Small lenders voice wary backing for ALP broker pay proposal

Labor’s softer approach to reforming mortgage broker pay is sensible, says Melos Sulicich, CEO of banking group MyState.

The Labor Party’s softer approach to reforming mortgage broker pay was sensible, although the “devil will always be in the detail”, said Melos Sulicich, chief executive of banking group MyState.

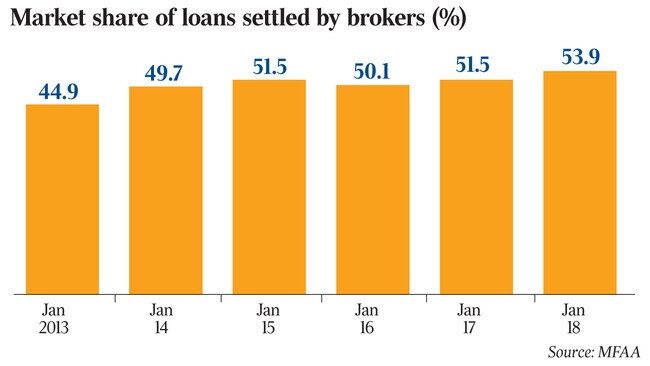

Mr Sulicich joined a string of small and mid-tier lenders in backing the value of the mortgage broking channel, and stressing the importance of any pay changes leaving the industry commercially viable.

Mr Sulicich told The Weekend Australian if the Hayne royal commission’s mooted changes damaged the broking industry, the large banks would benefit from greater flows of home loans.

“The Labor Party has been very sensible in reviewing its position” he said, noting the opposition should not have “blindly” initially committed to implement all the Hayne recommendations.

“The devil will always be in the detail. It needs to be a package (of measures),” he said.

MyState derives about 80 per cent of its mortgages through brokers, allowing it better access to customers outside its home states of Tasmania and Queensland.

Under Labor’s latest position if it wins the election, it will abolish trail commissions on new loans from July next year but retain a higher, fixed, upfront commission for mortgage brokers. The upfront payment will be fixed across lenders to eliminate brokers gaming the system to earn more.

Banks currently pay brokers an upfront commission as a percentage of the loan amount and a smaller trail commission annually over the life of the mortgage.

The Hayne royal commission recommended scrapping commissions altogether and introducing a flat fee paid by the borrower to the mortgage broker or bank, sparking outrage among brokers who said it made the model unviable and would hand power back to the major banks.

Smaller banks and lenders agreed with brokers as they don’t have large scale branch networks.

In a memo to brokers, Suncorp head of bank intermediaries Mark Vilo said: “We will continue to advocate for a strong and sustainable mortgage broking industry at every opportunity.”

ME Bank chief Jamie McPhee also came out in support of reforms that ensured competition.

“Brokers have provided the ability for ME to connect with those customers who would prefer to engage directly with a broker, rather than a bank,” he said. “Any changes to broking should ensure a sustainable industry that promotes competition.’’

The mortgage broking industry is collectively breathing a sigh of relief, given the federal government has also shied away from banning upfront commissions.

Aussie Home Loans boss James Symond said Labor’s move away from the consumer-pays model was “recognition that it would hurt the mortgage broking industry, but more importantly the millions of customers the industry supports”.

Shares in listed groups AFG and Mortgage Choice posted a second day of sharp gains yesterday. The former rallied to just 2c short of levels seen before the royal commission’s report was released on February 4.

“Our principal concern in the first instance was not to have a knee-jerk reaction,” AFG chief David Bailey said. “There is still a lot of detail that needs to be worked through, and we want to be part of the conversation.”

Labor’s other plans include banning volume-based commissions and any “soft-dollar” perks such as entertainment or holidays being offered to brokers.

It plans to impose a best-interest test and a rule under which upfront commission would be paid only on drawn-down loan amounts.

Yesterday, MyState cautioned of a drop in full-year earnings, crimped by fierce mortgage competition and higher loan funding costs. AFG’s interim net profit came in flat at $16.7 million.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout