The ‘quiet faith’ that makes Regal Partners founder Phil King rule markets

From his Bishop father to $50bn fund aspirations, Phil King has become the man many in the stockmarkets want to know more about, and they all want to emulate his financial success.

There is only one King. The one who rules the Australian stockmarket is the son of a bishop.

Whether it’s capital raisings, market making, last-minute block trades or start-ups, when it comes to market support it’s no longer AMP, BT, or even Perpetual that people first want in their camp. Nowadays, it’s the backing of Phil King from Regal Partners.

King has steadily transformed the 20-year-old Regal into Australia’s biggest alternative asset manager that is already garnering comparisons to Wall Street giant Blackstone.

And it’s all been done without the banker brashness. King has done it with what others describe as his “quiet faith”, having been raised as the son of a bishop. King’s father provided Australian Defence Force personnel religious guidance on behalf of the Anglican Church.

King tries to dodge questions about his own beliefs in a reluctantly given personal interview. It’s clear, however, that family matters more than Ferraris in the King world. This is a man more pious than plush, who is striding towards The Rich List yet has only recently upgraded himself from a Subaru to a Toyota hybrid.

“I grew up with a strong sense of social justice and a strong sense of what’s important in the world and I think that heavily influenced my upbringing,” is all the 55-year-old will say on his beliefs.

Regal chief executive Brendan O’Connor supports King’s reticence to talk religion.

“Think of the big Australian corporates and the trouble they got themselves into using shareholder money to espouse their own personal views,” O’Connor says.

But the clues are there. Apart from his car, King lives far from Sydney’s glitzy finance-heavy eastern suburbs in an apparently simple house in Manly, on the city’s northern beaches, and takes great pleasure from both rugby union – his father played for the NSW Waratahs – and rugby league, where he supports the Manly Sea Eagles.

The simple life

While he chooses a modest personal life, his professional ambition is anything but.

His company has made a takeover bid for Platinum Asset Management that could transform the combined firms into a $29bn empire. Platinum has rejected its existing offer but opened its books in the hope Regal comes up with a higher bid.

There will be more moves to play out. Funds veteran Geoff Wilson could put a spanner in the works if he proceeds with what The Weekend Australian understands is a plan to put forward a rival offer to merge the unlisted Wilson Asset Management with ASX-listed Platinum.

“If we don’t get Platinum, I suspect it’ll be because we’re not prepared to pay the price they want, in which case it will be good for Regal shareholders and we will continue to build the business,” O’Connor says.

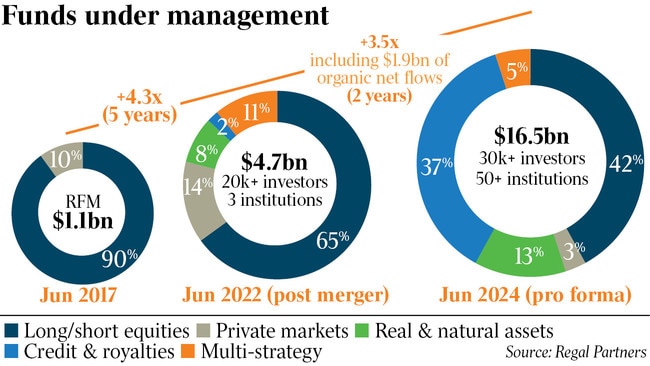

The plans for Regal are certainly ambitious. O’Connor says the firm’s aspirations are to move from a $17bn manager to a $50bn manager but not to chase deals just for the sake of increasing FUM.

“FUM can be a proxy for growth and I get it, but we’re trying to generate great returns for clients, great returns for staff, and great returns for shareholders,” he says.

It’s a contrasting order of importance to what was seen at Perpetual, once one of the nation’s most prestigious investors, which came unstuck by conducting a series of value destructive takeovers.

“It was not part of Perpetual’s growth ambitions,” O’Connor. says. “They were just chasing FUM for FUM’s sake. The only thing that matters in investment management in the long term is investment performance. If you get that right everything else becomes secondary.”

Ord Minnett estimates Regal’s FUM will surge 340 per cent to $22bn in the four years since its metamorphosis into public life in 2022.

It’s managing it by taking a different tack. For starters, the firm is just as happy to go short than long on a stock and has a diversified alternatives portfolio.

King says: “We have grown from just long-short equities to many strategies including private credit, resource royalties, emerging companies and water, carbon and electricity trading.”

Instead of being forced to cut fees to compete, it’s consistently smashing the benchmarks and charging top dollar for the returns.

Case in point is the Regal small-cap fund, which managed a gross return of 43.3 per cent in the financial year just ended, equating to about $55m in performance fees.

From this undoubted position of strength, Regal has been able to pluck off undervalued rivals and give comfort to key staff at takeover targets that they will survive and even thrive if they join forces.

In the past three years it snapped up hedge fund rival VGI Partners – the deal that gave it a listing on the ASX – along with PM Capital, Merricks Capital and a stake in Taurus Funds Management.

Regal also tried to jimmy in on the Perpetual-Pendal takeover with a bid for the former that its board would not consider, and chatted to beleaguered funds giant Magellan but was knocked back early on in the conversation.

Mini Blackstone

Someone who squarely backs King’s Pac-Man approach is one who was gobbled up himself and is as a result Regal’s second-biggest shareholder: VGI founder Rob Luciano.

“They are on track to be the Blackstone of the Asia-Pacific region,” Luciano says. “They are building out a multi-strategy, alternate asset manager. No one else has got it, that combination where everyone’s got real skin in the game.”

Blackstone is the world’s largest alternative asset manager with more than $US1 trillion ($1.5 trillion) of FUM. After first having to shelve an IPO, it listed on the New York Stock Exchange in 2007 and its shares have risen 350 per cent since then.

“Everyone underappreciated the true value to begin with,” says Luciano, who believes the same is now becoming true for Regal.

It is true that the market as a whole is just starting to see the power of King. Even just two years ago, background comments about the Regal founder always included sniping about a media tipped-off raid by the Australian Securities & Investments Commission.

There were penalties dished out. Regal and King provided enforceable undertakings to ASIC about a decade ago over the firm’s shorting of Ten shares after former Bell Potter broker Angus Aitken emailed King about an unnamed client’s selling intentions. Aitken’s brother Charlie now works at Regal.

Three years ago a former portfolio manager, Dylan Rands, was given a five-year ban after being found to have engaged in market manipulation.

Fast forward to now, and rivals are far more interested in what Regal is doing in the market – “I want to know if King is in,” says one – rather than past missteps.

When Luciano tied up with Regal, he was supposed to stick around and run a global hedge strategy but decided instead to focus on his family – he has a son currently sitting HSC exams – and manage his family funds.

As a result, he cut his stake in Regal by $32m a few months ago, and a following $16.5m this week, which leaves him with about 26.6 million shares and makes Regal stock more liquid, pushing it closer to inclusion on the ASX 300 in the next six months and potentially the ASX 200 later in the year.

“When you’re not involved in it, day to day, it’s much harder to have that disproportionate amount of your net worth in something like that,” Luciano says.

The VGI founder still “backs Phil and Brendan and the senior management team to make the best decisions in the interests of all shareholders”.

“Having that diversified platform and the high fee structures are deserved because most of these strategies have limited scale, and they produce, on average, superior risk adjusted returns,” he says.

Long and short

King says his plan with Platinum is similar to that of VGI.

“The real opportunity for us is to take control and then improve returns,” King says. “That’s been the tremendous success story we’ve seen with VGI and something we are happy to replicate with Platinum.”

Just how he manages to be so successful remains somewhat of a secret. Regal this year celebrates its 20th anniversary and “the hand of Phil” is now found all across the market be it long, short, resource minnows to the big four banks.

Most of Regal’s funds do not disclose long and short positions unless they reach a significant shareholding or King sees a reason to talk. “Some of our funds I want to keep private,” he says.

“Some of our holdings we want to keep private as it allows us to build positions without people front running us.”

One the firm has been happy to discuss is CBA, which Regal has shorted. And in the past few years he’s made a tidy profit from commodity stocks, particularly those acquired by larger rivals.

“The main reason we’re bullish on commodities is the fact that we see them as very supply-constrained,” King says. “It’s getting harder to build new mines, and to find new deposits, and that’s why companies like BHP and Rio are choosing to buy existing mines rather than try to build new mines themselves.”

Even the current economic weakness in China does not change his bullish view on commodities, “but we do have a strong preference for commodities that are less exposed to China. That’s why we like things like copper and uranium, and we’re probably less favourable on commodities like iron ore.”

He made a “truckload of money”, as one rival put it, through Regal’s holding in Lithium Power International. It was a company run by David Hannon, who was King’s year 9 commerce teacher at Sydney’s Barker College, the school King and his brother, Regal co-founder Andrew, attended.

Lithium Power shares surged about 1000 per cent in 2022 in the direct lead-up to being taken over by Chilean state-owned copper miner Codelco.

Regal also owned shares in Azure Minerals, which was snapped up by Chile’s SQM and Gina Rinehart’s Hancock Prospecting earlier this year.

It’s not just investing where Regal makes its money. The firm is, as one of his portfolio managers Jessica Farr-Jones recently told clients, a “market maker”, which means it provides liquidity to the market by buying and selling shares.

The biggest player in this space is Citadel Securities, and O’Connor defends Regal’s use of the technique as just another of its tools to make money for clients.

“You can only do it if you’re successful at it, both the risk management aspect and if you can make money for your clients by doing it, and Phil has been able to demonstrate that for over 20 years they’ve been able to do it and make money,” O’Connor says.

When he invests, King is happy to use net leverage of between 0-2 times, or gross of 0-4+ times.

Show me the money

Perhaps the thing King is even more loath to discuss than faith is money. His 27 per cent shareholding in the listed Regal Partners is worth $350m at current market value and because RPL is the management company, and he is not considered a “key management”, his remuneration is not disclosed in the firm’s annual report.

His stakes in other unlisted funds are likely to be vast.

When asked, O’Connor confirms “there is no key man risk insurance” taken out on King, whose official title is chief investment officer long/short equities for Regal Funds. But there isn’t a person in the market who doesn’t believe Regal is nine parts Phil King, with the backing of a strong CEO.

King joined the world of markets by joining Macquarie Bank after a stint at KPMG. His boss back then was Alex Pollak, who now runs fund manager Loftus Peak and who took him on back then as a research associate.

“We worked collaboratively,” Pollak says. “I learned as much from him as he learned from me. I probably learned more from him than he learned from me. So I considered him a friend first of all. He is incredibly numerate and just a hell of a nice guy.”

Being good with numbers and being nice shouldn’t seem to be that much out of the ordinary, nor should it explain why six out of the seven funds in Regal Long/Short Equites have returned double-digit growth since inception.

Sadly, says Pollak, it is.

“Phil is very capable, very valuation-driven, very savvy and a very clear thinker,” Pollack says. “As an investor, he ticks all the boxes.”

Having spoken widely to former bosses, colleagues, investors and rivals, they all share the view that the reason King’s investment performance stands out from the pack is that “he doesn’t have that fear of getting it wrong, because he’s done his homework”.

Former Macquarie Bank head of equity capital markets Wayne Kent says if King has strong conviction he will have a good crack. “What I like about his approach is his fundamental hard work and research-driven philosophy,” says Kent, once King’s senior at Macquarie and now his client at Regal.

A worthy rival

Fellow Fund Manager Hall of Fame inductee Wilson has worked with King on Wilson’s philanthropic brain child Future Generation, where fund managers such as Regal provide their investment services for free for a fund that donates a portion of its earnings to charities.

Wilson wouldn’t comment on any plans he may have to scupper the Regal/ Platinum takeover with his own plan to mimic King’s move on VGI, in order to list the management company of WAM on the stockmarket, but clearly views King as a worthy rival.

“Phil is highly intelligent and he’s created a very successful funds management business,” Wilson says.

Clearly, nice guys don’t always finish first in finance markets though. It’s a cut throat world and there are plenty of people who would like to earn enough money to buy something more than a Toyota hybrid.

Luciano says King’s success comes down to intelligence, belief and a bucketload of conviction.

“He’s an extraordinary money manager,” Luciano says.

“The numbers say that, but also not everyone can price risk as well as him. He will take risk when others won’t.”

Case in point was the way King traded Regal out of turmoil during the Covid pandemic. Luciano says: “He was down hard and he just loaded up the back of the truck and traded his way out of it to an extraordinary extent.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout