Westpac facing civil legal action for insider trading, unconscionable conduct

ASIC faces a host of challenges to secure an insider trading win against Westpac.

ASIC faces a host of challenges to secure an insider trading win against Westpac in relation to the nation’s biggest interest-rate swap deal, implemented for the $16.2bn privatisation of the NSW “poles and wires” business Ausgrid, according to corporate law expert Ian Ramsay.

The University of Melbourne law professor said the 2016 transactions were complex, the bank was very well-resourced, and the elements of the prosecution were often difficult to prove.

To suggestions that Westpac could argue it had only acted according to established market practice, Professor Ramsay said that would be a further complication.

“Australia has some of the broadest insider trading laws in the world - much broader than the US, for example - and that means that the regulator will inevitably test the boundaries,” he said.

“But no one is suggesting that this part of the Corporations Act is anything but complex.”

Westpac adopted a cautious approach on Wednesday, saying it took the allegations “very seriously” and was considering its position.

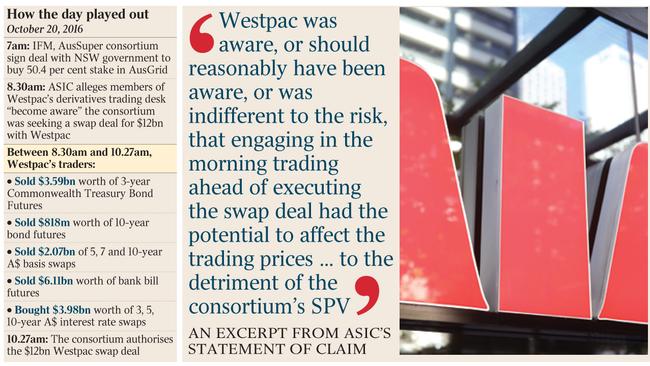

Earlier, ASIC sensationally claimed in Federal Court documents that the case involved Westpac’s role in executing a $12bn swap deal on October 20, 2016 with the Ausgrid purchasers, AustralianSuper and a group of IFM entities.

The transaction effectively enabled the conversion of variable interest rates for the debt funding to a fixed rate, in what remains the biggest swap transaction executed in a single tranche in Australian corporate history.

The regulator, however, alleged on Wednesday that Westpac became aware of certain “inside” information by 8.30am on October 20 - that the bank would soon execute the entire swap deal for the AustralianSuper consortium.

When the market opened shortly after, Westpac’s traders allegedly bought and sold interest-rate derivative products to preposition the bank in anticipation of the swap transaction.

This had the potential to adversely impact the price of the swap transaction for its client, the consortium.

“ASIC alleges that Westpac’s trading occurred while it was in possession of information that was not generally available to other market participants including those that traded with Westpac that morning,” the regulator said in a statement.

“Prohibitions against insider trading are a fundamental tenet of market integrity.”

ASIC also alleged in its court documents that Westpac’s failure to advise the consortium about its intention to preposition its trading books ahead of the swap deal amounted to unconscionable conduct.

Then-Westpac institutional boss Lyn Cobley was aware of the inside information, according to ASIC.

Others who allegedly knew some or all of the Ausgrid information included Nicholas Allen, Benjamin Mitchell and Shane Dorman on the derivatives trading desk, the head of fixed income Simon Masnick, and the managing director of corporate and institutional distribution and origination in financial markets Michael Correa.

ASIC is seeking declarations and pecuniary penalties for Westpac’s alleged contraventions of the Corporations Act and the ASIC Act.

The insider trading and unconscionable conduct case brought by ASIC continues a nightmare run of regulatory battles for Westpac.

It was the only one of the big four major banks to defend allegations of attempted manipulation of the bank bill swap rate in 2016, and ended up with a split decision.

It was targeted by ASIC in a controversial responsible lending case, and paid a record fine of $1.3bn to Austrac last year over millions of transgressions of anti-money laundering legislation.

Unlike previous battles, the bank adopted a cautious position on Wednesday instead of its more customary response that it would vigorously defend the case.

“Westpac takes these allegations very seriously and is considering its position having just received the (court documents),” the lender said in a statement.

“As the matter is now before the court it would not be appropriate to comment further at this time.”

Assuming the case goes to trial, sources said it was unlikely to be heard for at least a year.

Lawyers said there was no relevant legal precedent, arguing that Westpac was likely to raise the “own intentions” defence under the Corporations Act.

Under the defence, knowledge of your own trading intentions in a particular market is protected from the application of insider trading law.

If Westpac were to submit it only acted according to established market practice, experts said ASIC would probably counter that the “own intentions” defence was drafted with the equities market in mind; for example, when companies build a stake in a takeover target before making a bid.

“But this case occurred in the derivatives market in the debt world,” a senior lawyer said.

“It doesn’t fit in as easily, so ASIC would say that the defence is not available.”

A further key difference was that the insider information related to the intentions of a client, not the principal Westpac.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout