Chant West: Super returns can’t last forever

Super funds are closing in on a record 10th year of gains amid warnings that the gravity-defying run can’t go on forever.

Super funds are closing in on a record 10th year of gains amid warnings that the gravity-defying run can’t go on forever.

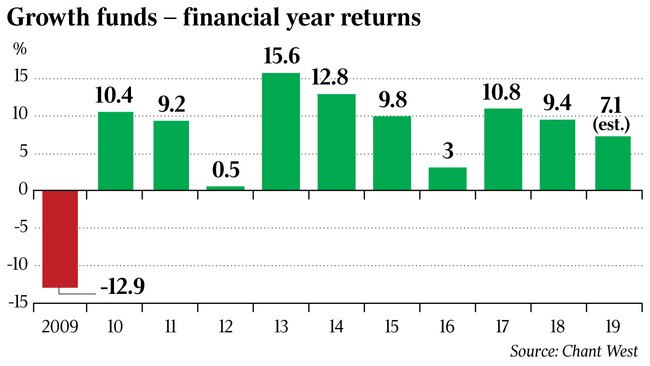

The median growth fund — in which the majority of workers are invested — is expected to return 7.1 per cent for the financial year that ends on Sunday.

It caps a stellar run from the depths of the global financial crisis when those same funds delivered consecutive years of negative returns — a 6.9 per cent loss in 2008 and 12.9 per cent in 2009.

According to Chant West it took those funds — which have 61 per cent to 80 per cent of their investments in growth assets — until September 2012 to recover the aggregate 26.5 per cent loss of those years and restore balances to pre-GFC levels.

Since then they have had an unbroken run of positive returns, including four years of double-digit gains that added 85 per cent to value of investors funds.

Chant West senior investment research manager Mano Mohankumar said fund managers should be pleased to see returns of almost 9 per cent a year over the decade, beating their typical investment objective of the inflation rate plus 3.5 per cent.

“So funds are growing their members’ savings well above the increase in the cost of living, and they’ve been doing that for a long time,” Mr Mohankumar said.

“That’s a tremendous run, but we should remember that it really represents the recovery from the setback of the GFC, so it would be a mistake to assume it’s sustainable.” Mr Mohankumar said growth funds typically expected one negative year in five, a pattern that hadn’t occurred in Australia since superannuation became compulsory in 1993.

But with mounting trade tensions between China and the US, the continuing uncertainty over Britain’s exit from the EU and with most asset classes looking fully valued or close to it, “we’re expecting some challenging times ahead”.

In the post-GFC decade funds had also diversified away from listed equities — down from 60 per cent to 53 per cent of the total assets — and into new classes like private equity and infrastructure.

That meant funds this year underperformed the listed equity market — with the ASX 200 delivering a total return at 12.6 per cent for the financial year, its third straight year of double-digit returns.

But Mr Mohankumar said the reduced weighting to local and international-listed equities and increased diversification also insulated super funds from events like the GFC.

Australian and international shares fell as much as 50 per cent during the GFC, and listed and international real estate investment trusts by 70 per cent. But the median growth fund lost 26.5 per cent.

Chant West said the 2018-19 financial year has been a tale of two halves, with funds down 2.4 per cent in the six months to December but up nearly 10 per cent since then, largely on the back of strong sharemarkets. International returns of 5.6 per cent ballooned to 11.5 per cent if the exposure was unhedged because of the fall in the Australian dollar.

All asset classes were up, with REITS surging by 21.6 per cent and even bonds up 9.8 per cent.

This year’s top funds in the growth category may report a return as high as 10 per cent — 8.7 per cent above the inflation rate.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout