Volatility creates M&A opportunity

The coronavirus outbreak will create challenges as well as M&A opportunities as buyers look to prop up growth.

The coronavirus outbreak will create short-term challenges for deal-makers in the Asia-Pacific but activity in 2020 will “remain resilient” as volatility creates acquisition opportunities and buyers look to prop up growth.

That’s the view of law firm Herbert Smith Freehills as it assesses the outlook for mergers and acquisitions in 2020.

The Asia Pacific M&A Review 2020, to be released on Monday, predicts a good year for deal making as China recovers from the near-term economic impact of the coronavirus and Singapore and Australia prepare for bumper activity levels.

“M&A activity across the APAC region will remain resilient in 2020 despite the challenges brought by the novel coronavirus and other global economic pressures,” said Tony Damian, a Freehills partner and global co-chair of the firm’s bank sector group.

“The demand side will remain strong, particularly with investors in North America still looking to deploy capital in the Asia-Pacific region. Indeed, some see potentially lower share prices on the back of current challenges as a good buying opportunity.”

Large companies throughout the region have faced supply issues as the coronavirus has curbed output and trade out of China.

“It is giving rise to volatility but volatility drives activity and creates activity,” Mr Damian said.

“The long-term strategic need to deploy capital is significant. I don’t think the challenges will override the positive drivers.”

Australia has experienced a strong start to 2020 for M&A. Portfolio divestments and bidding contests for Australian fuels retailer Caltex and the country’s largest self-storage operation, the National Storage REIT, have underpinned deal activity.

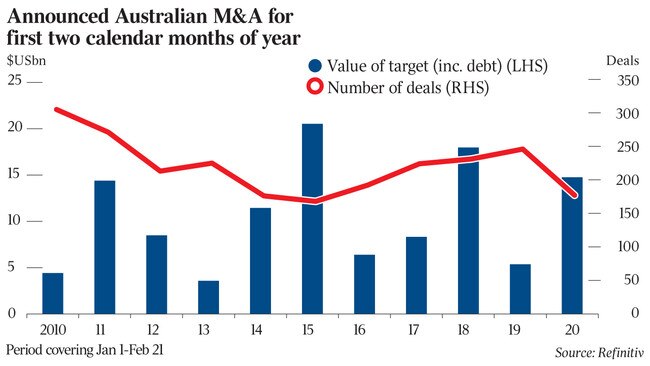

Announced M&A activity has more than doubled to $US14.8bn as at February 21, compared to the same time last year, driven by a surge in inbound transactions by offshore buyers, according to Refinitiv data. Announced deals amounted to $US5.4bn at the same time in 2019, and 2020’s tally marks the third best start to a year over the past decade.

But the Refinitiv data showed the number of announced deals, at 177 transactions, was notably lower than 246 at the same time last year.

The Freehills report tipped the Chinese M&A market would pick up later this year.

“China remained the largest recipient of foreign direct investment globally in 2019 and, with China’s new Foreign Investment Law coming into effect on 1 January 2020, we expect China will continue to attract strong investment interest from the Asia-Pacific region and beyond, once current challenges are navigated,” it said.

But separate analysis by global advisory group Willis Towers Watson in January predicted listed deals in China were unlikely to improve in 2020, even as performance in the Asia-Pacific stabilised.

The Asia-Pacific in 2019 posted its quietest period for M&A in five years as activity was weighed down by trade ructions between the US and China. Still, the Freehills Asia-Pacific report highlighted activity in Singapore as likely to lead a surge in M&A in 2020, with Australia expected to have one of its busiest deal-making years in some time.

The report called out the aged care royal commission as a source of M&A in the sector.

However, Mr Damian doesn’t expect it will spur as much activity as the Hayne royal commission did in banking and financial services.

In 2020, Mr Damian expects the divestment and spin-off theme to continue as large companies reassess their portfolio of businesses.

“Many companies are also continuing to sharpen their focus on their portfolio of businesses, resulting in high levels of thinking around sale processes and demergers,” he said.

He also expects cashed-up private equity firms and large superannuation funds will be a force in 2020 Australian M&A.

Freehills is a legal adviser to Caltex on M&A and has also worked on deals including Commonwealth Bank’s sale of its life insurance operations and the divestment of Colonial First State Global Asset Management to Mitsubishi UFJ Trust and Banking Corporation.

The Freehills report pointed to environmental, social and governance (ESG) considerations being prominent in M&A due diligence and planning throughout the region.

“People are thinking very deeply about ESG as part of that package,” Mr Damian said.

He also noted ESG considerations were becoming “increasingly influential” alongside financial and regulatory M&A deliberations.