Small caps to fuel 1851 Capital’s new gold rush

Chris Stott isn’t deterred by the challenge of his new funds management outfit starting to invest as the ASX hits new highs.

Market stalwart Chris Stott isn’t deterred by the challenge of his new funds management outfit — 1851 Capital — starting to invest in the wake of the Australian sharemarket bursting through new highs last week.

Stott, formerly Wilson Asset Management’s investment chief, is instead focusing on how smaller stocks have markedly underperformed the bigger end of the ASX over the past decade.

In his view, that provides his firm plenty of upside as it begins investing in February in emerging listed companies outside the ASX’s largest 100 stocks.

“Small caps have underperformed over the period of the last few years and we think that is set to turn,” Stott says.

“ We think small caps are in for a potentially very strong period over the next few years relative to large caps.

“It’s been quite a rocky road for the small caps space, which excites us given we are starting now and we think we are coming in at a reasonably good time.”

1851 portfolio manager Martin Hickson — also a former Wilson employee — cites analysis that shows that in the past decade the small ordinaries index has underperformed the ASX large capitalisation index by more than 60 per cent. Over two years that figure amounts to 9 per cent.

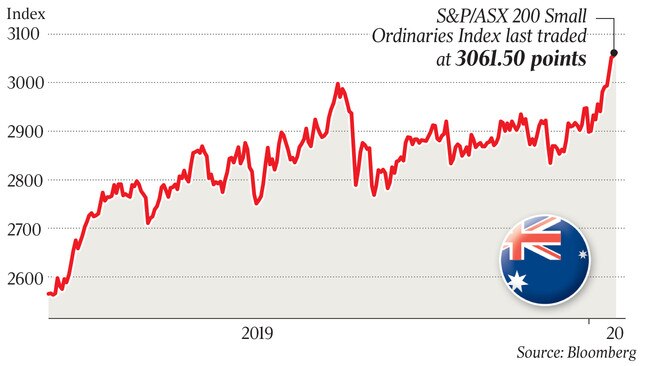

However, the gap has closed since the start of 2019, with the S&P/ASX Small Ordinaries index up about 26 per cent, the Accumulation Small Cap Ordinaries Index rising almost 30 per cent and the S&P/ASX200 posting gains of 27.1 per cent.

1851 will start with funds under management of between $50m and $100m and rules off an offer from the unlisted vehicle to high-net-worth and sophisticated investors, including family offices, at the month’s end.

The firm’s name reflects an important period for the Australian economy because gold found from 1851 onwards created the nation’s gold rushes.

The funds management house says 1851 was the year that started “a long period of wealth and prosperity”, which is what it aims to deliver to unitholders.

Stott is cognisant there are difficulties for funds management firms that invest at the smaller end of the ASX, yet he thinks some of the challenges will provide 1851 opportunities.

“The small caps space has become more inefficient,” he says.

“An example is that in the last five years, based on our data, the quantity of sell-side broker research has declined by 30 per cent and a lot of that has been in the small caps space.”

Stott also points to growing number of industry funds internalising equities management, which has hurt a spate of small cap firms that relied on institutional mandates.

“That will continue for many years to come; you’ll see more internalisation,” he says.

Small and mid-cap funds that have shut their doors in recent years include Discovery Asset Management, Adam Smith Asset Management and Concise Asset Management.

“We are taking a 20-year view for this business and we are setting this up for the longer term so we are not a fly-by-nighter,” Stott tells The Australian.

“We’ve got a long history of investing in the small caps space.

“We are very focused on getting some good early performance up within the first six to 12 months.”

1851 believes consumer confidence will continue to improve over the next 12 months, albeit at a gradual pace as near-term headwinds continue to impact on the Australian and global economies.

“Essentially, low interest rates are prolonging this cycle. We’ve got a cash rate at 0.75 per cent with expectations of a cut in a few weeks time … there is a very high probability of that now given the fires and the impact on GDP,” Hickson says.

Stott counts funds management veteran Chris Cuffe as a mentor and the Australian Philanthropic Services chairman has also committed capital to 1851.

Cuffe was the former head of Colonial First State and former chief executive at Challenger, where Stott began his career.

The Australian foreshadowed Mr Stott’s plans in August after he registered 1851 with the corporate regulator.

There are three 1851 staff, Stott, Hickson and another former Wilson employee who was most recently at Seed Partnerships and is now 1851’s operating chief, Mary-Ann Baldock. The trio have committed to invest personally in the new fund.

The 1851 management fee is pegged at 1.25 per cent, expenses are estimated at 0.2 per cent per annum and the performance fee comes in at 20 per cent. Performance fees are based on beating the benchmark S&P/ASX Small Ordinaries Accumulation Index and ensuring any prior underperformance is recovered.

There is a clause, though, in the information memorandum that shows the fund’s trustee and manager may reset any underperformance to zero if no performance fee has been paid for five years.

Hickson labels that clause “fairly standard” and reiterates that the fund is targeting outperformance. It will be long-only and seeks to hold a diversified portfolio of between 30 and 80 ASX companies.

1851 is upbeat on stocks including accounting and advice group CountPlus, retailer City Chic Collective and sees upside in the automotive sector as new car sales rebound after almost two years of declines.

While they won’t comment specifically on their target for fund size, Hickson says there will be a cap in place on funds under management.

“We will limit capacity because it is our belief as funds under management increase the ability to deliver strong performance erodes,” he says.

The 1851 fund is benchmark-unaware and aims to hold no more than 20 per cent cash on average.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout