Super funds feel heat of climate change revolution

Mark Cloney is part of a revolution that is fundamentally reshaping global finance.

Mark Cloney teaches economics to first-year and postgrad students at Melbourne’s La Trobe University. But he came to academia late, in 2015, at the age of 55.

While Professor Cloney, who lives in Melbourne’s bush-fringed northern suburbs, is seemingly a world away from the boardrooms of the nation’s biggest companies, he is part of a revolution that is fundamentally reshaping global finance.

Professor Cloney spent two decades working in the public sector in Canberra, including 13 years in the Department of Infrastructure. He then retired from government life, moved back to Melbourne, took up the Professor of Practice role at La Trobe Business School and moved his super across to fund giant UniSuper.

It is super fund members like Professor Cloney that are now demanding their retirement savings be used to lift the environmental, social and governance standards of the companies they invest in.

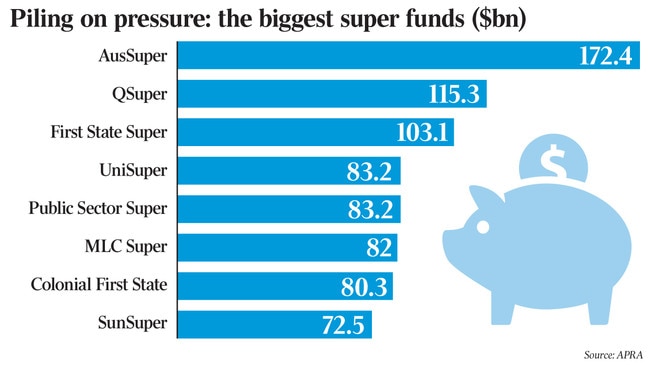

Collectively across the nation’s industry, public sector and retail funds this translates to hundreds of billions of dollars of investment clout, which is putting intense pressure on companies they invest in to lift their game on environment and sustainability concerns.

The bushfire crisis raging through the country has only magnified public distress about climate change, resulting in louder calls by investors to rethink the investment risk it poses.

Five years after signing up with UniSuper, Professor Cloney is pushing for stronger action. If it doesn’t come, he may be forced to pull his money out of the fund and put it elsewhere, he warns.

“UniSuper should transition out of fossil fuel investments. There’s going to be bigger returns in renewables down the track so they should use their institutional might to drive market change,” he told The Weekend Australian.

“At the moment we dig fossil fuels up and shoot them off overseas. Other countries turn, say, aluminium sulphite into aluminium products and we end up importing those back in. It’s the same with steel. We could invest in creating those plants here and use renewable energy to process them.”

Professor Cloney isn’t alone in his concerns about the $83bn super fund, which boasts 450,000 academics and researchers as members. Associate Professor Katrina Schmid, who lectures on ocular anatomy and physiology at Queensland University of Technology, wants the fund to do more to support sustainable energy companies. She thinks ethical investments should be the default option at the fund.

“They should try to support companies and put money towards fostering companies and ideas that have the interests of the environment and Australia at their core,” Professor Schmid said.

The swipes against the fund comes as its balanced option was named the best performer in 2019, with an 18.4 per cent return for the year, according to figures released by ChantWest.

Despite the outperformance, UniSuper has come under fierce pressure following the launch by climate activist group Market Forces of a campaign calling for it to “divest from all companies that are actively undermining climate change action”, believed to be worth about $10bn.

“UniSuper does not have fund-wide exclusions on fossil fuel investments of any kind. Instead, it claims to engage with investee companies in order to improve climate risk management,” Market Forces said this week.

“However, UniSuper has failed to vote in favour of a single climate change-related shareholder resolution in Australia”.

UniSuper chief investment officer John Pearce rejected the suggestion that the fund had not taken enough action on climate issues and was adamant there would be no change to its current stance.

“Our position on divestments has been very clear. We don’t divest out of assets for non-financial reasons and that’s going to continue to be our position.”

The reason the fund had not voted in favour of climate change-related shareholder resolutions was because it did not want to jeopardise the quality of engagement it had with Australian company directors, Mr Pearce said.

The fund voted in favour of climate resolutions in its international holdings because it did not enjoy the same level of engagement with global companies, he told The Weekend Australian.

The campaign against UniSuper came in the same week as Larry Fink, the chairman and chief executive of the $7 trillion asset manager BlackRock, warned that evidence on climate risk was compelling investors to reassess core assumptions about modern finance.

“Climate change has become a defining factor in companies’ long-term prospects,” Mr Fink wrote in his annual letter to CEOs on Tuesday.

“Awareness is rapidly changing, and I believe we are on the edge of a fundamental reshaping of finance.”

In response to rising climate change concerns, Mr Fink said BlackRock — which has the bulk of its funds in passive investments — would exit investments that presented a high sustainability-related risk, such as thermal coal. It would also make sustainability integral to portfolio construction and risk management going forward, he said.

Appearing unconvinced by BlackRock’s new policy, Mr Pearce pointed to the asset manager’s investment in a recent bond issue by oil and gas giant Saudi Aramco.

“BlackRock was one of the biggest investors in the bond issue by Saudi Aramco. So there’s a big gap between what’s perceived and what they’re actually doing.

“We’re not into virtue signalling … what we like to report on is exactly what we’re doing. And not try to neatly package stuff up that helps sell things,” Mr Pearce said.

Commenting on the pressure from members to divest, Mr Pearce said the fund’s exposure to fossil fuels was “not that high”. The bulk of its fossil fuel holdings are in gas via APA and Woodside, he noted.

“And if anyone doesn’t believe that gas has to play a role in transitioning to a carbon-neutral economy, I think that’s really unrealistic. Gas has to be part of the solution.”

UniSuper offers seven fossil fuel-free investment options to members, Mr Pearce added.

As super funds grapple with the weight of immense pressure coming from engaged members on climate action, Professor Cloney believes the best chance for a solution will come when a national framework exists alongside a shift in institutional investment. “We need a balance, and we haven’t got it at the moment,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout