Superannuation reforms could spark exodus of funds from market

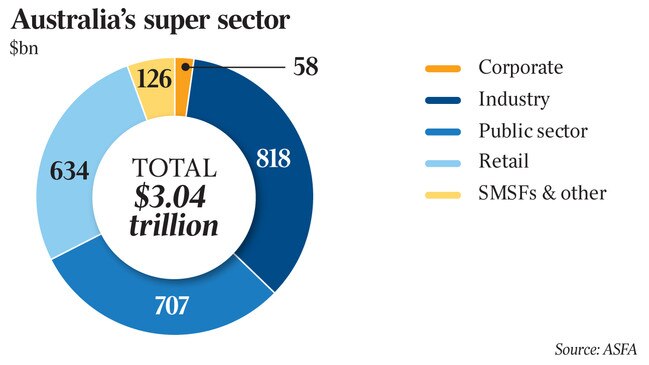

The superannuation industry says the government’s proposed reforms for the sector could result in a quarter of funds exiting the market.

The superannuation industry has hit back at the government’s proposed reforms for the sector, arguing the changes could result in a quarter of funds exiting the market and would discourage investment in infrastructure.

The changes would also see super funds lumped in a small legal category with terrorists and child abusers in putting the onus of proof on the accused rather than its accuser in legal prosecutions, an economics legislation committee heard on Wednesday.

The proposed Your Future, Your Super reforms, which include a new performance test, a stapling measure that ties members to a single fund for life and the requirement for trustees to act in members’ best financial interests rather than simply their best interests, announced in the October budget, are due to come into effect on July 1.

“The challenge we have with the proposed legislation is that there is the potential to see 25 per cent of funds exit the market,” Association of Superannuation Funds of Australia CEO Martin Fahy told the committee.

“And in that respect it risks disrupting retirement savings … of potentially three million Australians altering the competitive landscape beyond recognition, potentially leading to more oligopolistic structures.”

Dr Fahy also questioned whether there was enough time to implement the measures before the new laws were proposed to take effect in July.

In particular the single default account would place “an enormous burden” on employers, he said, as he warned against “unduly stifling” small and medium businesses from bringing on new employees.

Under current laws, trustees could act in the best interests of their members and be free to invest in a way so they could maximise risk-adjusted returns over the medium to long term, he said.

The proposed changes could see funds “hug the index” rather than risk underperforming the market, he said.

“Running that risk would see you probably dial down investments in non-indexed assets,” he said.

Rest CEO Vicki Doyle said her fund supported the intent of the reforms and agreed with the objectives, but said the changes as proposed would not achieve the outcome of removing underperforming funds from the sector.

The reforms would also have an impact on the types of investments undertaken, the fund’s deputy chief investment officer Simon Esposito said.

“The implementation of the proposed benchmarks would potentially lead to a lower level and different mix of investment because there’d be an inability to focus as much on optimal long-term returns,” Mr Esposito told the committee.

That shift would have broader implications for the economy, he warned. “The proposed infrastructure benchmark has mainly North American infrastructure assets in it, about 80 per cent. There’s also a concentration to railways and electricity assets. Those may not be the types of assets Rest would choose to maximise the best financial interests of its members and Rest may see better returns in other areas but these benchmarks would discourage investments in those valuable assets.”

QSuper CIO Charles Woodhouse said some measures of the bill could cause unintended consequences, such as funds taking high levels of risk to make up for previous underperformance.

The proposed reverse onus of proof provisions, meanwhile, which would require trustees to prove their decisions were in members’ best financial interests, represented a significant departure from both general and trust law, the fund’s acting general counsel, Nadia Bromley, said.

“Rather than directing attention to outlying aberrant behaviour in the industry, it characterises all trustees as falling short of their obligations,” she said.

Saying that the reverse onus of proof was rare, she noted that it was required in two other cases: where child sex offences are committed outside of Australia and in terrorism provisions.

Reversing the burden of proof would also impose additional costs and administrative burden on trustees, she said.

But the prudential regulator argued it would focus trustees’ minds on the evidence they must have and the records they must keep to show they have acted in the best financial interests of members at all times.

“This measure bolsters the requirements already introduced through SPS 515, building on penalty provisions recently introduced, which require trustees to ensure that their significant expenditure decisions are for the purposes of the sound and prudent management of its business operations and consistent with the best interests of beneficiaries,” APRA said in its submission to the committee.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout