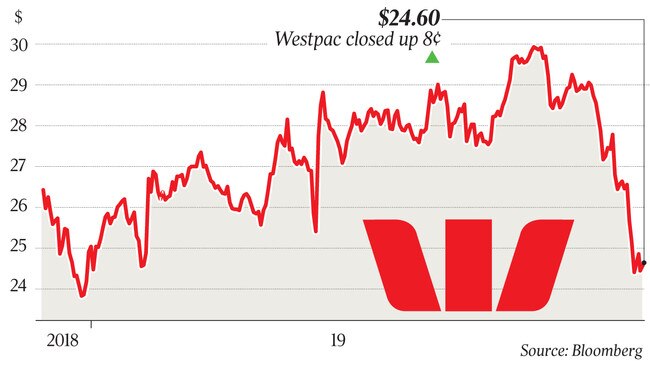

Westpac directors ‘may be disqualified’

APRA has raised the prospect of disqualifying Westpac directors and execs after the child exploitation funding scandal.

The banking regulator has raised the prospect it could could disqualify Westpac directors and executives in the wake of the child exploitation funding scandal and criticised Australia’s biggest banks for handing out too much of their profits to shareholders rather than investing in compliance systems.

Appearing before the House of Representatives standing committee on Monday, Australian Prudential Regulation Authority chairman Wayne Byres told MPs the watchdog was considering what action to take against Westpac, which has been accused by Austrac of breaching anti-money laundering laws and allowing payments potentially linked to child abuse.

“We’re thinking about a range of options,” Mr Byres said.

This month the financial intelligence agency Austrac accused Westpac of 23 million breaches of anti-money laundering legislation, including allegations it failed to act when it was facilitating thousands of child exploitation payments to The Philippines and Southeast Asia.

Westpac is expected to face a fine of close to $1bn after failing to properly monitor billions of dollars in international money transfers, known as IFTIs, or report those transactions to regulators.

“These are very serious allegations which have caused us, as the prudential regulator focused on the financial safety of institutions and the system, to carefully consider what they mean for the prudential standing of Australia’s second-largest bank,” Mr Byres told the standing committee. “While we must be careful not to duplicate or cut across matters for which Austrac is the appropriate regulator, and which are before the courts, we are actively considering what further action by APRA is required.

“This includes examining whether obligations under the banking executive accountability regime (BEAR) have been met, and how Westpac’s management of operational and compliance risks more broadly needs to be enhanced. As would be expected, we are also ensuring we closely co-ordinate our activities with our fellow regulators — especially Austrac and ASIC (the Australian Securities & Investments Commission).”

The banking executive accountability regime, which applies to the board of directors, chief executives and the rank of executives under the chief executive, could result in the “disqualification of individuals” if breaches were serious enough, Mr Byres said, adding that APRA was interested in finding out the extent to which information was known in one part of the bank but didn’t filter up, or whether there were warnings that were ignored by management.

Labor MP Andrew Leigh asked Mr Byres whether the scandal showed big banks needed to plough more cash into compliance.

“It’s pretty clear they do,” Mr Byres said.

Mr Byres added that the amount of profits paid out to shareholders “could play a role” in the lack of proper compliance systems.

“When returns have been very high, as they have been historically, it’s easy to both grow the business, grow the balance sheet and pay out returns to shareholders,” he said.

“We are entering into an environment now where that’s no longer going to be the case.

“There will be a much harsher choice for bank boards to make about how much of their reduced returns they need to retain to grow their balance sheets and fund balance sheet growth, and how much they can afford to return to shareholders.”

Mr Byres said there were no immediate prudential concerns about the stability of Australia’s second-largest bank, which last week lost chief executive Brian Hartzer over the scandal, but that there were concerns about the culture set by its leadership.

“The bank is financially strong, but the Austrac matter has raised issues of governance, culture and accountability in relation to risk management,” Mr Byres said.

In 2017, Commonwealth Bank was sued in the Federal Court by Austrac over 50,000 instances where it broke the law, ultimately leading to a record-breaking $700m fine.

Meanwhile, NAB told shareholders this month in a note attached to its annual report that it believed it may be involved in a breach, or alleged breach, of laws governing “bribery, corruption and financial crime”.

Mr Byres said the size and complexity of large banks, insurers and super funds meant there would always be failures.

“There are new products being added, there are old products being removed — and sadly and unfortunately even with the best will in the world there will be things that go wrong,” Mr Byres said.

ASIC deputy chair Karen Chester on Friday said Australia’s biggest companies had been focused on pouring money into unnecessarily complex “product proliferation” while failing to invest in compliance systems to monitor the subsequent sprawling operations.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout