Superannuation raids to pay for fat surgery

Australians are tapping their super to pay for healthcare at an unprecedented rate.

Australians are tapping their superannuation to pay for healthcare at an unprecedented rate, with more than 30,000 requests approved last financial year — twice as many as two years ago — mostly for weight-loss surgery and IVF.

This emerging funding source for private healthcare will soon be paying out $400 million a year as patients grapple with out-of-pocket expenses and public waiting lists. It is fuelled by rising rates of obesity and couples choosing to have children later in life.

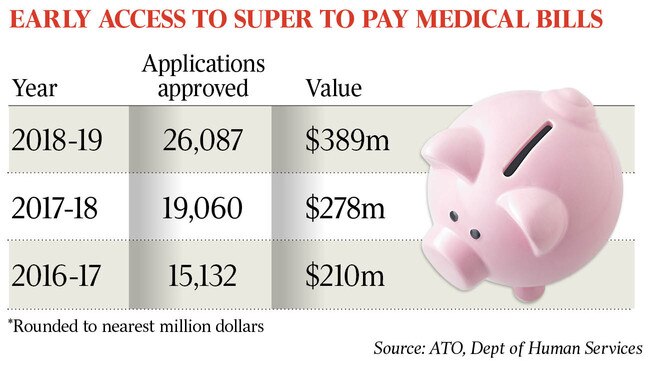

Even as federal Treasury was reviewing the rules on early access to superannuation, the surge in demand from people wanting to use their retirement savings continued at a phenomenal rate. In 2016-17, the Department of Human Services approved 15,132 applications to use superannuation to pay for healthcare. The following year, a further 19,060 applications were approved, representing annual growth of almost 26 per cent.

Last financial year, the number of healthcare approvals rose to 26,087, with growth accelerating to almost 37 per cent, according to new figures obtained by The Australian.

The rules allow for early access where medical treatment is “necessary to treat a life-threatening illness or injury, or alleviate acute or chronic pain, or alleviate an acute or chronic mental disturbance”.

While there are billions of dollars held in superannuation, the annual amount released on compassionate grounds to pay for healthcare has increased from $210m to $389m in two years — a significant injection into a health system facing cost pressures and calls for greater transparency.

Australia’s Chief Medical Officer, Brendan Murphy, has warned that people taking out reverse mortgages, crowd-funding and raiding their super to cover out-of-pocket expenses of more than $10,000 indicates a serious problem.

Based on the latest superannuation figures, the average amount released was almost $15,000. Professor Murphy is investigating whether there is a threshold at which billing becomes so unethical it should be considered malpractice, particularly where similar treatment is available without charge in the public sector. “One of the questions now is defining at what point it becomes egregious,” Professor Murphy told The Australian. “You could argue that the causing of severe financial pain, material financial pain, is egregious.”

It remains to be seen whether people using their nest egg to ostensibly improve or extend their lives would be regarded as financial pain.

Late last year, Treasury released draft proposals arising from its review of the rules on early access to superannuation, and reported “scant support” for further restrictions.

“Some stakeholders questioned why individuals should be required to pay for services by accessing their superannuation rather than receiving them from the taxpayer,” Treasury noted.

“However, there was also recognition that early access to superannuation could be beneficial in a world of finite government resources, as a supplement to other forms of support.”

The Department of Health had previously consulted on the issue and found the medical sector generally wanted super to be available to prospective patients.

Treasury’s final proposals included a tighter definition of mental illness — used to justify access to IVF — and restrictions on overseas medical treatment. Two doctors would also be required to certify treatment was generally accepted as being clinically relevant for the patient’s condition.

Requiring patients to obtain quotes was deemed unreasonable, as was the idea of capping the amount able to be released for healthcare.

“Out-of-pocket expenses for medical treatment are out of the control of the individual and the frequency with which the need for treatment arises is unpredictable,” Treasury stated.

Treasury consulted on the proposals until February but the outcome of the review remains unclear.

The Australian Taxation Office took responsibility for applications last financial year, still subject to the rules set out in the Superannuation Industry (Supervision) Regulations 1994. “The ATO considers each ‘compassionate release of super’ application on the specific circumstances and in accordance with the regulations,” an ATO spokeswoman said yesterday.

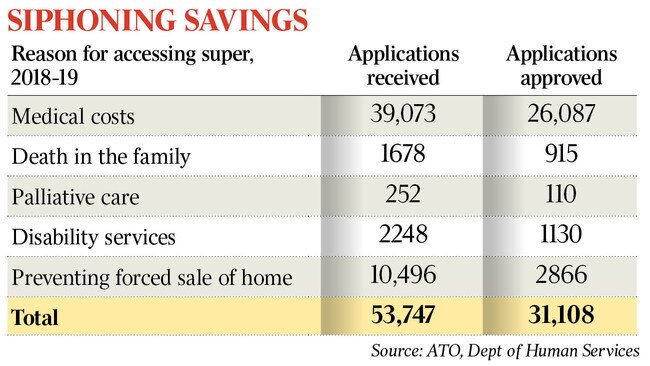

While people can also apply for early access on compassionate grounds for palliative care, to pay for a dependant’s funeral expenses, accommodate a disability or prevent foreclosure or the forced sale of a home, healthcare dominates: last year it accounted for 73 per cent of all 53,747 applications in that category and 84 per cent of all approvals (the average success rate was 58 per cent but for healthcare it was 67 per cent).

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout