Turbulent NAB knows all about transformation

At NAB’s shareholder meeting two decades ago chairman Mark Rayner was crowing about the pace of the bank’s transformation.

It’s telling that at National Australia Bank’s shareholder meeting two decades ago — when 55 per cent of revenue was generated in offshore markets — chairman Mark Rayner was crowing about the pace of the bank’s transformation.

Transformation is still a key buzz word at the Melbourne-based bank.

NAB’s potted history of the past 20 years is littered with mistakes, scandals, the unwinding of an acquisition-led strategy and transformation programs that didn’t get traction.

Shareholders at the bank’s fiery annual meeting this week were quick to point out the destruction of value, as the bank has lurched from one issue to another.

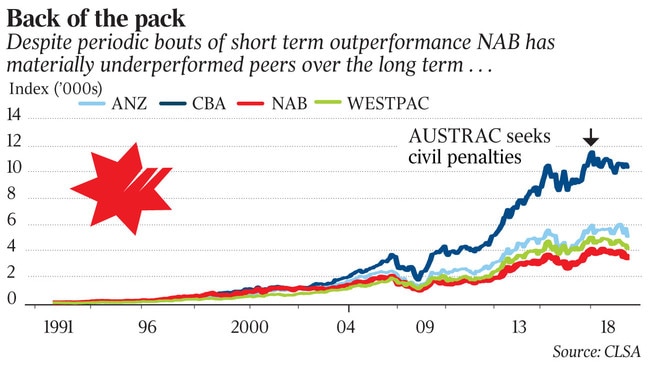

NAB’s market capitalisation of $63.4 billion is the lowest of the big four banks, by a $3.4bn margin to third-placed ANZ.

The road ahead is also bound to be bumpy, as credit growth slows and Kenneth Hayne delivers his final royal commission report and recommendations by February 1.

That is exacerbated by NAB chief executive Andrew Thorburn taking most of January and February off, bar several days to help formulate a response to the royal commission report.

A scandal engulfing Thorburn’s former chief of staff, Rosemary Rogers, who is being investigated by police over alleged fraud, legal action by the corporate regulator, a fee-for-no-service saga, and an 88.4 per cent vote against its remuneration report has longstanding NAB investors going through the wringer again.

Pat McConnell, an honorary fellow at Macquarie University Applied Finance Centre, says: “The long-term strategy was a merry-go-round where they just stumbled from one strategic mistake to another.

“NAB strategically are in a real bind. Everybody (the big four banks) has fallen into the malaise.”

Those with a long corporate memory can retrace the acquisition-fuelled 90s at NAB.

After buying US mortgage service group HomeSide in 1998 and continuing its multipronged offshore expansion, in subsequent years the bank snapped up BNZ across the Tasman and MLC Life.

Shortly after, the hits started.

After a period of unprecedented mortgage refinancing in the US and a series of severe writedowns, NAB called time in late 2001 and sold HomeSide for close to $US2bn.

By this time Frank Cicutto was in charge as CEO and the strategy was being overhauled again.

The biggest upheaval for NAB was the $360 million currency-trading scandal, which led to the departure of Cicutto in 2004 and a boardroom spat that ultimately led to the exits of Catherine Walter and five fellow NAB directors.

Traders had exploited weaknesses in NAB systems to hide trading losses and protect bonuses.

In the same year, NAB retreated from a local acquisition strategy by swiftly offloading stakes in St George Bank, AMP and its offshoot HHG.

Next up as chief executive was Scotsman John Stewart, a smooth talker who was meant to steady the ship and get risk management back under control.

In 2004, in attempting to highlight the “process inefficiency” at NAB, he showed a presentation slide that included a chart of the complexity involved — seven steps — to purchase his own computer.

The transformation and simplification started again.

After the global financial crisis Stewart was out and New Zealand chief Cameron Clyne installed, following large provisions against US mortgage investments.

Clyne introduced the “break-up” marketing campaign that saw NAB break ranks against its three big rivals as it sought to boost market share.

During his tenure the troubled British assets were a headache for investors and then came a British regulatory clampdown — embroiling NAB subsidiaries — on the mis-selling of insurance and interest-rate hedging products.

In 2014 Clyne handed the baton to Thorburn, who got the gig ahead of other candidates including then finance chief Craig Drummond, now the chief executive at Medibank. Thorburn got some investors onside quickly with a series of executive changes on his first day in the role. Then later in 2014 came the initial public offering of US unit Great Western Bank and finally the 2016 divestment of the British banks via a demerger.

Regal Funds Management chief investment officer Philip King believes Thorburn has done a good job given the situation he inherited at NAB.

“Andrew Thorburn made some decisive changes when he first took the role that were long overdue,” King says.

“He’s always had a huge challenge turning a big bureaucratic organisation around.”

CLSA senior banking analyst Brian Johnson thinks NAB needs to urgently make changes to its pay structures after the mammoth strike at its AGM.

“NAB urgently needs to move to a performance-driven culture as opposed to being gauged relative to decades of historical operational and share price underperformance,” Johnson told clients.

He thinks NAB needs to cut the CEO’s fixed remuneration, making it more akin to Macquarie Group’s model where chief executive Nicholas Moore’s annual fixed pay was $819,000, compared with Thorburn’s $2.3m.

Johnson’s other suggestions include greater differentiation between the pay of other executives and greater “shareholder alignment” through a performance share unit structure.

Shaw and Partners senior analyst Brett Le Mesurier puts many of NAB’s failures in the past down to those at the top.

“They have had a succession of poor CEOs over the last 20 years,” Le Mesurier says.

“I’d describe him (Thorburn) as the best of a poorly performing bunch.”

Thorburn’s overhaul has included spinning off or selling MLC, cutting about 4000 jobs and simplifying processes and systems.

His transformation program, which targets outperformance in 2020, is reaching the pointy end.

Firetrail Investments portfolio manager James Miller thinks the big banks, including NAB, will be tested on their change programs in the years ahead.

“The strong revenue environment for the major banks largely offset a lot of the cost inflation in their businesses,” Miller says.

“It’s only when we see a slowdown in credit growth, or contraction in margins, when we learn whether a transformation program has been truly transformational.”

Next year will be another tough one at NAB as the remuneration structure is reworked and the Hayne report is digested. When, or if, Thorburn returns from his extended break the pressure will certainly remain.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout