Tyro opens account as listed company with $19m loss

Payments group and business bank Tyro has reported a $19.2m bottom-line loss in its maiden half year as a listed company.

Payments group and business bank Tyro has reported a $19.2m bottom-line loss in its maiden half year as a listed company.

Revenue climbed 28 per cent to $117.3m, enabling Tyro to report $1.5m in earnings before interest, tax, depreciation and amortisation, compared with an EBITDA loss of $3m a year ago.

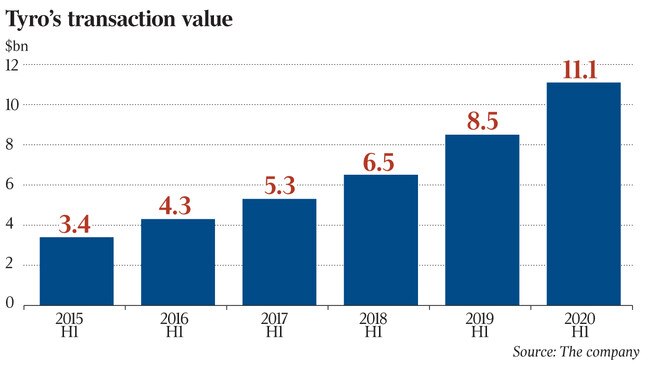

Chief executive Robbie Cooke said it was a “great result all around”, with a record $11.1bn in transaction volumes from more than 32,000 merchants.

“All this was achieved at a time when considerable focus was on our IPO,” Mr Cooke said.

“Maintaining our operating rhythm in such a frenetic period demonstrates the robustness of our business and the depth of talent in our team.”

Tyro, which is the country’s fifth largest merchant-acquiring bank by the number of terminals, listed on December 6 with a $1.4bn market capitalisation. Costs associated with the IPO contributed to the group’s $19.2m statutory loss.

Mr Cooke said the banking operation, which started after APRA issued a licence in 2015, continued its positive trend, albeit from a low base.

The company’s portfolio of merchant cash advance loans increased 82 per cent to $37.4m, with its fee-free, interest-paying bank account now boasting more than 3100 active accounts, with $39.7m held in deposits at the end of last year, up 80 per cent.

A new term deposit account will be offered to Tyro’s base in the current half year.

Tyro said the first month of trading in the second half “continued the positive trends”.

Transaction value for the seven months was $12.9bn, up 29 per cent, with payments revenue up 28 per cent to $132.7m.

In banking, loan originations in the year to date totalled $43.8m, up 75 per cent from the $25m generated in the seven months to the end of January last year.

Mr Cannon-Brookes’ Grok Ventures is the largest shareholder in Tyro, with a 12.74 per cent stake, worth $269.6m.

Tyro shares ended down 2.1 per cent on Thursday at $4.26. The payments company sold shares in its December IPO at $2.75 each.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout