Super funds have ‘a huge role’ to play in Covid recovery, former federal treasurer Wayne Swan says

Former federal treasurer and new Cbus chairman Wayne Swan says super funds have ‘a huge role’ to play in strengthening the post-pandemic economic recovery.

Superannuation funds have “a huge role” to play in strengthening the post-pandemic economic recovery, with a surge of investment into real assets and “a laser-like focus” on long-term returns crucial as the nation pulls through the Covid crisis, according to former federal treasurer Wayne Swan.

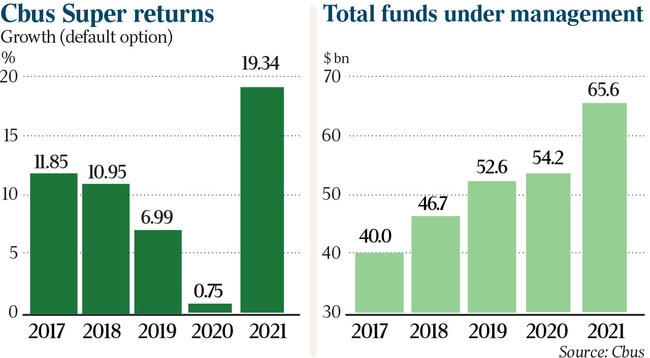

Mr Swan, the new chairman of the $67bn building and construction industry fund Cbus, on Wednesday zeroed in on the opportunity ahead for the $3.4 trillion super sector as he pointed to the shift in the national debate brought about by the public health emergency.

“What’s important post-pandemic is that we get the investment framework right for the future,” Mr Swan said in an interview.

“The economic debate prior to the pandemic was largely about flagging productivity, insufficient investment, particularly in key sectors, and low wage growth.

“There is an opportunity now, particularly for our super funds, to take a much more collaborative approach and make sure that the investments made are delivering the jobs for the future, not just in our traditional industries but in those that are going to be the subject of pretty substantial structural adjustments in the years ahead.

“Super funds have a huge role in strengthening the recovery.”

The fundamentals of Australian society and the economy would receive a much-needed boost from a super sector wave of investment in long-term assets, Mr Swan said. “Whether that is construction, property, transport, mining, value-adding or any number of occupations, we just need to focus on fundamentals for the long term,” he said.

“Superannuation has been an important part of Australia’s growth story over the last 30 years. And I think it’s going to be an even more important part of the growth story over the next number of years.”

Mr Swan, who was treasurer from 2007 to 2013 and was named Euromoney’s finance minister of the year in 2011, said super funds, in a way, needed to repeat the actions taken during the global financial crisis.

“What we saw super funds do during the GFC was basically provide a liquidity buffer, and a financial backstop for the economy and individual companies, but also get on with a pipeline of investment. That’s where we’re at again now,” he said.

“The advantage that I’ve seen in today’s economy, which has had a lot of fairly fractious debate, to put it mildly, over the last decade or so, has been the co-operation and collaboration between employers and unions.

“And it’s a collaborative model we can all get behind and continue to strengthen, and will be a huge economic advantage to us as we move forward.”

Commenting on the economic outlook, Mr Swan said Australia would recover from the Covid-19 pandemic, but warned that “the pace at which we’re going to bounce back will be determined by the success that the country has with the virus”.

He does not see rates pushing back to pre-GFC levels, and sees fiscal measures being gradually wound back.

“You won’t see a sudden withdrawal of the fiscal measures that protected economies during the pandemic,” Mr Swan said.

“They will be gradually withdrawn, but you won’t see them suddenly withdrawn and yanked out.

“In terms of the inflationary pressures and the implications of that for rates, I think you’ll see an economic future where rates may well rise over time, but they will not necessarily go back to levels people became used to for a period prior to the GFC. The official cash rate sat at 7.25 per cent in 2008.

“The most important thing we know is that through the pandemic we’ve seen how the government working with the private sector can stimulate long-term economic development. And that is new because that was decidedly unfashionable prior to the pandemic.”

Mr Swan, who stepped into the Cbus chairman role at the start of the month, replacing former Victorian premier Steve Bracks, hailed superannuation as the nation’s “secret weapon”.

“It does two things at once: it drives growth and it provides a share of profits to people who work hard to create those profits, and therefore contributes to a far more equal outcome for workers,” he said.

Cbus, one of the nation’s largest super funds and on a mission to get to $150bn in funds under management, is currently in talks to hoover up smaller funds EISS and Media Super. But it was not about growing for growth’s sake, Mr Swan said.

“We don’t want to just be a large generalist fund,” he said. “The benefits of growing are lower fees and therefore higher returns for our members.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout