online address. He said staff based in Sydney had confused Mr Hart’s town with Kingston, Victoria, where the city council CEO is named Peter Bean.

“That just was an email that came from our government affairs team. We’ve reviewed our processes to ensure that wouldn’t happen again. But most importantly, by making sure that we verbally communicate in the future to any local council, so we apologise,” he said.

Mr Miller acts as chief customer engagement officer for the whole group, also including the Westpac, St. George and Bank of Melbourne retail brands.

He said Westpac had South Australia’s largest network of branches and ATMs, grown over 175 years, and that statistics showed that only about 3 per cent of the bank’s 13 million customers were using its branches.

“When we make a decision to close a branch, we take into account many factors, and that includes the local knowledge of the branch … but ultimately, I make the decision about closing a branch and I feel satisfied that there’s a number of factors that help us determine that outcome.”

He said the bank’s policy was not to engage or seek input from local branch staff, councils or community organisations prior to a decision to close. Instead Westpac seeks the relevant input from regional bank managers, and engage with the community and the affected staff once a decision has been made and announced.

When asked what were the current plans for the Kingston bank in South Australian after the inquiry ends, Mr Miller said the bank no longer had “current” plans to close it.

“We have no future plans to close Kingston,” he said. “We’ve been in the branch today and we’re very grateful to the branch staff here and their patience which was a period of time where they had some uncertainty.”

The committee also heard from Cathy Clemow, a resident of Mannum, a historic town located 100km east of Adelaide with a population of around 2500 that swells to 10,000 during peak tourist season.

Ms Clemow described how on December 16, 2022, just as the disastrous Murray River floodwaters crept into the main street of Mannum, the local BankSA “heartlessly closed its doors and left town, leaving us without a bank and taking their ATM with them,” she said.

Soon after, Ms Clemow began a “Bank for Mannum Campaign” to raise awareness about the impact of the bank closure on Mannum residents.

“BankSA deserted Mannum when it was struggling the most. A clear indication that banks really don’t care about servicing their regional customers, only servicing their own interests.”

Getting to Mannum’s closest bank involves a 70km round trip to Murray Bridge, she said.

The committee also heard of customer experiences after the bank closed the only bank in Coober Pedy last year. A staffer from the city council drove 540km to the nearest Westpac branch in Port Augusta to change account signatories, but was told the manager was busy and to come back the next day.

Mr Miller from Westpac again apologised for any poor customer experiences like that, and said the bank would look into verifying those stories don’t happen again.

Rural community leaders told the hearing banks should engage to provide communities with transition plans to help them adapt and survive a new, branchless, way of life. For example, through partnership with supermarkets or through co-locations. This was particularly important for towns with increasingly ageing populations, some of which were further challenged by poor connectivity.

Asked about exploring partnership options to meet community banking needs in rural areas, Mr Miller said the bank would be open to opportunities beyond its Bank at Post partnership if they could provide a service where Westpac couldn’t.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout