Westpac dives amid doubts on loan book

Westpac shares yesterday suffered their single biggest one-day loss since the Brexit market rout two years ago.

Westpac shares yesterday suffered their single biggest one-day loss since the Brexit market rout two years ago, as an influential market analyst raised doubts about the quality of the banking giant’s $400 billion home lending book following a review of a cache of documents submitted to the financial services royal commission.

UBS analyst Jon Mott warned lending standards might be falling short after an analysis released by the royal commission of 420 Westpac loans showed almost a third were not checked for proof of borrower income and the majority were assessed against a much criticised benchmark. This could lead to more focus by banks on following responsible lending rules, which in turn could make loans harder to get for some.

“We believe the royal commission is a game-changer for Australian financial services,” Mr Mott said.

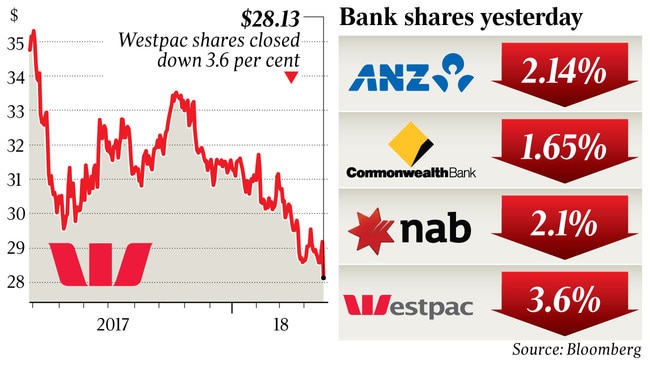

Westpac shares slumped to an intraday low of $27.80 before recovering to close at $28.13, down $1.05 or 3.6 per cent. At its lowest point, the share-price decline of 4.7 per cent eclipsed the bank’s post-Brexit fall of 4.4 per cent. Concerns over so-called “liar loans” weighed on other banks, with ANZ down more than 2 per cent and Commonwealth Bank, the nation’s biggest, down 1.65 per cent.

Even so, Westpac sought to calm the market by clarifying that a portfolio of 420 mortgages highlighted by UBS was continuing to perform well.

APRA also joined the fray, announcing yesterday that the 10 per cent speed limit on investor loan growth introduced in 2014 would be removed from July.

However, rather than lifting demand for credit, UBS said the move fed into its narrative about a potential credit crunch after the banking regulator affirmed it would replace the macroprudential measure with a more permanent framework to strengthen lending standards.

UBS’s Mr Mott raised questions in his report about the quality of Westpac’s $400bn home lending book, slashing his 12-month price target for the bank by a whopping $4.50, or 15 per cent, from $31 to $26.50.

Westpac chief financial officer Peter King responded in a late statement to the ASX that the 420 loans reviewed were performing soundly.

“Our mortgage delinquencies and losses remain low both relative to historical and industry averages,” Mr King said.

At the end of last year, the delinquency rate for Westpac home loans overdue for a repayment by 90 days or more was 0.67 per cent. The bank is due to provide an update at its interim result on May 7.

Mr Mott’s report followed the release of a trove of documents in the financial services royal commission, including APRA’s targeted review program in May last year of the controls used by the major banks in their mortgage borrower serviceability assessments.

After the reviews, APRA chairman Wayne Byres said Westpac was a “significant outlier”, with the independent expert PricewaterhouseCoopers finding eight of the bank’s mortgage “control objectives” were ineffective.

While UBS has supported Westpac as a well-managed, conservative organisation, Mr Mott said he had now incorporated significantly higher risks into his assessment of the lender after the release of the APRA targeted review.

“In particular, its focus on ensuring the banks ‘obey’ the responsible lending laws, and with boards and management likely to be much more risk-averse, further tightening of underwriting standards are highly likely across the industry,” he said. “This could potentially lead to a sharp reduction in credit availability.”

PwC found that Westpac had not completed all minimum income verifications in 29 per cent of the 420 sample mortgages, with 86 per cent of the sample assessing living expenses as equal to the much criticised household expenditure measure benchmark.

Mr Mott said all the banks relied heavily on HEM to assess a customer’s living expenses, but Westpac appeared to be the heaviest user of the benchmark.

“We believe that overuse of the HEM benchmark is a material concern (and a focus of APRA),” he said.

“However, this risk was elevated given the royal commissioner’s statement that: ‘An available point of view may be that there is a trade-off between administrative convenience and obeying the law. Now that’s a very awkward trade-off.’ ”

Westpac pointed to commentary in the PwC report that lenders were being held to a higher standard than the “reasonableness” benchmark envisaged by the law and regulations. Where the bank’s standard fell short, it should therefore not be regarded as a breach of regulations.

Since the PwC review, Westpac said it had reassessed the 38 loans that PwC believed would have failed the standard.

Westpac found that all the loans would have been approved, bar one, using the information on the credit files available to PwC as well as other information available to the bank, which was not part of the review.

The loan that would not have been approved was currently ahead of its repayment schedule.

The bank also said that only four of the loans in the sample were more than 30 days past due, of which only one was greater than 90 days past due.

Of the original 420 loans, 90 had already been repaid or refinanced.

Meanwhile APRA chair Wayne Byres said the decision to remove the cap on investor loan growth had been taken in close consultation with the other members of the Council of Financial Regulators.

To benefit from the move, bank boards were expected to confirm that lending had been below the benchmark for at least six months, and that lending policies also met APRA’s guidance on serviceability.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout