Superannuation: More than a million apply for early release

The grim milestone underscores the depth of the economic damage inflicted by the coronavirus shutdown.

More than a million of the nation’s workers have applied for early access to their superannuation savings, in a grim milestone that underscores the depth of the economic damage inflicted by the coronavirus shutdown.

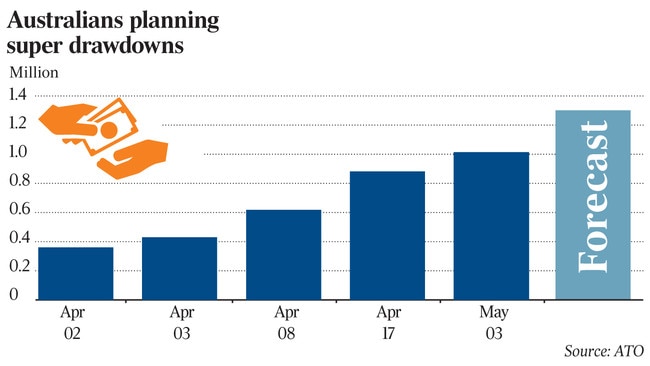

As at end of Friday, less than two weeks after the scheme opened, 1,014,958 people had requested to draw down up to $10,000 from their nest eggs, totalling $8.38bn in early payments, according to the latest Treasury figures.

The figures come as the banking regulator is preparing to release data on how long trustees take to make payments to members after receiving notification from the ATO.

The industry-level data, which APRA has had access to since last week, could be released as early as Monday, while fund-level data that will name and shame those who delay making payments will be made public in the coming weeks.

Before applications for the early access scheme opened on April 20, more than 900,000 people had registered their interest. The early access allows workers to take out $10,000 in savings before June 30, and a further $10,000 between July 1 and September 24. Both payments are tax free.

More than 1.7 million savers are expected to draw down funds from their nest eggs, with Treasury estimating more than $29bn will be withdrawn from super funds in the coming months.

Assistant Minister for Superannuation Jane Hume said the scheme was a temporary, targeted and proportionate response to the economic downturn.

“It’s important to remember that behind every application is a story of financial hardship due to the impact of COVID-19,” Senator Hume said. “We understand that this is a very difficult time for many Australians and the purpose of the early release super scheme is about giving Australians flexible options to balance the family budget.”

Senator Hume also said she was pleased with the super industry’s response to the influx of withdrawal requests, adding that the billions flowing out of funds would not have a significant impact on the overall system.

“To put the figure of $8.38bn into context, superannuation in Australia is a $3 trillion dollar industry. The forecast of $29bn is around one quarter of the total contributions made to super last financial year alone,” she said.

Workers thinking about drawing from their nest eggs should seek financial advice, Senater Hume advised, as she pointed to the MoneySmart calculater that showed the impact a withdrawal may have on future retirement savings.

Analysis by Industry Super Australia has found that a 20-year-old who accessed the full $20,000 available under the scheme could lose more than $120,000 from their retirement savings, while a 30-year-old could lose $100,000 and a 40-year-old more than $63,000. But the lobby group has come under fire for its figures, which are significantly higher than those produced by other calculators. ASIC’s MoneySmart calculator finds a 20-year-old accessing the full $20,000 could lose about $53,000 from their retirement savings, while a 30-year-old could lose about $43,000 and a 40-year-old $35,000.

The difference in outcomes is at least in part due to varying assumptions behind the calculators, including expected inflation rates and investment returns.

People who have lost their jobs or had their working hours reduced by at least 20 per cent are among those eligible to apply for the early access scheme. Sole traders that have suffered a 20 per cent or more decline in turnover are also eligible, as are some temporary visa holders.

A silver lining from the crisis was that people were taking more interest in their super, Senator Hume said. “Superannuation is one of those issues that can be pushed to the back of the filing cabinet. Australians are now very invested in their superannuation and financial future,” she said.