Westpac warns bank inquiry could tip nation into recession

Westpac’s David Lindberg yesterday said a lengthy inquiry into the banking system could push the nation closer to a recession.

A lengthy and damaging inquiry into the banking system could bring the nation closer to a recession and “economic collapse” if it deters global investors from the local financial sector, says Westpac head of business banking David Lindberg.

Speaking at the Trans-Tasman Business Circle in Sydney yesterday, Mr Lindberg said a royal commission could ignite a drought in global investment in Australia, adding to similar warnings from Westpac chairman Lindsay Maxsted and National Australia Bank chairman Ken Henry.

The comments preceded the extraordinary step on Wednesday morning of the major banks throwing their weight behind calls for an inquiry, in order to end speculation and uncertainty.

The CEOs of the Commonwealth, Westpac, National Australia and ANZ banks made the request in an email sent on Thursday to Treasurer Scott Morrison.

Mr Lindberg’s warning earlier on Thursday came as momentum built for a royal commission into the banking sector, with Greens leader Richard Di Natale yesterday offering his party’s support for a commission of inquiry into the banks proposed by National senator Barry O’Sullivan, following a string of amendments to proposed legislation.

“If you are an overseas debt investor, the truth is you just don’t know that much about Australia,” said Mr Lindberg, one of the most senior Westpac executives.

“If you’re sitting in an office in New York or Shanghai and you don’t know much about Australia other than that the government just called a royal commission, then you might just send your money to Singapore instead,” he said.

“We always talk about shareholders, but we get much more capital from debt holders than shareholders. When it’s gone, Australia will go into economic collapse.

“Political risk — higher capital requirements, higher taxes, expensive regulation, weak support statements — all puts us at risk.”

The likelihood of a lengthy inquiry has become a near certainty and the major banks are assembling internal and external teams of lawyers to co-ordinate a response to a commission.

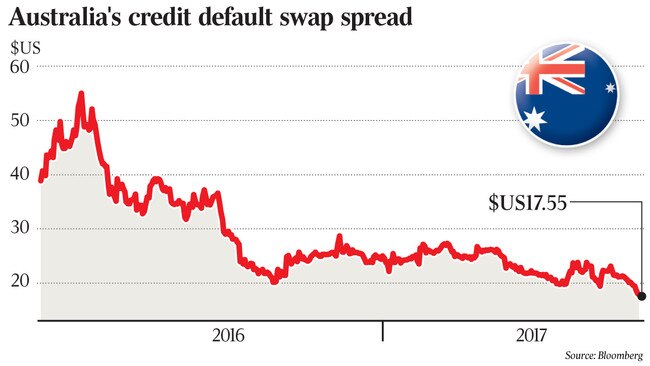

However, investors appear unmoved by the prospect. The spread on credit default swaps for the major banks — an indicator of investor belief in a likely bank collapse — are close to their lowest point since the before the global financial crisis. The spread on credit default swaps is currently around 50 basis points, compared to a peak of about 250 basis points at their peak during the aftermath of the GFC in 2011.

Mr Lindberg said Westpac last year secured about $145 billion of capital primarily from overseas, and lent that out almost exclusively to business borrowers.

He said it was always more important to have strong banks with scale than smaller banks that were unprofitable.

“Weak banks are known to be the accelerator of a crisis,” Mr Lindberg said. “A small economic shock means bad debts will rise, capital requirements on the banks will go up and so will funding costs.

“If it happens in an environment where the banks are weak the banks will have to raise capital, but they won’t be able to raise capital. They will have to raise funding, but they won’t be able to raise funding. They will have only one choice, which is to restrain credit.

“Asset prices will fall, businesses will fail, we will be in a recession and people will lose their jobs and house.”

Mr Lindberg said claims of excessive profits had to be tempered by measuring profitability in terms of return on equity, rather than raw numbers, such as the $31bn collective profit between the big four banks for the latest financial year.

Australia’s major banks are the second-most profitable in the world, following Canada.

Westpac booked a return on equity of 13.8 per cent last year. Mr Lindberg said a return of between 10 and 15 per cent was “about right”.

“If you start to get ROEs that are lower it comes with a higher cost of capital that ultimately gets borne by business customers and mortgage customers. So the lower it goes the more expensive it will be for them. The higher it goes, that suggests the more they’re paying the banks. We want to find an intermediate range,” he said.

Mr Lindberg said comparisons with other developed nations’ banking systems failed to account for the many banks that struggled during the GFC or that were bailed out by taxpayers.

“Bank bashing is a serious political wedge issue between the liberals and Labor right now. It all sounds a little bit depressing, but I’m very, very positive and I think things are going to work out well.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout