Westpac chief says borrowers may need a pay boost and to cut spending if the cash rate hits 4pc

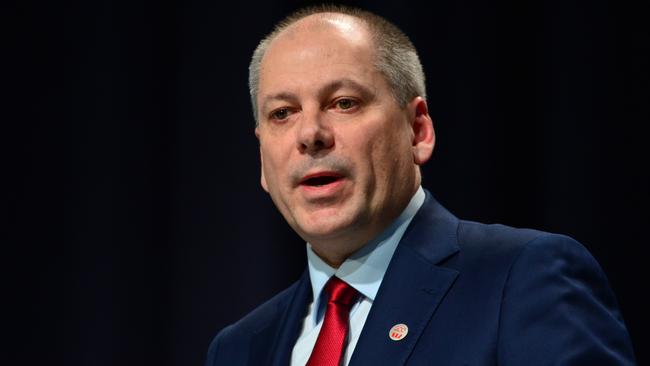

Westpac’s Peter King says interest rate rises are a necessary ‘blunt tool’ but borrowers might need a pay rise or to cut their spending.

Westpac chief Peter King has labelled interest rate rises a “blunt tool” required to tame inflation, as he cautioned that many borrowers would need a pay rise or to cut their spending to manage repayments if the official cash rate hits 4 per cent.

He was speaking at a trans-Tasman business circle event in Sydney on Friday after Westpac reported an uptick in 30-day mortgage and consumer finance delinquencies due to cost-of-living pressures and seasonal factors.

The bank also signalled it was managing the roll-off of $92bn in ultra-low fixed rate loans over the next 13 months.

The Reserve Bank this month raised the official interest rate a ninth time to 3.35 per cent as it seeks to slow price pressures and demand in the economy. The sharp rise is expected to lead to higher loan losses through this year.

“If we end up at the 4 per cent and people haven’t got pay rises, or they aren’t able to reduce costs then there may be issues, but there’s also options for the bank to help customers through that period,” Mr King said. “We’re monitoring closely … The big picture though will all come back to unemployment.”

Mr King outlined his expectation that inflation would reduce over coming quarters, otherwise the official rate would stay higher for longer.

“It feels like it’s on the way down (which) is the good news and I think each quarter from here we will start to see it come down,” he said.

“It really is something that we need to get down because the quality of living for a lot of people will reduce if we have prolonged high inflation.”

Treasurer Jim Chalmers, speaking via video, told the same event 2023 would be a “challenging year” for the global economy.

“The defining feature of the Australian economy in 2023 is inflation,” he said, noting the government’s budget plan to address inflation relief, repair supply chains and keep spending in check.

“We are providing responsible cost-of-living relief, where it delivers an economic dividend as (it) doesn’t add excess demand.”

Mr King said while the economy would slow, the bank was still positioning for growth.

“We still see opportunities to grow, we still see parts of the economy that will do well, we’re ready for that,” he said. “We also know that this is a transition year. For a lot of people it will get a lot harder.”

While Westpac’s December quarter data showed stressed assets to total committed exposures dipped one basis point to 1.06 per cent, there were tentative signs of increased pressures in its home loan, credit card and personal loan books.

Economists tip further rate hikes in the months ahead, which will result in loan repayments rising even higher.

Westpac’s Australian 30-plus day mortgage delinquencies edged up to 1.24 per cent, from 1.21 per cent three months earlier, albeit the rise was from a very low base. The same metric for consumer finance climbed 13 basis points to 2.92 per cent.

Mr King noted many borrowers were entering the tougher climate in a position of strength and played down the increase in shorter-term delinquencies.

“That tends to happen over Christmas when people go on holidays,” he said.

“We’re as best as we can be going into what will be a tougher environment.”

Mr King expects higher loan losses will start to emerge around the middle of the calendar year, given it takes time for rate rises to filter through to repayments.

Westpac’s December quarter data showed 90-plus day mortgage delinquencies fell by 5 bps to 0.7 per cent.

The bank’s shares edged up 0.09 per cent to $22.78 on Friday.

Goldman Sachs analyst Andrew Lyons said Westpac’s loan quality printed “slightly better” than his estimates and the bank’s capital position was in line with expectations.

The bank’s analysis also detailed the challenges a large proportion of borrowers will face given they are already confronting payments close to, at or above the buffers Westpac built into their loan serviceability assessment. The bank said 45 per cent of its $471bn home loan book reflected mortgages written between August 2019 and June 2022, when it was assessing loans at the prevailing interest rate plus a buffer of 2.5 per cent or 3 per cent.

“Assuming a cash rate of 3.85 per cent (Westpac Economics peak forecast), the serviceability buffer for these mortgages is expected to be exceeded,” the bank’s update said.

The RBA has hiked rates 3.25 percentage points since May and banks have passed on the increases to home loan borrowers, although there is a lag around when repayments rise. That underscores the pressure many borrowers are facing.

Westpac also reported an impairment charge of $184m for the December quarter. Total impairment provisions rose to $4.78bn from $4.63bn three months earlier.

The bank’s risk-weighted assets rose to $480.4bn at December 31, up $2.8bn from three months earlier.

Higher residential mortgages, specialised and corporate lending buoyed an increase in credit risk-weighed assets.

Asked about fierce competition in the mortgage market, Mr King said: “I can’t think of a period when it’s been more competitive.”

That is exacerbated by a refinancing wave as borrowers that locked in low fixed rates during the depths of the pandemic shift to markedly higher variable rates.

Westpac said it had $11bn of those loans rolling off over the next six weeks, after which there are $92bn over the next 12 months. From March 31 2024, the bank has a further $42bn transitioning in the 12 months following.

Westpac’s customer deposit funding to net loans ratio rose to 84 per cent as at December 31, the highest level on record.

Westpac’s common equity tier one capital ratio was 11.13 per cent at December 31, down on 11.29 per cent three months earlier.

Two of the bank’s rivals reported similar dynamics this week as loan losses remained in check but they brace for an increase.

After handing down a record interim profit, Commonwealth Bank chief Matt Comyn said households were drawing down savings buffers and would rein in spending to navigate living cost and rate pressures.

CBA’s troublesome and impaired assets as a percentage of its total exposures eased by 2 basis points to 0.46 per cent from the prior six months. But the decline masked a notable increase in troublesome and impaired assets in the construction and commercial property sectors.

National Australia Bank provided a December quarter update on Thursday noting the ratio of loans 90-plus days past due and gross impaired assets to gross loans and acceptances decreased four basis points to 0.62 per cent.

NAB’s credit impairment charge was $158m in the December quarter, up from $114m three months earlier.

Chief executive Ross McEwan said the higher rate environment had benefited NAB’s revenue, but would also cause economic growth to slow and prompt a further slump in property prices.

Unlike NAB which provided a trading update with unaudited quarterly cash profits, Westpac just provided a pillar three update. Westpac’s disclosures did not detail changes in its net interest margin, a profitability measure that assesses what the bank earns on loans less funding costs.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout