Slow growth for troubled life insurance sector

Life insurance is growing at a snail’s pace while undergoing the most dramatic ownership changes in almost 20 years.

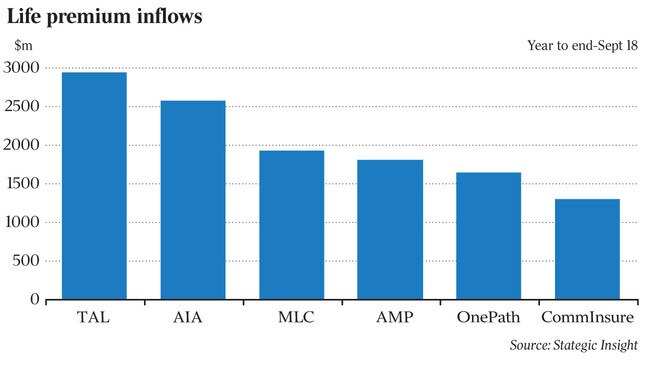

The local life insurance industry is undergoing the most dramatic ownership changes in almost 20 years while growing at a snail’s pace, with troubled players CommInsure and AMP being hit with negative annual growth in inflows.

The life insurance sector — including the retail and group superannuation segment of the market — witnessed inflows up just 1.7 per cent in the year ended September 30, 2018, the latest data from actuary and research house Strategic Insight showed. Inflows amounted to $16.5 billion, while annual sales across the sector edged up 2.1 per cent.

But the numbers masked a diverse range of outcomes for life insurance players over the period.

Commonwealth Bank-owned CommInsure — which was lambasted by the Hayne royal commission over outdated medical definitions — posted negative annual inflows of almost 18 per cent in the year ended September 30. It was followed by AMP, which had negative 5.6 per cent growth in inflows during the period.

CBA’s results are understood to have been weighed down by the loss of several large mandates, including HESTA, which shifted its insurance for 800,000-plus members to AIA Australia. AMP’s numbers have probably been damaged by the fallout from the royal commission and any associated mandate losses.

A CBA spokesman declined to comment, as did a spokeswoman for AMP, with both citing next month’s profit results season.

The Hayne royal commission and the corporate regulator have taken exception to life insurance claims handling, commissions and dodgy sales practices in the retail part of the life insurance market. That, coupled with closer federal government scrutiny of the value of life insurance, consumers and superannuation funds, and the capital intensity of the sector, has prompted several players to seek to exit.

“It’s probably a bit of disruption related to the royal commission, and uncertainty over ownership of the business always hurts flows,” Switzer Asset Management portfolio manager Shawn Burns said of poor results at CommInsure and AMP.

“There may be extra compliance and double checking, which is slowing things down. It (life insurance) hasn’t been a happy hunting ground for the locals in the past few years.”

An industry executive, who declined to be named, said ownership changes in life insurance would radically change the industry. “When mergers and acquisitions flow through they will change the whole shape of the industry,” he said.

The executive noted the regulatory clampdown on direct selling of life insurance, often over the phone, was likely to impact the data and said stalling industry momentum was disappointing given superannuation accounts were growing.

CBA and AMP are among a long list of local companies that are divesting or have already sold their life businesses, including Macquarie Group, Suncorp and ANZ Bank. National Australia Bank sold 80 per cent of its life insurance arm to Japan’s Nippon more than three years ago. These transactions are prompting the largest overhaul of the market since the deal frenzy in 2000, which saw a string of transactions including CBA buying Colonial and NAB acquiring MLC.

The market share numbers for total risk premiums will look different when TAL, which has 17.8 per cent, completes a takeover of Suncorp’s life business, and Asia’s AIA, which holds 15.6 per cent, seals its CommInsure deal. Zurich will also get a big boost when its acquisition of ANZ’s life business completes. AMP angered shareholders last year when it announced the sale of its life insurance unit to London-based Resolution Life.

Players that had strong annual growth in risk premium inflows in the year ended September 30 included Westpac’s BT Financial and US group MetLife.

BT posted annual growth of 21 per cent, with industry sources saying the numbers were buoyed by Westpac shifting a mandate for its Asgard business from AIA to BT.

MetLife had annual growth of 13.5 per cent, followed by AIA, Zurich and TAL respectively.

The research covered term life, total and permanent disablement and trauma insurance, income protection or sickness and accident insurance.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout