Stay calm, this is no Enron, says Westpac’s Brian Hartzer

Hours before he quit, Westpac’s CEO told executives in a closed door meeting the scandal ‘didn’t need to be overcooked’.

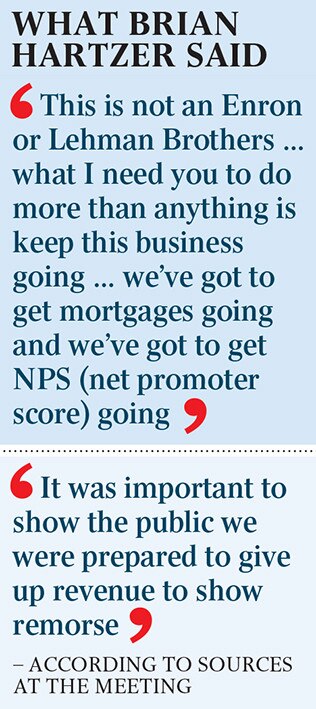

Embattled Westpac chief executive Brian Hartzer told his executives just hours before his resignation this morning that the bank’s pedophile money scandal was “not an Enron or Lehman Brothers”, and mainstream Australia was not overly concerned so “we don’t need to overcook this”.

In an hour-long, closed-door meeting on Monday, Mr Hartzer implored his team to “get mortgages going and we’ve got to get NPS (net promoter score) going” following allegations the bank facilitated child exploitation in The Philippines.

But he told executives and general managers he was “very sorry” the bank would be forced to cancel Christmas parties, according to two people at the meeting. “Unfortunately in the heightened media environment it will not look good if we have our staff whooping it up with alcohol,” he said.

READ MORE: Hartzer quits over Austrac scandal | Libs turn on Westpac | Victorian government threatens Westpac contracts | Westpac giving ‘a free pass to pedophiles’ | Investors demand action by Westpac |

An email was sent to bank staff late on Monday about the party’s cancellation.

Mr Hartzer, who is fighting to remain in Westpac’s top job, tried to assure the bank’s most senior leaders that the scandal “was not playing out as a high street issue”.

“We all read the Fin (The Australian Financial Review) and The Australian, and we all read that and think the world is ending,” he said, according to the two people. “But actually for people in mainstream Australia going about their daily lives, this is not a major issue so we don’t need to overcook this.’’

The Austrac statement of claim includes allegations that Westpac financially facilitated transactions enabling child exploitation in The Philippines. More than 23 million transactions are alleged to have breached anti-money-laundering laws and the bank is facing the prospect of fines totalling more than $1bn.

The allegations, filed in the Federal Court, included not properly monitoring international fund transfers and claims the bank failed to properly assess 12 customers with links to child pornography and sexual exploitation in The Philippines and other Southeast Asian nations.

A third person who attended the meeting said Mr Hartzer had not intended to underplay the gravity or importance of the issue.

Home Affairs Minister Peter Dutton on Monday accused Westpac of giving “a free pass to pedophiles”, strongly suggesting senior executives needed to be accountable for the alleged law breaches.

“Westpac banking bosses, through their negligence, have given a free pass to pedophiles and there is a price to pay for that and that price will be paid and we have been very clear about it,” Mr Dutton said.

“We will make sure through Austrac and the other entities within the Home Affairs portfolio that people who commit those egregious offences or breaches of the law will pay a serious price.”

The Victorian government signalled Westpac could lose access to more than $60bn worth of annual transactions under a $250m state contract.

Victorian Assistant Treasurer Robin Scott said he would launch a review of Westpac’s compliance with state and federal laws. Mr Scott is also demanding an explanation from Mr Hartzer as to why the state government shouldn’t ban the country’s second largest bank from a competitive tender for its banking cash and services, which is scheduled for next year.

Mr Hartzer spent Monday morning calling Westpac’s largest customers, pleading with them to stick by the bank in its time of crisis.

The chief executive also briefed his core response team handling the fallout of the Austrac allegations, telling them about conversations he had had with Treasury secretaries, in which he warned that if states and territories started withdrawing their deposits the damage to the bank would blow back on the wider economy.

The money-laundering scandal has wiped more than $8bn off the bank’s market capitalisation and analysts say its share price will remain under pressure in the absence of a leadership change.

Global ratings agency Moody’s on Monday warned the governance implosion could trigger a cut to the bank’s credit rating.

Mr Hartzer finished the hour-long briefing on Monday by saying: “This is not an Enron or Lehman Brothers, we will get through this. What I need you to do more than anything is keep this business going. We’ve got to get mortgages going and we’ve got to get NPS going.”

Westpac’s senior executive team had been holding discreet meetings, dubbed Project 106, in recent months as it planned for the Austrac investigation fallout.

The Australian Securities & Investments Commission said on Monday it was investigating Westpac over “possible breaches of legislation”, including disclosure obligations and directors’ duties in relation to the Austrac allegations.

The Australian Prudential Regulation Authority announced it was investigating the bank over governance issues and whether senior management breached the new executive accountability regime.