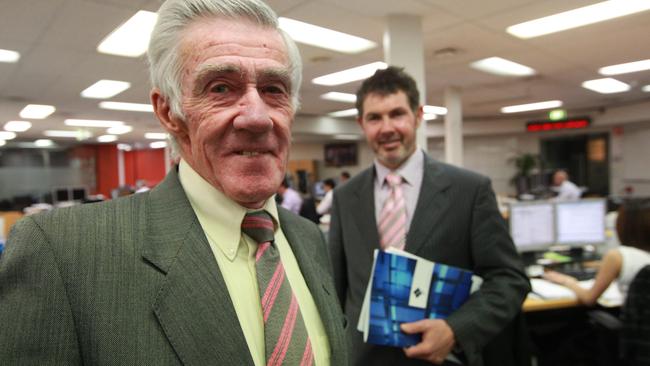

Tennis great grilled on broker’s collapse

Tennis great Ken Rosewall made contradictory statements on his opinion of stockbroker BBY’s financial health before its collapse, KPMG’s legal team has alleged.

Tennis great Ken Rosewall made contradictory statements over the past four years on his opinion of stockbroker BBY’s financial health before its collapse, liquidator KPMG’s legal team has alleged.

In a NSW Supreme Court hearing on Thursday, Mr Rosewall was peppered with questions about his statement to the corporate regulator under compulsory examination and to a court in earlier liquidator’s hearings.

Those statements were compared with affidavits lodged in the court for the current civil case where KPMG, is pursuing Mr Rosewall over $3.3m repaid to Ficema, an entity associated with him, before the 2015 demise of BBY. KPMG argues the loan repayment was preferential treatment of Mr Rosewall, making it voidable given BBY was already insolvent.

Mr Rosewall, appearing via video link from Queensland, said while he attended all board meetings as a BBY director from 2008 to 2015, his role was related to “public relations and events” and he was not across financial details.

KPMG barrister Daniel Krochmalik attempted to pick apart Mr Rosewall’s current evidence versus what he had previously said about his concerns over BBY’s finances and capital position, and the potential for the company to fail.

Mr Krochmalik read out a previous statement from Mr Rosewall in which he had agreed BBY was in financial crisis in the final months of 2013.

Mr Rosewall responded by saying: “I said it but not with a lot of conviction … I took the optimistic view that the company would come good.”

On further questioning, he did admit he had some concerns about BBY and that one sentence in his most recent affidavit was only “partly true”.

“There was always some concern because they (BBY) were asking for more money and investment,” he said.

PCI insolvency partner John Melluish’s appearance in court for Mr Rosewall’s legal team was withdrawn at the 11th hour.

Judge Fabian Gleeson has called for defendant and plaintiff written closing submissions by month’s end, while the next court hearing is December 14, when parties will hear from Mr Rosewall’s accountant, Peter Collier, of Collier & Partners, and closing oral submissions will be made.

Mr Rosewall was a BBY board director alongside son Glenn, who was BBY executive chairman, and lawyer David Perkins. At various times on Thursday, Ken Rosewall admitted to not being across the detail and had depended on relayed conversations by then BBY chief executive Arun Maharaj and his son.

One of those references was in relation to money loaned to BBY by Mr Rosewall when a $192m trade in Aquila shares went awry in mid-2014, spurring the firm to meet an ASX call for more capital.

“I trusted him, as my son, that the money would be used for the Aquila transaction,” Ken Rosewall said.

The court heard there were no formal restrictions or specifications in the loan terms about how the funds were used, but the loan was to be repaid within 10 days.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout