Westpac first of the big four out of the door with interest rate increase

Westpac has fired the gun on the first home-loan rate hikes for three years, with the other major banks set to follow.

Westpac has fired the gun on the first home-loan rate hikes made independently of the Reserve Bank for three years, with the other major banks set to follow.

The decision to hit borrowers with higher interest rates is the first test for Josh Frydenberg, who comes to the Treasury portfolio faced with record levels of household debt and rising levels of financial stress. “My view is it’s up to the bank to explain to the Australian people why it lifted rates,” the Treasurer said yesterday. “Any financial institutional which makes these decisions needs to explain to its customers why.”

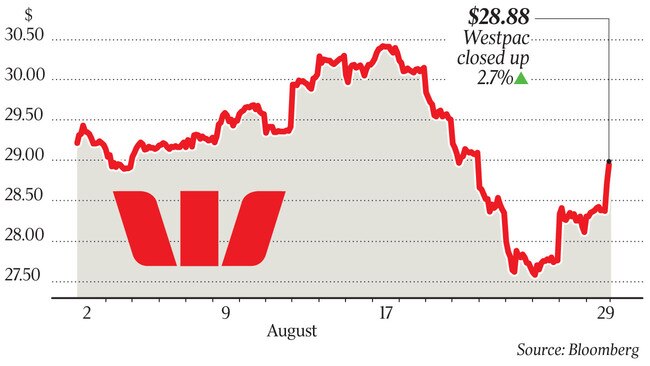

Blaming rising funding costs, Westpac, the nation’s second-largest bank, said yesterday it was increasing rates by 14 basis points to 5.38 per cent for owner-occupiers with principal-and-interest loans.

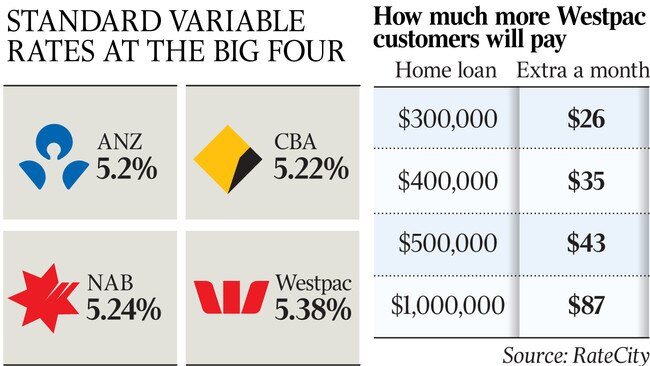

For owner-occupiers with interest-only loans, rates will rise by the same 14-basis-point margin to 5.97 per cent. For investors with principal-and-interest repayments, rates will rise to 5.93 per cent, while property investors on interest-only loans will be hit with a 6.44 per cent variable rate. Borrowers with an average $300,000 loan can expect to pay about $26 more a month. Customers with a $1 million loan will pay an extra $1044 a year.

The changes will come into effect on September 19 and are likely to be copied by Commonwealth Bank, National Australia Bank and ANZ. “Now that Westpac has hiked, taking the brunt of the bad PR, we expect the other three banks to follow suit,” RateCity research director Sally Tindall said.

Former treasurer and current Future Fund chairman Peter Costello said the banks should not treat increased funding costs as a “free-for-all” opportunity to hike rates.

Mr Costello also said evidence at the royal commission showed some of the banks had “behaved appallingly”.

“Coming out of all of this, I think, will be that banks won’t be so profitable and credit will be harder to get, and financial advice will be more expensive,” Mr Costello said.

The move comes despite the Reserve Bank having kept the official cash rate at a record low of 1.5 per cent since 2016, and a recent signal from governor Philip Lowe that official rates would remain low for some time. The Reserve Bank is increasingly concerned about rising interest rates amid stalled wages growth and growing household debt.

Rising rates are also likely to further dent the property market, which is recording price falls across most capital cities. Westpac chief executive Brian Hartzer said it was never easy to increase interest rates. “It’s not something that we relish doing,” he said. “We deal with the swings and roundabouts of market volatility and we were hoping that they (funding costs) would go back down, but we think it’s now a permanent feature and needs to be reflected in our lending rates.”

Mr Hartzer said the delay in moving on interest rates had nothing to do with the financial services royal commission, but he agreed the banks were under scrutiny. Asked whether Westpac expected a political backlash, he said it was “very conscious of the external environment … but I have to run the business for the long term”.

Mr Hartzer said the bank was “not seeing any particular build-up in household stress”.

Mr Costello said he believed it was “important that monetary policy in Australia is still principally mediated by the Reserve Bank of Australia, but given the international pressures, I think they (banks) will be looking for out-of-cycle rate increases.”

Westpac’s rate of 5.38 per cent leaves it by far the bank with the highest standard variable rate of the major lenders. ANZ offers a 5.20 per cent rate, below CBA’s 5.22 per cent and NAB’s 5.24 per cent.

Along with Macquarie, other lenders have increased rates, including AMP Bank, Bendigo Bank, Bank of Queensland, ING Direct, ME Bank, Suncorp and Citigroup, as have small lenders including Beyond Bank, Auswide Bank, MyState and Qbank.

Labor Treasury spokesman Chris Bowen said Westpac had made a “commercial decision” that it needed to justify. “Australians are already doing it tough with cost-of-living pressures, mainly rising power prices and private health insurance cost, and this won’t help,” Mr Bowen said.

Despite a flurry of rate hikes in recent weeks by smaller and regional lenders, the major banks have been reluctant to push increased costs on to borrowers as the banking royal commission continues to unearth scandals.

The major banks control about 75 per cent of the $1.6 trillion mortgage market.

The last time the central bank cut rates — in August 2016 — the banks withheld most of the rate cut from customers.

The then-Turnbull government responded by establishing the twice-yearly parliamentary grilling of the big bank chief executives, which was then surpassed by the royal commission.

Westpac consumer bank boss George Frazis said yesterday the move was “a tough decision” and did not fully recoup the rising cost of funding.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout