Takeover bonanza has bankers tipping record 2021 for M&A, spilling into next year

Bidding wars and cheap funding have deal making activity running at a frenetic pace, and bankers and lawyers are confident 2021 will set a record.

Bidding wars, cheap funding and growth aspirations as Australia’s Covid-19 risks recede are driving frenzied takeover activity amid expectations 2021 will be a record year.

The activity is also being helped by the nation’s sharp bounce back from recession, private equity’s desire to deploy billions of dollars and larger domestic superannuation funds looking to get directly involved in mergers and acquisitions.

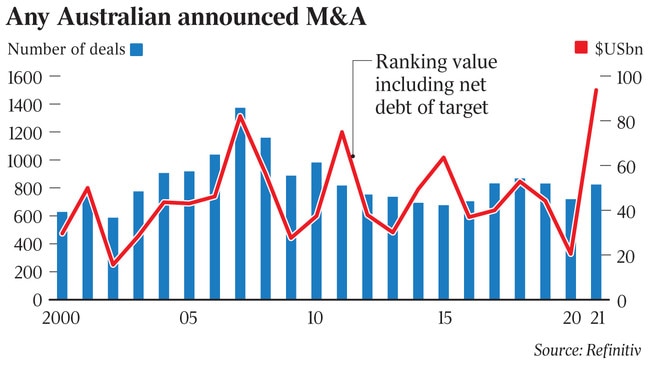

Announced domestic, inbound and outbound Australian M&A totalled $US93.7bn ($121.6bn) as at June 11, a record calendar year-to-date tally, according to Refinitiv data. That is up from a pandemic-depressed total of just $US20.5bn in announced deals this time last year, and has surpassed a 2007 pre-GFC June 11 high of $US82.1bn.

If momentum is sustained, 2021 may beat the prior annual announced M&A high of $US196.6bn from 2007.

The bonanza M&A activity has touched many sectors this year, and bankers and lawyers are confident 2021 will mark a new record.

The tussle for Crown Resorts dominates the nation’s top five announced deals, given the proposed merger with Star Entertainment and a takeover bid from private equity giant Blackstone.

Kerry Stokes’ Seven Group Holdings’ tilt for building materials firm Boral, which an independent board committee has urged investors to rebuff, is among the year’s largest announced transactions.

Also within 2021’s top 10 are takeovers of telco firm Vocus and property company Milestone, and multiple bids for Tabcorp and its divisions.

Credit Suisse’s joint local investment banking and capital markets boss Dragi Ristevski said elevated M&A activity signalled the market was “operating efficiently”. He tips 2021 will be a record year as the latter half has historically outpaced the earlier six months of a calendar year.

“Bankers are forever talking about the strength of the pipeline, but the data supports the view that this will be a record year,” he added, noting private equity and strategic buyers were both actively pursuing more deals.

“ASX boards also seem to have some of their mojo back to pursue transformational M&A or execute on major strategic initiatives to sell assets and unlock value across their portfolios. We are seeing boards pursue transactions that have industrial and financial logic more aggressively.” Citigroup’s local head of investment banking Alex Cartel highlighted that activity was being underpinned by the availability of equity and debt funding, increased confidence and industry dynamics such as the transition to greener energy and more interest in technology companies.

“There is a lot of growth aspiration among corporates coming out of a Covid year, uncertainty, lockdowns, reflection – and corporate leaders have come out of it and really decided to try and accelerate their aspirational agendas,” he said.

Mr Cartel expects 2021 will be a record year for M&A, but thinks 2022 may be even busier. “Barring a material change in economic conditions, I’d expect 2022 to be a continuation and probably even stronger than this year,” he said. “Large aspirational M&A deals have a gestation period, and we’re seeing some really big landmark M&A being thought about or in the early stages of discussion around the market.”

While inflationary pressures were being closely watched, Mr Ristevski is upbeat on 2022, saying tailwinds from this year are likely to spill into the following 12 months, as monetary and fiscal policy remain highly stimulatory.

MinterEllison partner Victoria Allen also anticipates a bumper 2021 and 2022 for deals, noting offshore acquirers and private equity are increasingly active.

She said the financial services space remained busy as divestments continued and consolidation interest ramped up following Bank of Queensland’s purchase of ME Bank.

“The regional banks, that are quite big, would have to be thinking about what their growth strategy is.”

Citigroup is also in the process of selling off its Australian retail banking operations.

But one concern for bankers – given the bidding contests occurring for some companies and boards knocking back bids – is whether takeover transactions can be sealed at reasonable prices or targets will demand larger premia.

A fierce and protracted bidding war for Vitalharvest saw Macquarie Group win out last week. ASX-listed software company Altium has rejected a takeover proposal from US-based Autodesk, while Crown has rebuffed Blackstone’s bid and Tabcorp has kicked off a strategic review – including considering a demerger – after pouring cold water on offers for its wagering and media business.

“The one thing that’s going to be a tempering factor on M&A is asset prices because they are continuing to rise,” Mr Cartel said.

“You’re seeing premia that are being paid for public markets M&A are increasing this year – there’s no doubt about that.”

Mr Ristevski said higher M&A activity and well-capitalised buyers suggested more bidders for more assets, which could drive up prices being paid.

“You only need two bidders for an auction and we are seeing a number of situations where strategics (buyers) or (private equity) sponsors and strategics are going head to head, which can only have one effect on multiples and premia,” he added.

“Overall, bidders will be disciplined through, so we’re not necessarily predicting a permanent shift in premia or multiples.”

Mr Ristevski said institutional investors were agitating more for deals and asset reviews, while superannuation funds and private equity firms were also getting increasingly involved.

“The increasing consolidation of Australian superannuation funds means that internal investment teams of super funds are getting larger and more confident and ready to express their preferences for a transaction or actively participate in a takeover offer.”

He said private equity accounted for 40 per cent of announced 2021 M&A.

Globally, M&A activity has also been frenetic in 2021 and is being buoyed by mega-deals including the $US43bn merger between AT&T’s WarnerMedia and Discovery, and special purpose acquisition companies (SPACs) in some parts of the market.

Australia’s equity capital markets activity has declined in 2021, though, after a spate of companies shored up their balance sheets last year as they feared potential Covid-19 fallout.

Total ECM deals amount to $US13.1bn so far this year, down from $US16bn at the same time in 2020, Refinitiv data shows. ECM includes initial public offerings, follow-on raisings and convertible deals.

“Equity capital raising activity has slowed into 2021 and has been principally M&A-related. Seven of the top 10 equity raisings of 2021 have been to finance acquisitions and we expect this trend to continue,” said Angelo Scasserra, Credit Suisse’s co-head of investment banking and capital markets.

The market for IPOs has proven turbulent in recent months as underperforming transactions dented sentiment. Still, Mr Scasserra said with the ASX 200 climbing about 60 per cent from Covid-19 lows, companies seeking to list would look to take advantage of bumper valuations.

This year, the advisory market has also seen poaching wars between firms as new investment bank Barrenjoey and others such as Jarden fill out their teams.

The M&A league tables show UBS is on top, despite the loss of a spate of bankers in 2021, working on deals worth $US20.1bn, followed by Goldman Sachs and Credit Suisse. In ECM, Goldman is leading, followed by UBS.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout