Superannuation’s decade of failure exposed

Five million super accounts holding $260bn have delivered average annual returns less than the risk-free ‘cash’ rate.

Five million superannuation accounts holding $260 billion and managed by the Big Four banks and financial services companies AMP and IOOF have delivered average annual returns less than the risk-free “cash” rate over the past decade and many have performed below the rate of inflation.

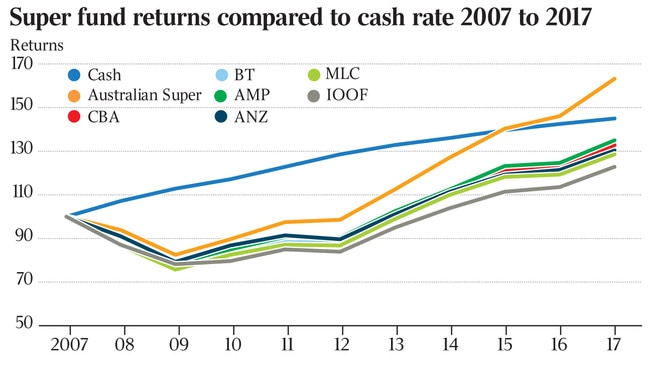

Audited performance data provided to the Australian Prudential Regulation Authority by Westpac, NAB, CBA, ANZ, AMP and IOOF shows the biggest super fund operated by each of those institutions delivered total average annual returns to members of 2.1 per cent to 3.1 per cent over the decade to June 30 last year.

At the same time, the average annual rate of return on risk-free “cash” investments was 3.8 per cent, meaning the owners of those five million super accounts would have been better off had the money been placed in low-interest term deposits or invested in government bonds.

More than 1.3 million member accounts were with funds that earned average annual returns below the rate of inflation, meaning those members made zero on their retirement nest eggs over the decade, with many losing money over 10 years.

The returns on those super accounts over the past decade have been weighed down by fees and charges and are roughly half the returns the money would have earned had it been invested at normal market rates, and also roughly half the returns delivered by the nation’s six biggest “industry” or not-for-profit funds in that time.

Those major industry funds delivered returns of roughly double those major retail funds, despite both types of funds being impacted by the 2007-08 global financial crisis.

During the GFC, both types of fund returns grew at well below the cash rate but in recent years have all been growing faster than the cash rate.

University of NSW Business School senior lecturer Kevin Liu, who completed his PhD thesis examining costs associated with the nation’s super funds, said the “average annualised 10-year returns of these (retail) funds are significantly lower than the average annualised 10-year cash rate”.

Dr Liu told The Australian his analysis of superannuation performance found that for-profit funds typically paid their own related entities far above normal market rates for services provided to the funds, such as funds management fees.

-

-

Members of MLC Superannuation Fund, which is operated by NAB and at June 30 last year had 79,487 member accounts holding $18.7bn, delivered an average annual return of 2.5 per cent over the decade, below the average annual inflation rate of 2.6 per cent.

Workers whose super is in Retirement Wrap, Westpac’s biggest super fund, which at June 30 last year had 953,145 members, earned an average annual rate of return on their super exactly in line with the rate of inflation, meaning that super earned zero in real terms over the 10-year period.

The Weekend Australia n on Saturday revealed trustees responsible for protecting investors in all major super funds faced zero penalties under super legislation, in place since 1993, if they failed to meet legal requirements that they protect investors and act in their best interests.

Financial Services Minister Kelly O’Dwyer said she was seeking to introduce “penalty provisions and criminal sanctions” for directors who failed to execute their duty to act in the best interests of super members, but that proposed law had been “frustrated” last year and not passed the Senate “following lobbying against (it) by vested interests within the industry and the Labor Party”.

Do you know more? klana@theaustralian.com.au