Westpac CEO Brian Hartzer defends loan book

Westpac chief Brian Hartzer has launched a strident defence of his lender’s $600bn mortgage book.

Westpac chief executive Brian Hartzer has launched a strident defence of his lender’s $600 billion mortgage book amid concerns about the bank’s quality controls left it a “significant outlier” among the major banks.

Mr Hartzer also doubled down on the bank’s continued ownership of its wealth management operations despite the rest of the sector moving to unravel decades of cross-ownership of financial planning businesses.

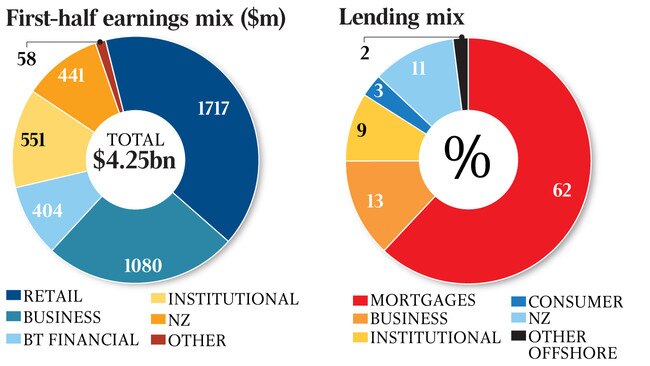

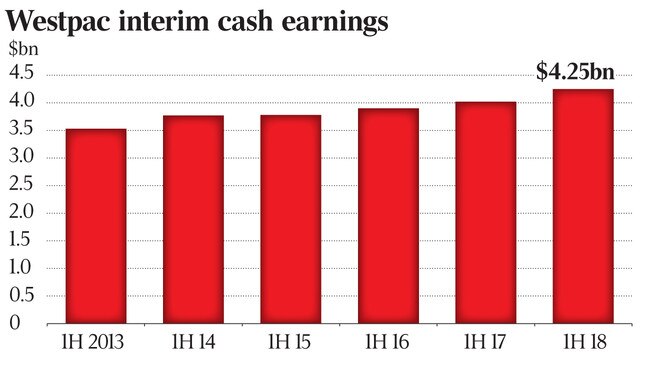

His comments came as the nation’s second-largest bank reported a first-half cash profit of $4.25 billion for the six months to the end of March — a 6 per cent increase year on year. Revenue rose 4 per cent to $11.2bn.

Westpac held its interim dividend steady at 94c a share. The bank said the government’s bank levy cost $186 million during the half year.

“Our top priority continues to be balance-sheet strength,” Mr Hartzer said, adding that the bank’s mortgage book was “in good shape”.

Mr Hartzer said the bank’s lending standards had been tightened recently, while it was now paying closer attention to borrowers’ expenses and income.

The bank’s loan quality remained sound, with stressed assets as a percentage of total exposure rising four basis points to 1.09 per cent — less than half the rate six years ago. The bank has fewer than 400 houses in possession out of a portfolio of about 1.6 million loans.

Westpac shares recently suffered their single biggest one-day loss since the Brexit market rout two years ago, as an influential market analyst raised doubts about the quality of the banking giant’s home lending book following a review of a cache of documents submitted to the financial services royal commission.

UBS analyst Jon Mott had warned that lending standards might be falling short after an analysis released by the royal commission of 420 Westpac loans showed almost a third were not checked for proof of borrower income and the majority were assessed against a much-criticised benchmark. This could lead to more focus by banks on following responsible lending rules, which in turn could make loans harder to get for some.

After the reviews, APRA chairman Wayne Byres said Westpac was a “significant outlier”, with the independent expert PricewaterhouseCoopers finding eight of the bank’s mortgage “control objectives” were ineffective.

Responding to the concerns yesterday, Mr Hartzer said the APRA targeted review “had a higher bar than what is required by the regulator” and that only one loan in the review should not have been approved. Even then, the borrower was still ahead on its repayments.

Westpac chief financial officer Peter King said that for loans sold before it last tightened standards in 2015, about 90 per cent of borrowers had a deposit of 20 per cent or more.

“Overall I’m comfortable with the quality of the book,” Mr King said. He said the data set that provided the basis for the APRA review was incomplete. “So conclusions from it would likely be incorrect,” he said.

Mr Hartzer said he had read the results of APRA’s six-month investigation into the culture and governance of Commonwealth Bank and had encouraged all Westpac’s executives to read it.

He said there were some “very important messages and reminders” for all the banks contained in the report.

APRA last week forced CBA to top up its minimum capital levels by $1bn after finding it guilty of “complacency”, having a “reactive stance”, as well as being insular and not learning from experiences and mistakes.

CLSA analyst Brian Johnson said while the overall Westpac profit result was “good”, the bank would probably suffer as more borrowers switched from interest-only loans to those requiring principal repayments and as funding costs rose.

Mr King said the share of interest-only loans in the mortgage book had fallen from 50 per cent to 40 per cent over the past year.

He also said for every five-basis-point increase in short-term funding costs, the bank’s profit margin would fall by one basis point.

Regal Funds analyst Omkar Joshi said the benign loan stress conditions would not continue forever.

“It’s a good result overall with considerable margin expansion,” Mr Joshi said.

“Bad debts have continued to decline which is probably not as sustainable but the margins were good.”

The bank’s return on equity — the key measure of profitability for shareholders — hit the top end of Westpac’s target, at 14 per cent. Westpac’s net interest margin — the different between what the bank lends at and the rate it pays savers — rose seven basis points to 2.17 per cent.

The bank’s consumer bank, responsible for mortgages, booked a 12 per cent increase in earnings year on year, rising to $1.7bn.

Despite continued criticism faced by the vertically integrated major banks, which own and operate financial advice and wealth management arms, Mr Hartzer said his lender was committed to keeping its BT Financial Group division.

National Australia Bank last week said it would carve off its MLC wealth unit, while ANZ and Commonwealth Bank have already made moves to ditch their own problematic businesses.

“There are challenges in financial planning generally. We think those issues have been dealt with,” Mr Hartzer said. “We can do more on the compliance side.”

He said the bank was “constantly reviewing” its operations and was fixing issues where it found them.

The Australian last week revealed audits of BT Financial found worryingly low levels of apparent compliance with anti-money-laundering laws and a high risk of poor advice being pushed by the bank’s advisers.

As late as January this year, Westpac had no minimum education standards for some supervisor roles in its BT Advice financial planning business and there was a “high risk” that customers were being shunted into financial products against their best interests, documents tendered to the royal commission showed.

Westpac reported yesterday that BT had a 7 per cent increase in earnings to $404 million, due to lower general insurance claims and a rise in funds under administration.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout