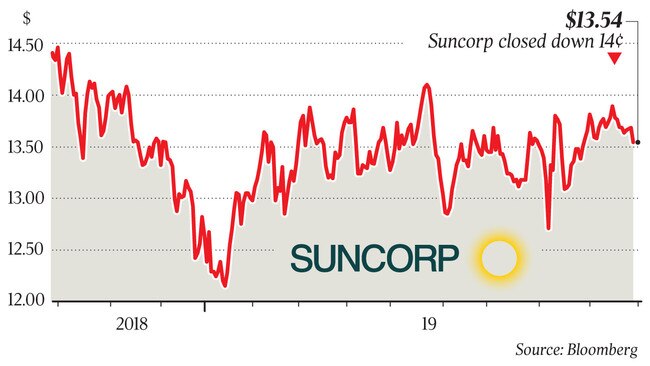

Suncorp feels heat over climate change issues

Extreme weather and activist pressure have left insurer Suncorp scrambling to update it response to climate change.

Suncorp chairman Christine McLoughlin has defended the insurer’s record on climate change action as she stared down a challenge from some shareholders who were calling for an end to its investment in, and exposure to coal, oil and gas.

Fronting investors at Suncorp’s annual meeting in Brisbane on Thursday, Ms McLoughlin, who stepped into the chairman role a year ago, said the board considered climate change a high priority and the insurer and banking business was working with reinsurers and climate scientists to assess climate risks in its portfolios. But she conceded Suncorp needed to do more.

“Suncorp is on an active path in addressing climate change. There’s been a lot of work achieved in the past couple of years … but this is a journey. There is a lot of transition to work through.

“We are really committed to doing the best we can and we really see the importance of weather and climate as critical to the future sustainability of our business,” Ms McLoughlin told shareholders.

Fossil-fuel related business made up 0.5 per cent of its insurance arm and a negligible part of its lending and investment portfolio, she added, and there were no plans to increase its investments in oil and gas.

Suncorp earlier this year committed to phasing out investments in coal by 2025. It followed former CEO Michael Cameron in February calling for climate action after its half-year profit took a dent due to a rise in extreme weather events.

For the 2020 financial year the insurer increased its allowance for natural hazards from $720m to $820m and also purchased $200m reinsurance cover in a bid to cope with the more frequent extreme weather events.

“I don’t think I can be clearer on how seriously our board and management team are taking these issues that we’re facing,” Ms McLoughlin told shareholders. “We’ve taken significant steps in reducing our own environmental footprint … Directionally you should see that we are genuine in what we’re seeking to do, we’re not disputing the science,” she added.

Banks and insurers have come under mounting pressure from climate activist shareholders to snub fossil fuels, with environmental group Market Forces targeting Commonwealth Bank, AGL, QBE and Suncorp in recent months, among others.

Following discussions with the Melbourne-based group, CBA last month said it would reduce its thermal coal mining and coal-fired power generation exposures with a view to exiting the sector by 2030.

At Suncorp’s AGM, activist group Market Forces had called for the company to set targets to reduce its investment in and underwriting of fossil fuels but its resolution failed to pass, with 95 per cent of shareholders voting against it.

Separately, newly appointed chief executive Steve Johnston was “disappointed” critics of Suncorp continued to focus on the “last little bit of the story”, rather than the steps it had taken to reduce its environmental footprint.

“We’ve done so much to protect the group of people in this room, our shareholders, around the impacts of increased frequency and severity of natural hazards,” Mr Johnston said.

“The next two generations ... will be continuing to deal with cyclones, continuing to deal with flood and bushfires.

“There is a big role for government, working with the finance sector and insurance particularly, to help mitigate those activities and provide some resilience in our communities,” he said. Mr Johnston was this month appointed to the chief executive role after holding the position on an acting basis since the start of the year.

Ms McLoughlin also used the annual meeting to provide an update on action the company was taking to implement changes brought about by the royal commission into financial services.

“Suncorp has already implemented several recommendations identified by the Royal Commission, our own risk governance self-assessment to APRA as well as reviews conducted by the New Zealand regulators.

“The APRA self-assessment, which was conducted by the board last year, highlighted that, while Suncorp’s culture benefits from a clear and consistent tone from the top and governance practices are well established, there are areas for improvement and we have been addressing those,” she said.

She confirmed the insurer would not release its self-assessment to the public, instead treating it as a “confidential request” from APRA.

Suncorp last month posted a net profit of just $175m for the 2019 financial year, down 84 per cent slide on the year prior as it booked a $910m loss on the sale of its life business and counted the cost of the increasing frequency of extreme weather events.