Westpac banks on turnaround in home loans after profit tumble

Westpac expects a turnaround in the dismal performance of its key mortgage business.

Westpac expects a turnaround in the dismal performance of its key mortgage business, with growth expected to match its major-bank peers by the second half of next year.

Chief executive Peter King blamed the 2 per cent, year-on-year contraction in the home loan portfolio to $441bn on the bank taking too long to approve applications, and offshore providers suffering a blowout in processing times due to COVID-19 complications.

“It’s going to take a bit of time but we’re getting there,” Mr King told The Australian.

“We’ve seen early signs of a pick-up in the past two to three weeks.”

The poor performance of the mortgage business was a big contributor to the profit hit suffered by the consumer bank, where annual cash profit tumbled 12 per cent to $2.75bn.

It deteriorated further in the second half compared with the first half, down 13 per cent to $1.27bn, with the mortgage portfolio shrinking by $3.5bn in the six months to March, and $4.7bn in the six months to September.

Part of the decline was due to a deliberate strategy to wind back investor lending.

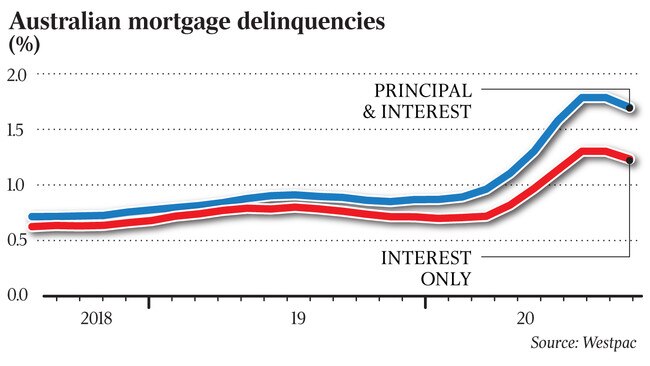

Interest-only loans as a percentage of the total book fell from 27 per cent a year ago to 21 per cent, as the proportion of customers paying principal and interest correspondingly jumped from 70 per cent to 76 per cent.

Westpac announced last July it would bring 1000 jobs back onshore, after its home loan turnaround times were hit by processing delays in The Philippines due to COVID-19 imposed lockdowns.

Mr King said at the time the move, which would take about 12 months to implement, was a further step in the transformation of the mortgage operations through boosting local employment, reducing the risk of disruption, and accelerating the bank’s digital push to simplify processes.

The other problem in mortgages has been the complexity of the application process — an outcome of the financial services royal commission.

“We’ve overlaid too many checks and balances,” Mr King said. “We’re redesigning it and making it simpler.”

As the nation’s second-biggest home lender, Westpac’s mortgage unit is a problem worth fixing, particularly with annual system growth expected to be 3.2 per cent.

Westpac anticipates business credit, on the other hand, will contract by 3.5 per cent. On slated changes to responsible lending rules, Mr King said they would help in “speeding up” loan processes, but Westpac would still ensure borrowers could repay.

While mortgages on repayment pauses sharply declined at Westpac in recent months, the bank is closely monitoring the situation.

For mortgages on repayment deferrals, Mr King said up to 30 per cent of customers were not responding and engaging with the bank.

He noted Westpac was closely tracking whether customers were resuming repayments without having contact with the bank.

UBS analyst Jon Mott highlighted Westpac’s stronger capital position and the run-off of repayment deferrals as positives, but said the bank still faced a tough outlook. “The underlying profit and loss trends are very challenging. Westpac appears to be facing a multi-year turnaround story,” he said.

On Monday, Westpac said it had $16.6bn in Australian home loans on repayment pauses at October 28, reflecting 41,000 accounts. That was down from $54.7bn provided at the height of the pandemic.

About 31 per cent of home loan customers on repayment deferrals had opted to extend the pause for a further four months.

Westpac also has $1bn in Australian small business loans on repayment deferrals, reflecting 4300 customers. That has reduced from $10.1bn provided.

Mr King said up to 60 per cent of business customers on repayment deferrals were dodging engagement with the bank.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout