Troubled ClearView foresees rosy future

ClearView Wealth has weathered some poor investment returns but predicts industry reforms will be a plus in the next two years.

ClearView Wealth chief Simon Swanson has flagged a challenging short-term earnings outlook, but stressed reforms and an industry shake-out would present “good opportunities” over the next two years.

His comments came as the fallout from the Hayne royal commission and choppy markets saw the life insurer and wealth group hit by negative sentiment and poor investment returns.

ClearView yesterday told the ASX net profit declined 6 per cent to $11.5 million for the six months ended December 31. Underlying net profit sank 13 per cent.

Results across its life insurance, wealth management and financial advice divisions printed lower, and the company booked royal commission costs of $1.3m.

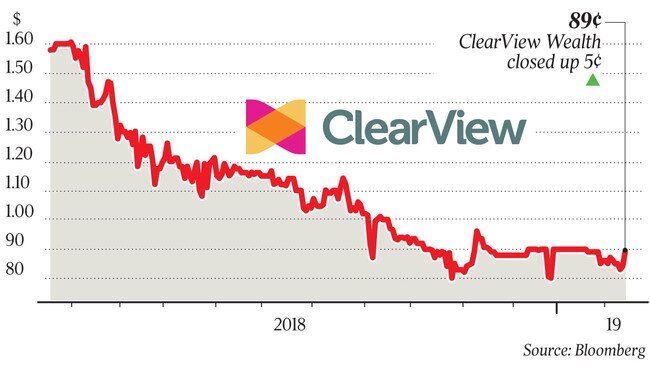

But the stock climbed almost 6 per cent to 89c yesterday as the company signalled a cost-cutting program.

As with many of its peers, ClearView’s life division was weighed on by the lapsing of policies and cancellation of coverage. The in-force portfolio continued on its growth trajectory.

Mr Swanson said the company was implementing price changes and a retention strategy to improve its life insurance income.

That includes cutting five financial adviser groups from its distribution network.

Mr Swanson is upbeat about the longer-term post-royal commission landscape, saying ClearView had completed most of its remediation to customers.

He noted ClearView had the technology to implement annual advice reviews and had already expressed its support for an enforceable industry code of conduct.

But during last year’s final round of royal commission hearings, the corporate regulator said it was revisiting a case against ClearView and could start criminal proceedings over breaches of anti-hawking laws.

ClearView’s statements yesterday did not suggest recent engagement with the Australian Securities & Investments Commission, after it closed an outbound call centre in 2017 and committed to pay customer compensation.

“We implemented the program, which covered the categories of consumers and the level of remediation approved by ASIC, and final reports on the program were provided to ASIC by ClearView and the independent expert on December 24, 2018,” Mr Swanson said.

In November, ClearView started its LaVista project, which offers advisers back end and other services under their own financial services licence.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout