Super funds notch up positive February return despite tech wreck

Super funds notched up another month of solid growth in February but members should still prepare for a ‘bumpy’ ride ahead.

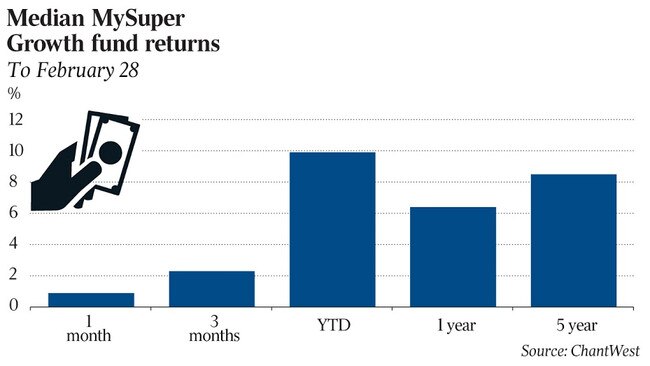

Super funds notched up another positive month in February, with the median growth fund returning 0.9 per cent and pushing the cumulative return for the past 12 months close to 20 per cent, according to Chant West.

February’s return was dampened by the global tech wreck that hit equity markets in the second half of the month, with the 0.9 per cent final figure well below the 2.5 per cent gain the research house estimated funds had achieved midway through the month.

“While there’s great optimism around the rollout of vaccines and a return to some economic normality, there were some fears that a stronger-than-expected economic recovery may result in increased inflation and fast-tracked tightening of monetary policy,” Chant West senior investment research manager Mano Mohankumar said.

“That caused investors to drive up bond yields in late February and that in turn had the effect of pulling back sharemarkets.”

Despite the investor jitters, Australian shares ended the month up 1.5 per cent, while international shares rose 2.7 per cent in hedged terms. Unhedged, the gain was reduced to 1.6 per cent.

With sharemarkets rising further in the first half of March, Chant West estimates the median growth fund is up a further 2.3 per cent so far this month, bringing the 12-month rise close to 20 per cent.

Mr Mohankumar said the result was remarkable given the impact of the COVID-19 pandemic and widespread lockdowns.

“It also means that we’re more than 5 per cent above the pre-COVID crisis high that was reached at the end of January 2020,” he said.

Elsewhere, SuperRatings found the median balanced super fund returned 0.7 per cent in February, bringing the financial-year-to-date returns to just below 10 per cent.

“Super has notched up another positive month, thanks to the vaccine narrative and the relative strength of Australia’s economic recovery, which has exceeded expectations,” SuperRatings executive director Kirby Rappell said.

“With the severe shock of the pandemic now behind us, the challenge will be gradually transitioning away from government support programs and getting households and businesses back on a sustainable footing.”

Super members should not be surprised to see bumpy markets and the value of their nest eggs fluctuate this year, he added.

The positive momentum in monthly returns comes after the nation’s total superannuation assets passed the $3 trillion mark at the end of December.

Data from the prudential regulator, released this month, showed the 2.2 per cent lift in national savings last year took total superannuation assets to $3.04 trillion.

The lift came despite the COVID-induced sharemarket collapse in February and March 2020, the more than $36bn siphoned out through the federal government’s early super access scheme, and lower member contributions than the year prior.

Annual member contributions in 2020 came in at $22.9bn, down 6.4 per cent on the 2019 figure.

But employer contributions increased 4.1 per cent, pushing total superannuation contributions up 1.9 per cent for the year.