Was your superannuation fund the 2020 winner for returns?

Australia’s best-performing superannuation fund finished the year with an impressive 9.6 per cent return.

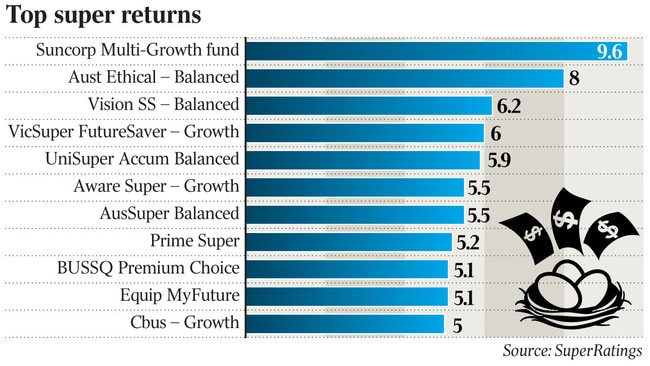

Australia’s best-performing superannuation fund shrugged off the turmoil that gripped markets early in 2020 to finish out the year with an impressive 9.6 per cent return, research house SuperRatings says.

The near-10 per cent return achieved by Suncorp’s Multi-Manager Growth Fund was well ahead of the median super fund return of 3.3 per cent for the year.

Australia’s benchmark S&P/ASX 200 index fell 1.45 per cent over the same period.

The second-best performing fund was Australian Ethical’s balanced option, which returned 8 per cent, and Vision SS, which delivered a 6.2 per cent return for members in its balanced option.

The outperformance by the nation’s best super funds masked the extremes experienced in markets in February and March, as the coronavirus pandemic sent shockwaves around the globe, SuperRatings executive director Kirby Rappell said.

“As members accumulate wealth over time, market movements will have a bigger impact on their account balance in dollar terms,” he said.

“This is a challenge for funds and members as the average super balance rises over $100,000, with the need for education and support paramount.”

It was a year in which unprecedented fiscal and monetary policy stimulus trumped economic concerns and vaccine developments, and the US election outcome added to the market’s upward momentum.

The height of the market ructions had equity markets tumble at the fastest pace in history through February and March, with a 30 per cent drop from peak to trough. But a swift recovery had US markets hit record highs by mid-year, while the S&P/ASX 200 ended 2020 8 per cent below the February peak.

While acknowledging the funds that outperformed over 2020, Mr Rappell said members should bear in mind that long-term performance was what really mattered. “Overall, funds have done an excellent job of managing risks through a tumultuous period, (but) super is a long-term game, so it’s pleasing to see long-term returns remain healthy and ahead of their CPI+ targets,” he said.

Over a 10-year period, UniSuper’s balanced option was the top performer, returning 9 per cent, followed closely by AustralianSuper and Cbus. QSuper’s balanced option was the least volatile fund over the medium term and still recorded decent gains, with a 7.9 per annum return over the past seven years.

Research house Chant West this week said the median growth fund (61 per cent to 80 per cent in growth assets) ended up 3.7 per cent for the year, which was the ninth consecutive positive return for a calendar year and the 11th over the past 12 years.

Chant West senior investment research manager Mano Mohankumar said the result highlighted the long-term nature of super and the importance of patience.

“Members who sat tight generally did OK,” he said.

“Sadly there were many others who panicked when markets fell and switched their investments to cash or a more conservative option.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout