SMSF Association hopes Senate will amend 30pc super tax for high balances

The government’s proposed 30 per cent tax on super balances over $3m has put it on a collision course with the Self Managed Super Fund Association which hopes the Senate will intervene.

The Self Managed Super Fund Association hopes proposed legislation to impose a 30 per cent tax on superannuation balances above $3m will be amended in the Senate.

The association is strongly opposed to aspects of the legislation, which is expected to go to the Senate after parliament resumes for the May 14 budget, particularly its application to unrealised gains and the lack of indexation of the $3m tax threshold.

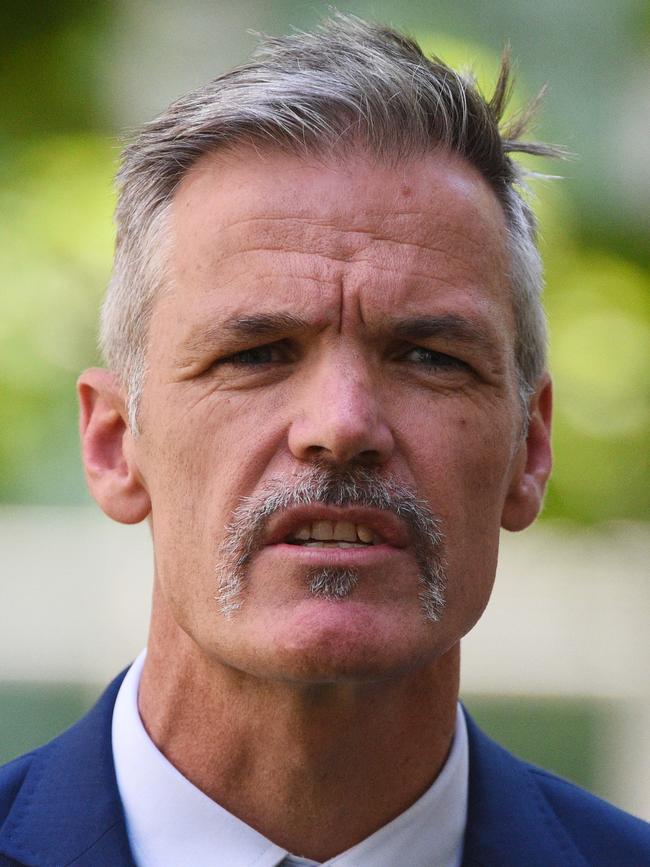

SMSF Association president Peter Burgess said the association believed that Senate cross benchers “are open to sensible changes” to the legislation, which is set to come into force next year.

“They understand the unfairness of taxing unrealised capital gains, the dangerous precedent this sets, and the impact this will have on small businesses, farmers and venture capital,” Mr Burgess said on Tuesday.

The proposed changes to increase the taxes on superannuation balances above $3m are expected to fall heaviest on the $915bn self-managed super sector, which has more than 1.1 million members. The SMSF Association has been lobbying extensively to head off the harshest aspects of the proposals, first outlined by federal Treasurer Jim Chalmers in February last year that would see a tax rate of 30 per cent imposed on superannuation balances of more than $3m from July 2025.

The association has been particularly concerned that the radical move to tax unrealised gains would result in super fund members, such as farmers and small business people with property in their super funds, having to sell assets to pay for the tax.

The federal Treasury has said the proposals would only affect 80,000 super fund members and raise $2bn a year in extra revenue. But critics have warned that it could have more far reaching consequences over time, as people’s super fund assets increased, and arguing that imposing taxes on unrealised gains would set a dangerous principle.

National Farmers’ Federation chief executive Tony Mahar said farmers were “particularly concerned about the taxation of unrealised gains”.

“In a worse case scenario, it might mean family farms are sold off to meet a tax bill purely because the value of an asset has increased on paper,” he said.

Mr Mahar compared the proposal to changing capital gains tax on the value of the family home every year. He said the proposed changed did not consider the “unique nature of farming businesses, where land assets are often the primary form of retirement savings”.

“It’s pleasing some senators are on the same page as farmers and we continue to call on the government to rethink this legislation,” he said.

The SMSF Association has been lobbying key independents and crossbenchers in federal parliament. “The Bill was supposed to be debated in the parliament last week but has now been adjourned until the next sitting day on May 14,” Mr Burgess said. “The teals came out last week and said they would oppose the taxation of unrealised capital gains and the absence of indexation.”

The association expects NSW independent Kylea Tink to put forward amendments backed by the association to remove the tax on unrealised gains for super funds with balances of more than $3m and to index the $3m figure.

But while the proposals could help generate support for amendments in the Senate, they will not succeed given the government’s numbers in the lower house.

“The government doesn’t support the amendments, so we still expect the bill to pass the lower house without amendment,” Mr Burgess said. “But we remain hopeful the crossbenchers will vote for a sensible alternative to taxing unrealised gains.”

The Greens last year threatened to block the legislation in the Senate if the government did not agree to paid superannuation on paid parental leave.

But the government recently announced it would go ahead with plans to pay super on paid parental leave from July 1, 2025 – the same day as the proposed super tax increases are set to come into force.

Mr Burgess said the proposed new tax system on super “turns existing tax policy on its head by treating the increase in the price of an asset as income received during the income year”.

“When the asset is eventually sold, the capital gain may be subject to capital gains tax, subjecting taxpayers to double taxation,” he said.

He said the tax system was based on only imposing taxes on an asset at the time it was sold.

“To impose tax annually on the ‘paper increase’ in the value of an asset would involve taxing investors on amounts they haven’t received, so would require investors to call on cash reserves to pay the tax,” he said.

“This should send a shiver down the spine of all investors.

“If allowed to be implemented as proposed it would set a dangerous precedent for tax change.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout