With the chilling release of personal health details of hundreds of customers linked to the attack on health insurer Medibank, McEwan says we should learn the lessons from the powerful response when everyone came together to stare down the threat to the economy from Covid-19.

“These are Australian moments where we need to actually get together. I think if you’ve got the big players, the big banks, the big telcos and the government together, we could make a lot of progress in this area,” McEwan says in an interview. “But it would mean we would need everybody holding hands and agreeing what was the right thing for Australia, which I’m in total support of.”

McEwan was talking after handed down his third annual result at NAB where the bank’s closely watched cash earnings line increased 8.3 per cent over the year to $7.1bn.

The NAB chief ranks cyber threats at the very top of potential issues keeping him up at night which could do damage to the bank and the broader financial system. This eclipses other problems such as the health of NAB’s lending book and or a slowing economy which are way down his list of potential problems.

Personal details of millions of Australians were stolen in recent months from separate cyber attacks on telco Optus and Medibank. The Medibank attack continues to unfold with personal details of some customers released on the dark web after the insurer refused to pay ransom to the hackers. It also has political implications with Prime Minister Anthony Albanese confirming on Wednesday he was a Medibank customer.

McEwan points out that NAB gets something like 50 million cyber attacks a month which means his bank has to have the defences up all the time. NAB is not alone or an outlier, as others from ANZ to Commonwealth Bank also report tens of millions of attacks each month. Collectively this represents billions of individual attacks on Australia’s banking system every year.

With the Albanese government looking to increase financial penalties against companies that have data stolen, McEwan urges perspective about going after the right target.

“At the end of the day, we shouldn’t forget the criminals are not Optus or Medibank, the criminal is the one that actually is taking the data. And we shouldn’t criminalise the parties that are getting hit.”

The consequences of reputational damage from cyber attack against a company are potentially much bigger than a fine.

“For a financial service organisation I’ve always maintained you only have two things. One is your reputation and the other one is your financial strength and you need to look after both of them.

“Cyber crime goes after the reputation in an organisation and that’s where the damage is done.”

Eliminating shocks

The latest numbers build on his commitment to weed out negative surprises and make the bank a more certain proposition for investors.

NAB had developed a reputation over decades of being accident prone, giving it the nickname among fund managers of “Bad news NAB”. It gobbled up CEOs and as the perennial underperformer of the big four banks could be relied on to disappoint.

This has changed with the latest results showcasing McEwan’s knack for removing surprises and teaching basics banking again. It has become number one on the critical customer net promoter score and is in the top two in business satisfaction rankings.

This is also playing out in its shares. Over the past year NAB has quietly pulled away from ANZ and overtaken Westpac as the nation’s second biggest bank with its value now breaking the $100bn barrier.

Banking analysts labelled the latest full-year accounts as “uncomplicated” and “clean” which in banking language is actually a positive. “No surprises, executing well,” quipped Credit Suisse’s Jarrod Martin.

Elsewhere over the year NAB’s revenue was up 8.9 per cent to more than $18bn, while dividends of $1.51 a share and return on equity were also ahead.

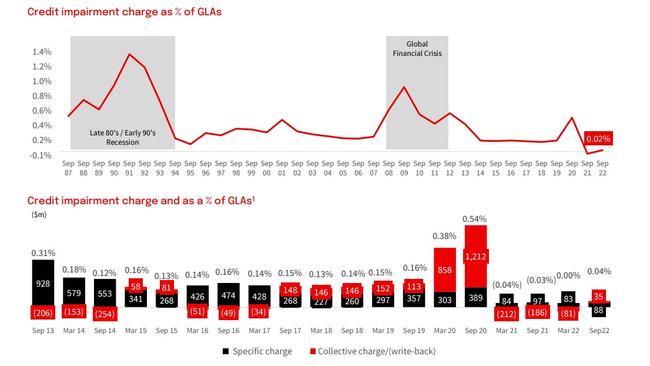

NAB reported similar trends to its big bank rivals of almost no mortgage stress or lending losses even as official interest rates continue to climb. NAB is expecting the cash rate to move to 3.6 per cent, although the bank is preparing for it to move higher – potentially to 4 per cent in the battle to get inflation lower.

McEwan is not complacent but is tipping Australia could be on track for a soft landing rather than a sharp slowdown.

“At this stage all of the numbers look like Australia will continue to grow in GDP next year which is good given what’s going on and predicted to go on in the world,” he says.

The bank like others is adding to its provisioning as the economy moves into the higher rate period. Some borrowers who bought houses at the top of the cycle and are highly leveraged are getting the most attention. NAB has run the numbers and has called out $1bn in mortgages for the most at- risk borrowers. Still, this is less than 1 per cent of the bank’s home loan book and the bulk of these borrowers are sitting on three- month repayment buffers.

McEwan says “there will have to be pain” as rates rise. “Unfortunately, that’s what putting interest rates back up again is all about.”

After more than three decades in banking, McEwan is the most experienced bank CEO in Australia. He got most of his executive training under Ralph Norris running Commonwealth’s vast retail banking business and went on to run the UK major Royal Bank of Scotland as it was undertaking a post-global financial crisis rebuild.

He has a mantra of getting the basics right. He is also getting NAB to lean into its strengths – lending to businesses big and small – which perplexingly had been ignored for years as other managers chased retail banking greatness.

The figures show NAB’s business bank franchise underpins earnings with profit from the division up 19.2 per cent on the year. This compares to a lift of just 1 per cent in profit from retail banking where interest margins haven’t yet seen the full benefit of the RBA’s cash rate rise.

The bank is heading into a slower business lending cycle which means it could be vulnerable. But McEwan says business customers are the ones keeping confidence up. He expects to see another 12-24 months of solid demand for business loans.

McEwan’s mantra since taking charge of NAB is to do the basics well. “We don’t have to be spectacular. We do have to look after customers and colleagues and just do the basics well. And if you concentrate on that all day, every day, you tend to make less mistakes.”

It’s not all smooth sailing however. NAB’s costs are starting to push up as inflation starts to bite. There are many moving parts to the cost line with NAB’s initial wage rise offer under a new enterprise agreement rejected by the Finance Sector Union. The longer negotiations take with the union, the risk is the claim for staff wage rises could move higher.

Elsewhere, investment spending needs to move higher, particularly around NAB’s digital rebuild. Although McEwan is looking to claw back some broader cost rises through $400m of savings next financial year.

johnstone@theaustralian.

com.au

According to National Australia Bank boss Ross McEwan the time has arrived for another “Team Australia” moment to tackle cyber security, with big businesses and government pulling together to take on the threat.